- Japan

- /

- Marine and Shipping

- /

- TSE:9104

3 Reliable Dividend Stocks Yielding Up To 7.5%

Reviewed by Simply Wall St

As global markets navigate a tumultuous landscape marked by busy earnings reports and mixed economic signals, investors are seeking stability amid the volatility. With major indices like the S&P 500 experiencing fluctuations due to cautious corporate earnings and macroeconomic uncertainties, dividend stocks present an appealing option for those looking to secure steady income streams. In this environment, reliable dividend stocks can offer a measure of predictability and resilience, making them attractive choices for investors aiming to balance growth with income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.93% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2033 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

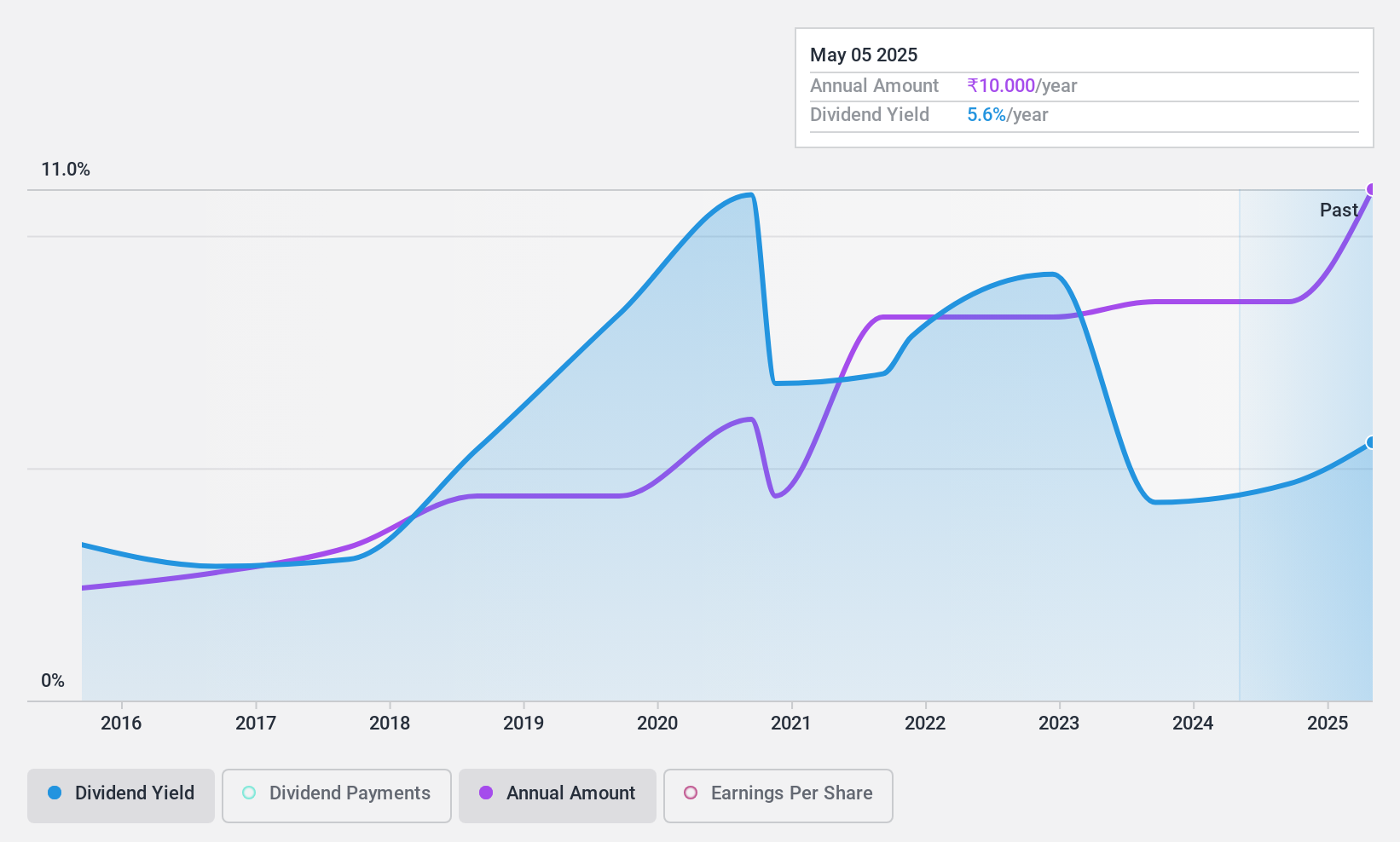

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹55.12 billion, operates in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from its Power segment, amounting to ₹159.67 billion, and its Financing Business, contributing ₹7.35 billion.

Dividend Yield: 4.2%

PTC India announced a final dividend of INR 7.80 per share for FY 2023-24, with dividends covered by earnings (payout ratio: 54%) and cash flows (cash payout ratio: 9.4%). Despite being among the top dividend payers in India, PTC has a history of volatile dividends over the past decade. However, recent growth in net income suggests improved financial stability, supporting its ability to maintain current dividend levels.

- Click here and access our complete dividend analysis report to understand the dynamics of PTC India.

- Our valuation report here indicates PTC India may be undervalued.

Unitronics (1989) (RG) (TASE:UNIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unitronics (1989) (R\G) Ltd, with a market cap of ₪425.23 million, designs, develops, produces, markets, and sells programmable logic controllers and other automation products in Israel and internationally.

Operations: Unitronics (1989) (R\G) Ltd generates revenue of ₪213.84 million from its products segment, which includes programmable logic controllers and automation products.

Dividend Yield: 7.5%

Unitronics trades at a significant discount to its estimated fair value, offering a high dividend yield of 7.53%, which ranks in the top 25% in the IL market. Despite this, its dividend history is unstable and has been volatile over the past three years. Dividends are covered by earnings (66.7% payout ratio) and cash flows (72.8% cash payout ratio). Recent earnings growth of 90% may enhance future dividend sustainability despite fluctuating sales figures.

- Click here to discover the nuances of Unitronics (1989) (RG) with our detailed analytical dividend report.

- Our valuation report unveils the possibility Unitronics (1989) (RG)'s shares may be trading at a discount.

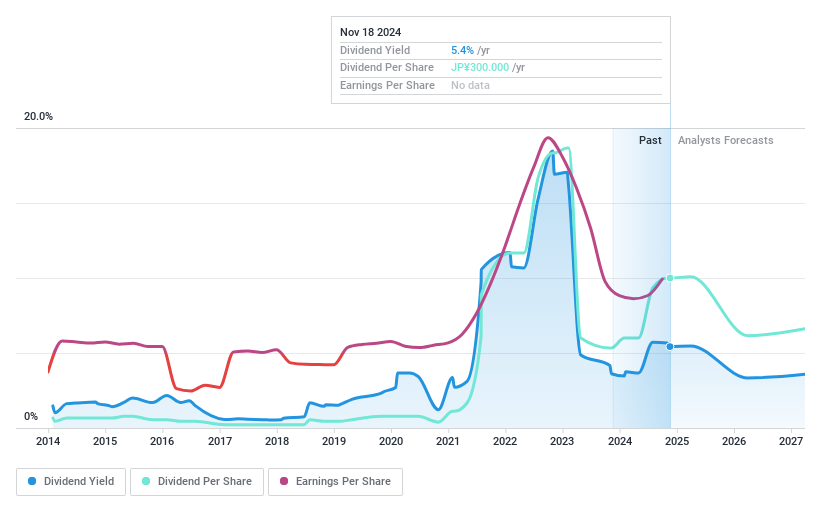

Mitsui O.S.K. Lines (TSE:9104)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui O.S.K. Lines, Ltd. operates in the marine transportation industry both in Japan and globally, with a market cap of ¥1.88 trillion.

Operations: Mitsui O.S.K. Lines, Ltd.'s revenue segments include the Energy Business at ¥515.10 billion, Dry Bulk Business at ¥420.16 billion, Product Transport Business - Car Carriers, Terminal and Logistics, Ferries and Coastal RORO Ships at ¥579.82 billion, Product Transport Business - Container Ships at ¥60.42 million, Ferry· Coastal RORO Ship and Cruise Business at ¥66.69 million, Real Estate Business at ¥45.93 million, and Connection Businesses (Excl. Real Estate) at ¥88.02 million.

Dividend Yield: 5.8%

Mitsui O.S.K. Lines offers a high dividend yield of 5.79%, ranking in the top 25% of Japanese dividend payers, though its dividends have been volatile and unreliable over the past decade. Despite a low payout ratio of 29.4%, indicating coverage by earnings, dividends are not supported by free cash flows. The recent share buyback program, valued at ¥100 billion, aims to enhance shareholder returns and corporate value amidst ongoing M&A activities and strategic investments in logistics assets.

- Delve into the full analysis dividend report here for a deeper understanding of Mitsui O.S.K. Lines.

- The analysis detailed in our Mitsui O.S.K. Lines valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Reveal the 2033 hidden gems among our Top Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9104

Mitsui O.S.K. Lines

Engages in the marine transportation business in Japan and internationally.

Adequate balance sheet average dividend payer.