- Japan

- /

- Healthtech

- /

- TSE:4820

Uncovering Undiscovered Gems In November 2024

Reviewed by Simply Wall St

As global markets react to a "red sweep" in the U.S., small-cap stocks have shown notable activity, with the Russell 2000 Index leading gains but still trailing its previous record highs. This dynamic backdrop provides an intriguing environment for investors seeking undiscovered gems, as these stocks often offer unique growth potential and resilience amid shifting economic policies and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ramco Industries | 3.16% | 9.84% | -14.15% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Shree Pushkar Chemicals & Fertilisers | 22.85% | 17.68% | 3.50% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Abu Dhabi Ship Building PJSC (ADX:ADSB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abu Dhabi Ship Building PJSC, along with its subsidiaries, focuses on the construction, maintenance, repair, and overhaul of commercial and military ships and vessels in the United Arab Emirates with a market capitalization of AED981.52 million.

Operations: The company's revenue streams primarily derive from the construction, maintenance, repair, and overhaul of ships and vessels. Its market capitalization stands at AED981.52 million.

Abu Dhabi Ship Building (ADSB) has been making waves with significant earnings growth of 92.9% over the past year, outpacing the Aerospace & Defense industry average of 8.8%. This growth is reflected in their recent financial results, where third-quarter sales jumped to AED 339 million from AED 170 million a year ago, and net income rose to AED 16.56 million from AED 2.34 million. The company's debt-to-equity ratio also improved dramatically from 155.6% to just 25.8% over five years, indicating strengthened financial health. A strategic partnership with SIATT further boosts ADSB’s prospects by integrating advanced missile systems into its vessels at no extra cost, showcasing innovation in naval defense capabilities ahead of NAVDEX in February 2025.

EM Systems (TSE:4820)

Simply Wall St Value Rating: ★★★★★☆

Overview: EM Systems Co., Ltd. develops and sells IT systems for pharmacies, clinics, and care/welfare businesses in Japan with a market cap of approximately ¥43.73 billion.

Operations: EM Systems generates revenue primarily from its Dispensing System Business, contributing ¥17.49 billion, followed by the Medical System Business at ¥2.47 billion. The Nursing Care/Welfare System Business adds ¥555 million to the revenue stream.

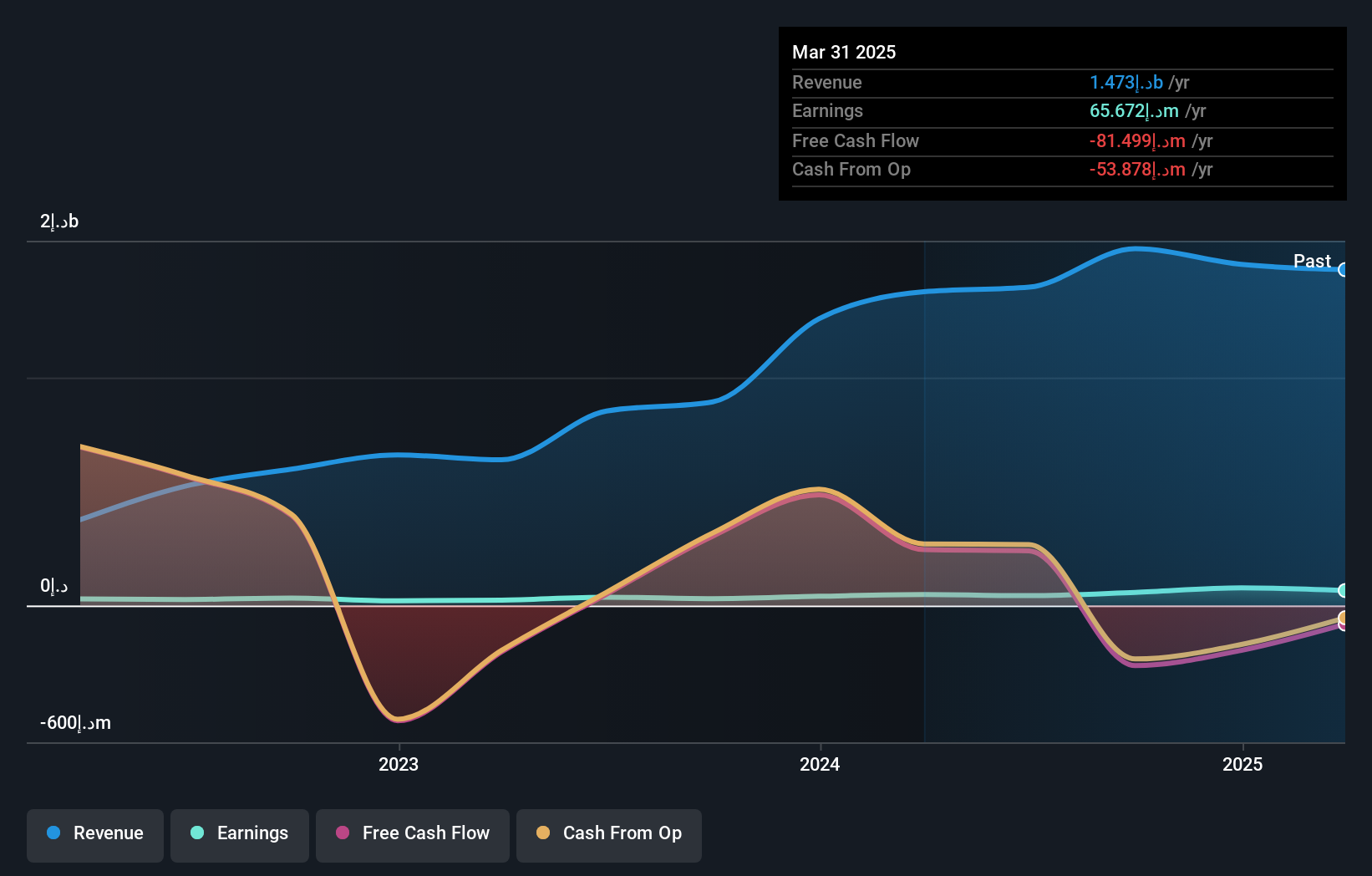

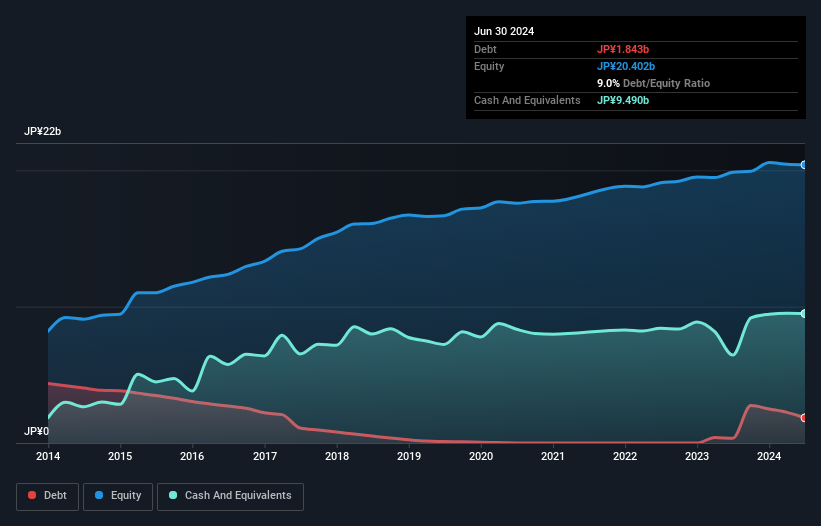

EM Systems, a healthcare services player, has been making waves with its impressive earnings growth of 35.5% over the past year, outpacing the industry average of 11.1%. The company's debt-to-equity ratio rose from 0.7 to 9 over five years, indicating increased leverage but not necessarily a red flag given its strong cash position relative to total debt. EM Systems recently completed a share buyback program repurchasing about 1.82% of shares for ¥810 million (US$), which could signal confidence in future prospects despite recent share price volatility and trading at a significant discount to estimated fair value by 41%.

- Click to explore a detailed breakdown of our findings in EM Systems' health report.

Understand EM Systems' track record by examining our Past report.

Aoyama Zaisan Networks CompanyLimited (TSE:8929)

Simply Wall St Value Rating: ★★★★★★

Overview: Aoyama Zaisan Networks Company, Limited offers property consulting solutions to individual asset owners and business owners in Japan, with a market capitalization of ¥41.51 billion.

Operations: The primary revenue stream for Aoyama Zaisan Networks comes from its Property Consulting Business, generating ¥43.05 billion. The company's focus on this segment is reflected in its financial structure and performance metrics.

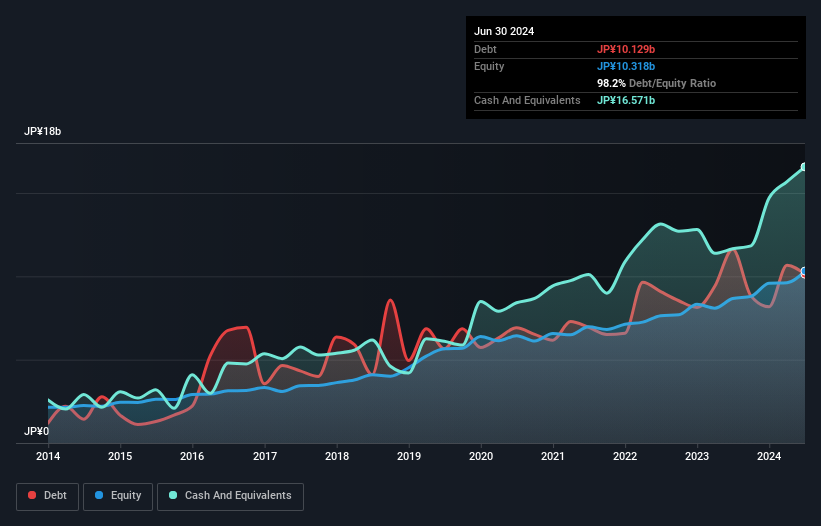

Aoyama Zaisan Networks, a compact player in the real estate sector, is trading at 12.1% below its estimated fair value, offering potential upside for investors. Over the past year, earnings surged by 34.7%, outpacing the broader industry growth of 18.8%. The company has reduced its debt to equity ratio from 100.1% to 98.2% over five years and boasts an impressive interest coverage of EBIT at 68.5 times its debt payments, indicating strong financial health. Recently announced plans for a share buyback program aim to repurchase up to ¥2,100 million worth of shares by May 2025, signaling confidence in future growth prospects and shareholder returns.

Turning Ideas Into Actions

- Gain an insight into the universe of 4659 Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4820

EM Systems

Develops and sells various IT systems for pharmacies, clinics, and care/welfare other business in Japan.

Solid track record with excellent balance sheet and pays a dividend.