- Japan

- /

- Marine and Shipping

- /

- TSE:9107

Does a Higher Dividend Amid Lower Profit Guidance Change the Bull Case for Kawasaki Kisen (TSE:9107)?

Reviewed by Sasha Jovanovic

- Kawasaki Kisen Kaisha recently announced a higher interim dividend of ¥60 per share for the second quarter ended September 30, 2025, up from ¥50 per share a year earlier, with payments commencing from December 4, 2025.

- At the same time, the company revised its full-year guidance downward, citing lower expected profits mainly due to weaker performance in its Product Logistics segment.

- We’ll explore how the combination of a raised dividend and reduced earnings outlook affects the company’s overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kawasaki Kisen Kaisha Investment Narrative Recap

For investors, the core thesis for Kawasaki Kisen Kaisha remains its ability to generate stable cash flows from long-term charters in energy transport alongside its active investment in fleet decarbonization. Recent moves to lift the interim dividend while lowering full-year profit guidance signal a commitment to shareholder returns, but also reinforce that near-term earnings remain sensitive to shipping market softness and cyclical volatility, an already well-flagged risk. At this stage, short-term earnings risk remains the most material concern and likely overshadows the near-term impact of the dividend hike.

Of the latest developments, the November earnings guidance revision is especially relevant, as management now expects full-year profits to be lower than previously forecast, largely due to weaker performance in the Product Logistics segment. This aligns closely with market concerns around overcapacity and pricing pressure, issues that could weigh further on the major catalysts investors have been watching.

However, with increased dividend payouts, there remains a contrast that investors should not overlook: the sustainability of these higher returns in light of persistent industry headwinds...

Read the full narrative on Kawasaki Kisen Kaisha (it's free!)

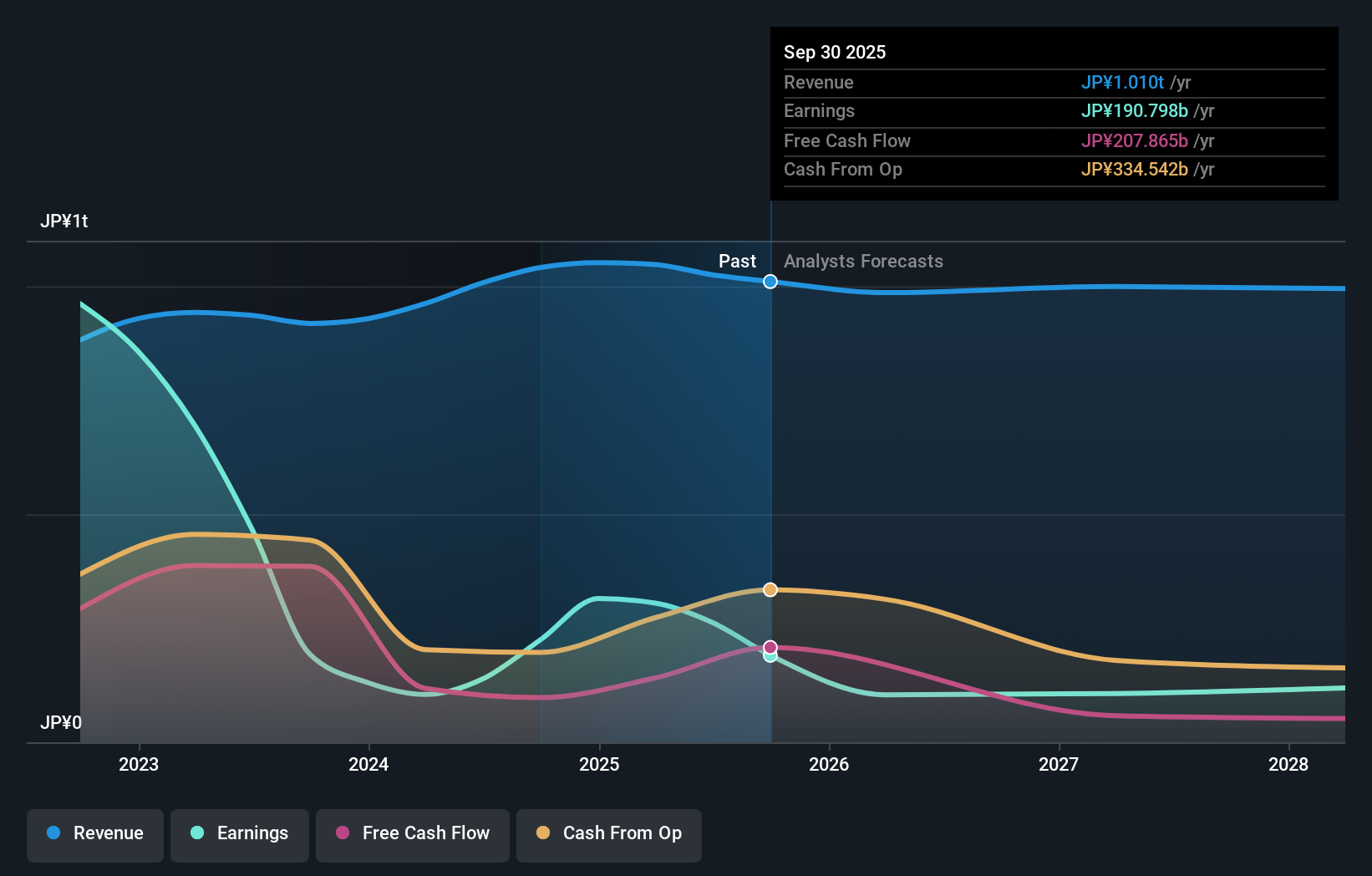

Kawasaki Kisen Kaisha's narrative projects ¥1,015.3 billion in revenue and ¥117.3 billion in earnings by 2028. This requires a 0.3% yearly revenue decline and a ¥145.5 billion decrease in earnings from the current ¥262.8 billion.

Uncover how Kawasaki Kisen Kaisha's forecasts yield a ¥2097 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community fair value estimates for Kawasaki Kisen Kaisha range from ¥2,097 to ¥2,988, sourced from 2 individual perspectives. With profit forecasts now lower and exposure to cyclical markets high, you will find these opinions often diverge, explore more views on what could drive further shifts in the company’s value.

Explore 2 other fair value estimates on Kawasaki Kisen Kaisha - why the stock might be worth as much as 41% more than the current price!

Build Your Own Kawasaki Kisen Kaisha Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kawasaki Kisen Kaisha research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Kawasaki Kisen Kaisha research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kawasaki Kisen Kaisha's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawasaki Kisen Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9107

Kawasaki Kisen Kaisha

Engages in the provision of marine, land, and air transportation services in Japan, the United States, Europe, Asia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives