- Japan

- /

- Infrastructure

- /

- TSE:9066

Top Asian Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by trade negotiations and economic policy adjustments, investors are keenly observing how these factors might influence regional indices. In such an environment, dividend stocks can offer a measure of stability and potential income, making them particularly appealing to those seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Daito Trust ConstructionLtd (TSE:1878) | 4.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.72% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.41% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.06% | ★★★★★★ |

Click here to see the full list of 1217 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

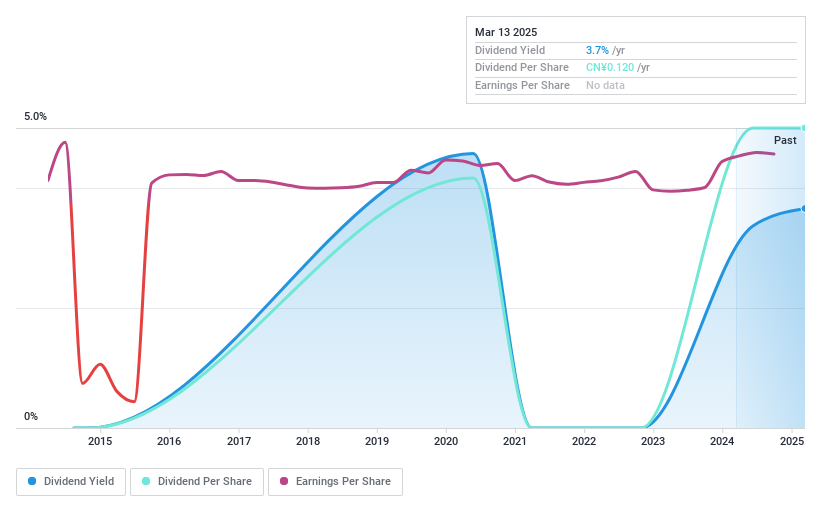

Huaihe Energy (Group)Ltd (SHSE:600575)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huaihe Energy (Group) Co., Ltd operates in the logistics and trade sector in China, with a market capitalization of CN¥14.92 billion.

Operations: Huaihe Energy (Group) Co., Ltd's revenue is primarily derived from its operations in the logistics and trade sector within China.

Dividend Yield: 3.1%

Huaihe Energy's dividend, yielding 3.13%, ranks in the top 25% of China's market. However, its five-year dividend history is marked by volatility and unreliability. Despite a reasonable earnings payout ratio of 46%, the cash payout ratio stands at a higher 87%. Recent earnings show slight declines with Q1 net income at CNY 266.11 million compared to CNY 309.9 million last year, indicating potential pressure on future dividends amidst fluctuating performance.

- Navigate through the intricacies of Huaihe Energy (Group)Ltd with our comprehensive dividend report here.

- Our expertly prepared valuation report Huaihe Energy (Group)Ltd implies its share price may be lower than expected.

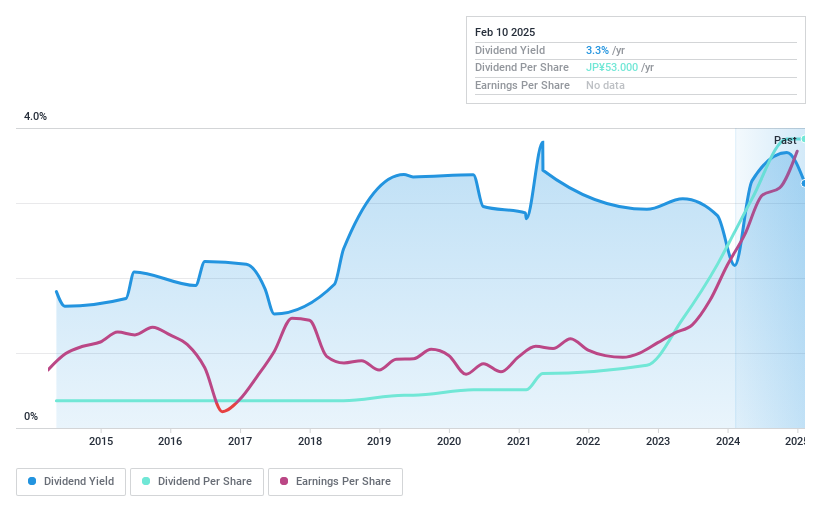

Yamax (TSE:5285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yamax Corp. manufactures and sells concrete and cement products for construction and civil engineering projects in Japan, with a market cap of ¥14.65 billion.

Operations: Yamax Corp.'s revenue is primarily derived from its operations in manufacturing and selling concrete and cement products for Japan's construction and civil engineering sectors.

Dividend Yield: 3.5%

Yamax's dividend yield of 3.51% is below the top 25% in Japan, yet it offers stability with consistent growth over a decade. The payout ratio of 19.9% indicates strong coverage by earnings, although the cash payout ratio is higher at 82.5%. Despite recent share price volatility and trading slightly below fair value, its dividends remain sustainable and reliable, supported by significant earnings growth of 51.8% last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Yamax.

- According our valuation report, there's an indication that Yamax's share price might be on the cheaper side.

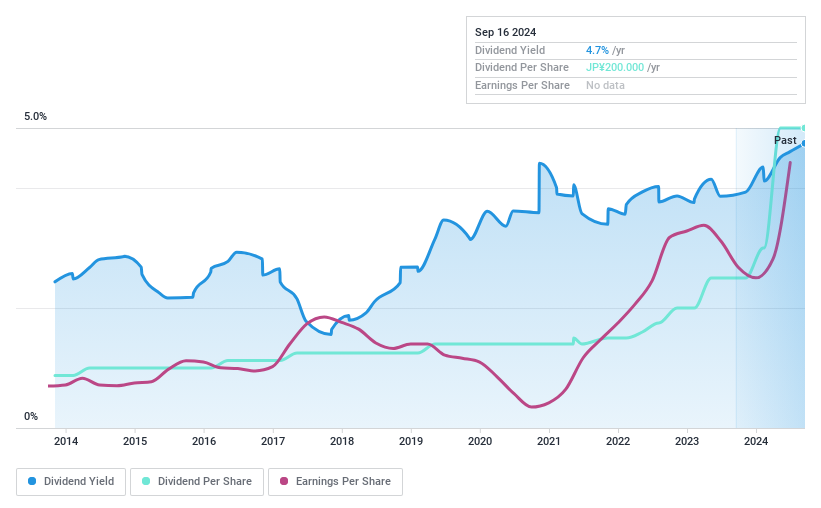

Nissin (TSE:9066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nissin Corporation offers logistics services across Japan, Europe, the Americas, China, Russia, and other international markets with a market capitalization of approximately ¥78.55 billion.

Operations: Nissin Corporation's revenue is primarily derived from its Logistics Business, which generates ¥183.67 billion, supplemented by the Travel Business at ¥8.66 billion and the Real Estate Business contributing ¥1.83 billion.

Dividend Yield: 3.7%

Nissin's dividend yield of 3.74% trails the top 25% in Japan, but it boasts a decade of stable and increasing dividends. Despite a low payout ratio of 19.6%, suggesting strong earnings coverage, the high cash payout ratio of 101.9% indicates dividends are not well covered by free cash flows. While recent earnings surged by 68.6%, large one-off items impact financial results, and its price-to-earnings ratio is attractively low at 6x compared to the market average.

- Click to explore a detailed breakdown of our findings in Nissin's dividend report.

- Our expertly prepared valuation report Nissin implies its share price may be too high.

Make It Happen

- Embark on your investment journey to our 1217 Top Asian Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9066

Nissin

Provides logistics services in Japan, Europe, the Americas, China, Russia, rest of Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives