- Japan

- /

- Entertainment

- /

- TSE:3632

3 Top Dividend Stocks Offering Yields Up To 4.4%

Reviewed by Simply Wall St

In the wake of recent global market movements, U.S. stocks have surged to new heights following a "red sweep" in the elections, with investors optimistic about potential economic growth and regulatory changes. Amidst these developments, dividend stocks become an attractive option for those seeking steady income streams; they offer potential stability and yield benefits even as markets react to political and economic shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

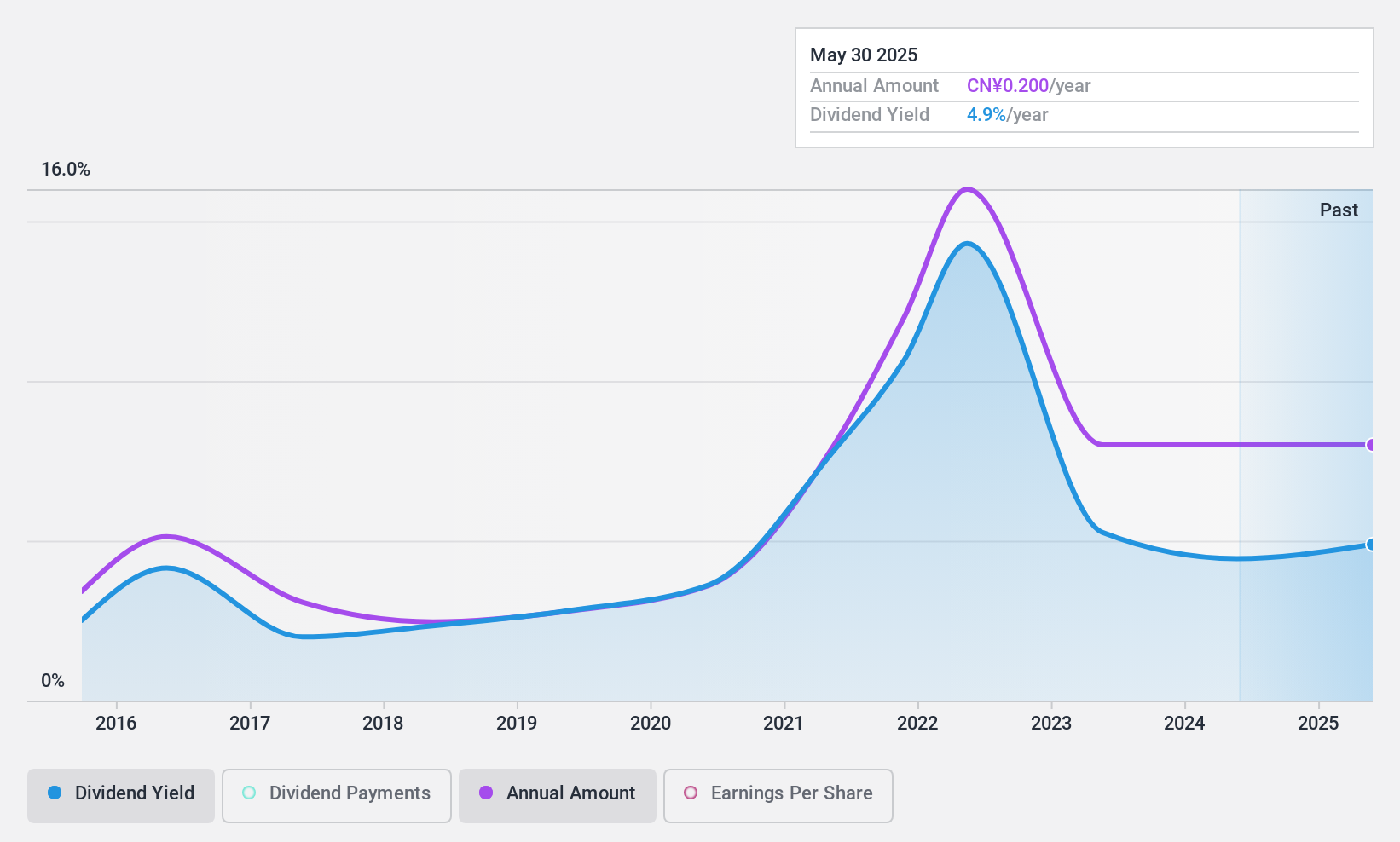

TangShan Port GroupLtd (SHSE:601000)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TangShan Port Group Co., Ltd operates in the transportation and warehousing services sector in China with a market cap of CN¥26.79 billion.

Operations: TangShan Port Group Co., Ltd's revenue segments include transportation and warehousing services in China.

Dividend Yield: 4.4%

TangShan Port Group Ltd offers a mixed dividend profile. While its 4.42% yield ranks in the top 25% of Chinese dividend payers, the company's dividends have been volatile over the past decade. Despite this instability, dividends are well-covered by earnings (62.6%) and cash flows (60%). Recent financials show slight declines in revenue and net income for nine months ending September 2024, highlighting potential challenges amidst its attractive valuation with a P/E ratio of 14.2x below market average.

- Click here to discover the nuances of TangShan Port GroupLtd with our detailed analytical dividend report.

- Our valuation report unveils the possibility TangShan Port GroupLtd's shares may be trading at a discount.

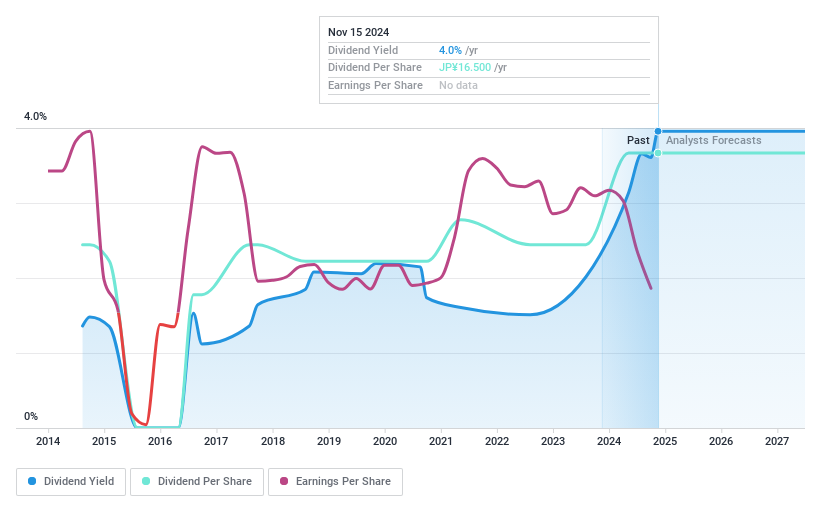

GREE (TSE:3632)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GREE, Inc. engages in Internet entertainment, investment, and incubation activities both in Japan and globally, with a market cap of ¥71.34 billion.

Operations: GREE, Inc.'s revenue segments include the Game and Anime Business at ¥42.19 billion, the Metaverse Business at ¥7.24 billion, the DX Business at ¥5.82 billion, and the Investment Business at ¥2.32 billion.

Dividend Yield: 4%

GREE Holdings, Inc. presents a complex dividend outlook. Despite being in the top 25% of Japanese dividend payers with a yield of 3.96%, its dividends have been volatile and are not well-covered by earnings, given a high payout ratio of 156.4%. However, cash flows do cover dividends with an 83.9% cash payout ratio. Recent restructuring into a holding company may impact future stability as profit margins have decreased to 3.1%.

- Unlock comprehensive insights into our analysis of GREE stock in this dividend report.

- The valuation report we've compiled suggests that GREE's current price could be quite moderate.

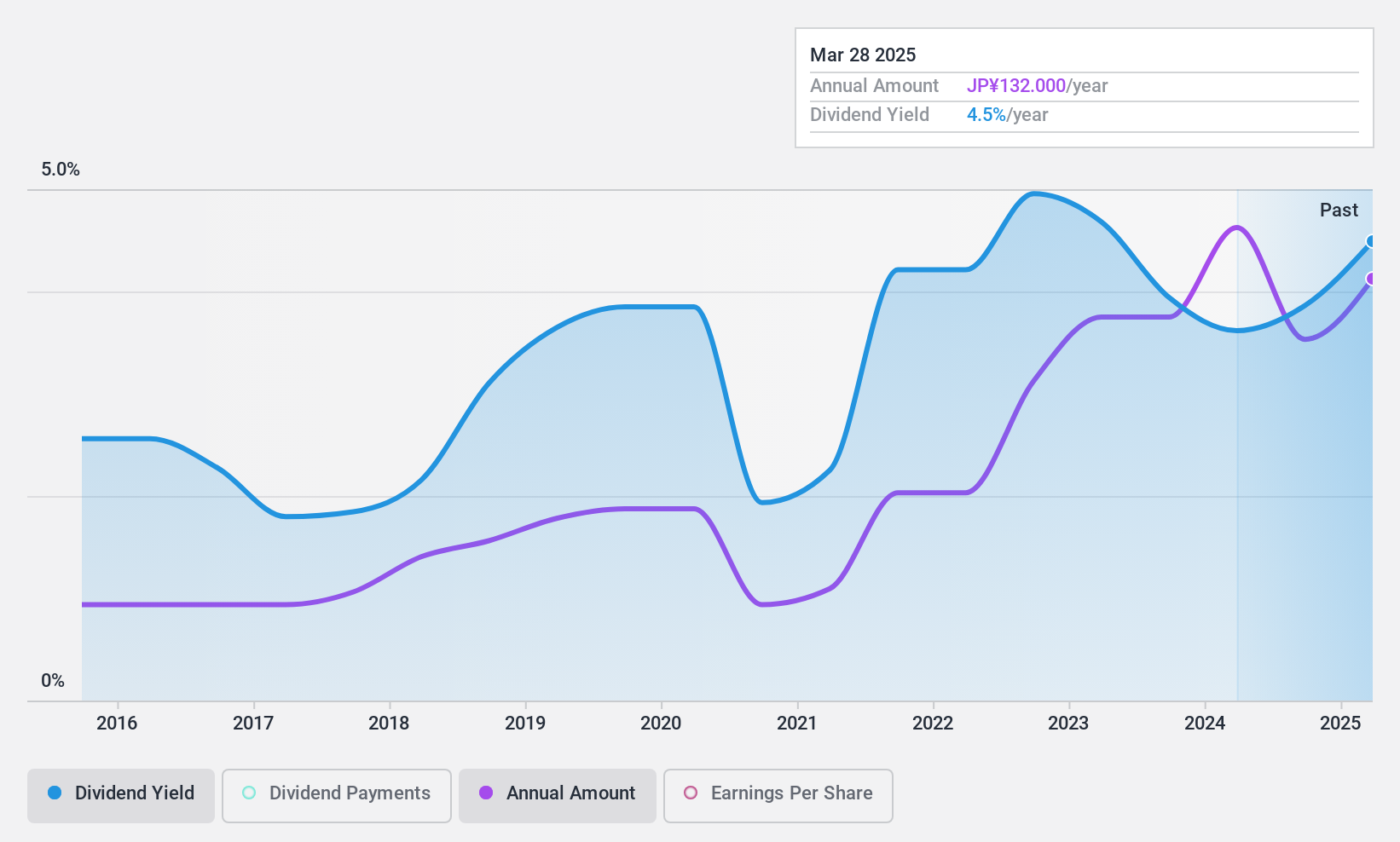

Rix (TSE:7525)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rix Corporation manufactures and sells machinery equipment and industrial materials in Japan with a market cap of ¥22.35 billion.

Operations: Rix Corporation's revenue segments include machinery equipment and industrial materials in Japan.

Dividend Yield: 4.1%

Rix Corporation offers a compelling dividend profile with its 4.09% yield ranking in the top 25% of Japanese payers and a low payout ratio of 22.3%, ensuring earnings cover dividends well. Cash flows also support payouts, reflected by a cash payout ratio of 48.7%. However, the dividend track record shows volatility over the past decade, indicating potential instability despite being undervalued at 87.5% below estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Rix.

- In light of our recent valuation report, it seems possible that Rix is trading behind its estimated value.

Summing It All Up

- Get an in-depth perspective on all 1955 Top Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3632

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives