- Japan

- /

- Transportation

- /

- TSE:9044

Nankai Electric Railway Co., Ltd.'s (TSE:9044) Shareholders Might Be Looking For Exit

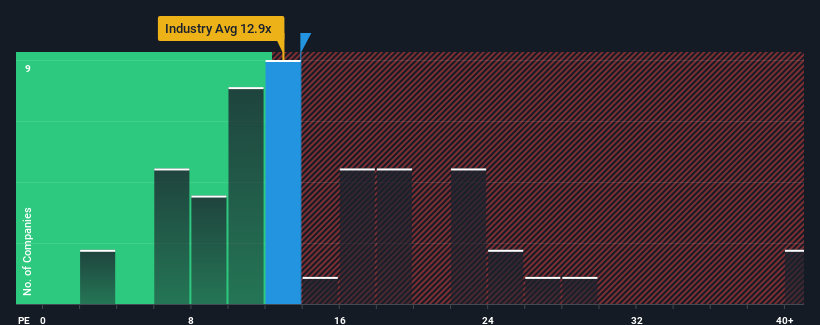

It's not a stretch to say that Nankai Electric Railway Co., Ltd.'s (TSE:9044) price-to-earnings (or "P/E") ratio of 13.9x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Nankai Electric Railway has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Nankai Electric Railway

Is There Some Growth For Nankai Electric Railway?

The only time you'd be comfortable seeing a P/E like Nankai Electric Railway's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 136% last year. The strong recent performance means it was also able to grow EPS by 4,460% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 11% over the next year. That's not great when the rest of the market is expected to grow by 11%.

In light of this, it's somewhat alarming that Nankai Electric Railway's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From Nankai Electric Railway's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nankai Electric Railway currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Nankai Electric Railway that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Nankai Electric Railway, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nankai Electric Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9044

Second-rate dividend payer with questionable track record.

Market Insights

Community Narratives