- Japan

- /

- Transportation

- /

- TSE:9042

The past year for Hankyu Hanshin Holdings (TSE:9042) investors has not been profitable

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Hankyu Hanshin Holdings, Inc. (TSE:9042) share price is down 12% in the last year. That's well below the market decline of 0.6%. Longer term investors have fared much better, since the share price is up 3.4% in three years.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

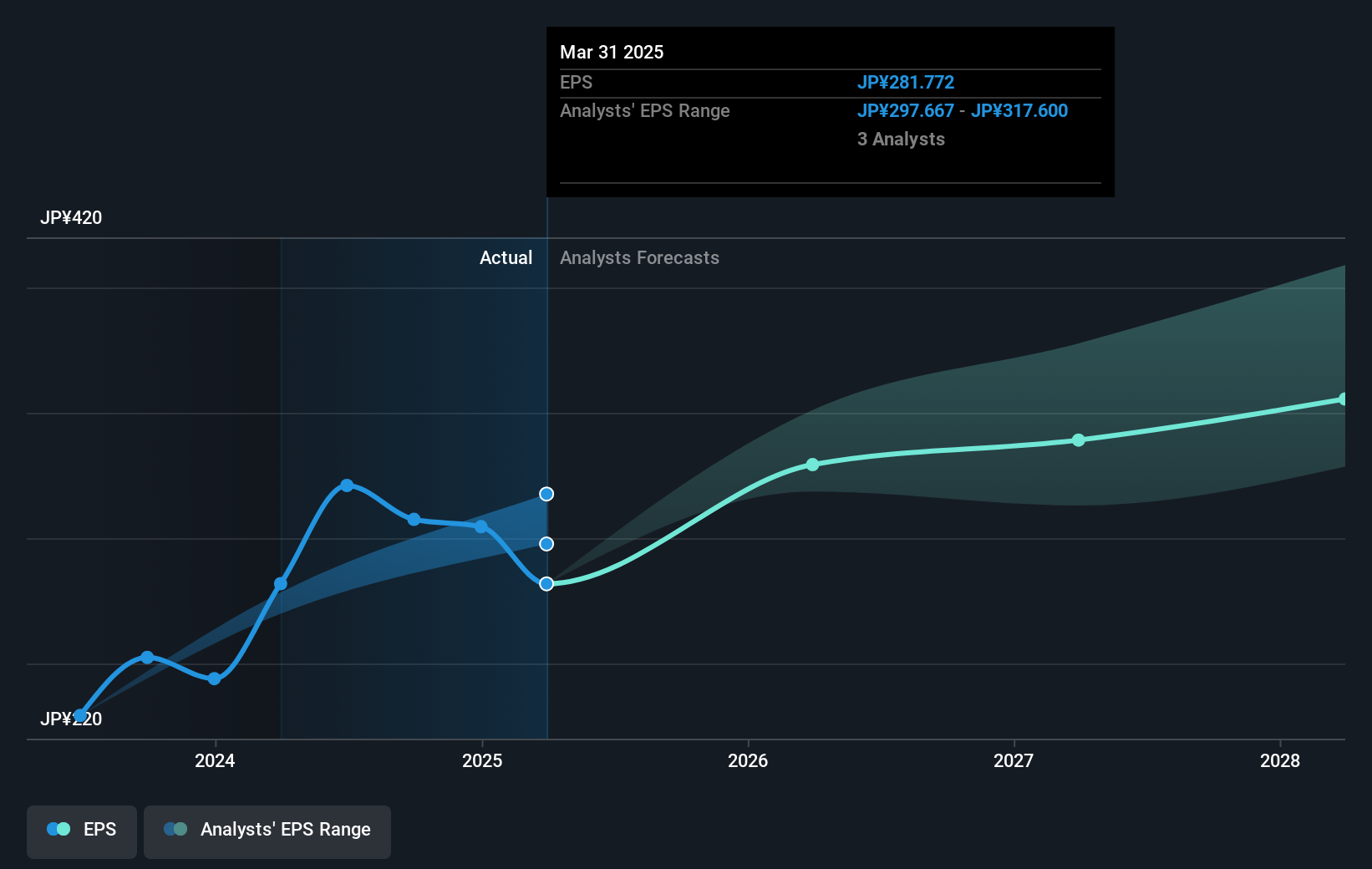

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, Hankyu Hanshin Holdings had to report a 0.02% decline in EPS over the last year. This reduction in EPS is not as bad as the 12% share price fall. This suggests the EPS fall has made some shareholders more nervous about the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Hankyu Hanshin Holdings has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 0.6% in the last year, Hankyu Hanshin Holdings shareholders lost 11% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Hankyu Hanshin Holdings is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hankyu Hanshin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9042

Hankyu Hanshin Holdings

Operates in the urban transportation, real estate, entertainment, information and communication technology, travel, and international transportation businesses in Japan and internationally.

Average dividend payer with questionable track record.

Market Insights

Community Narratives