Tohbu Network Co., Ltd.'s (TSE:9036) investors are due to receive a payment of ¥7.50 per share on 9th of December. Based on this payment, the dividend yield on the company's stock will be 1.8%, which is an attractive boost to shareholder returns.

See our latest analysis for Tohbu Network

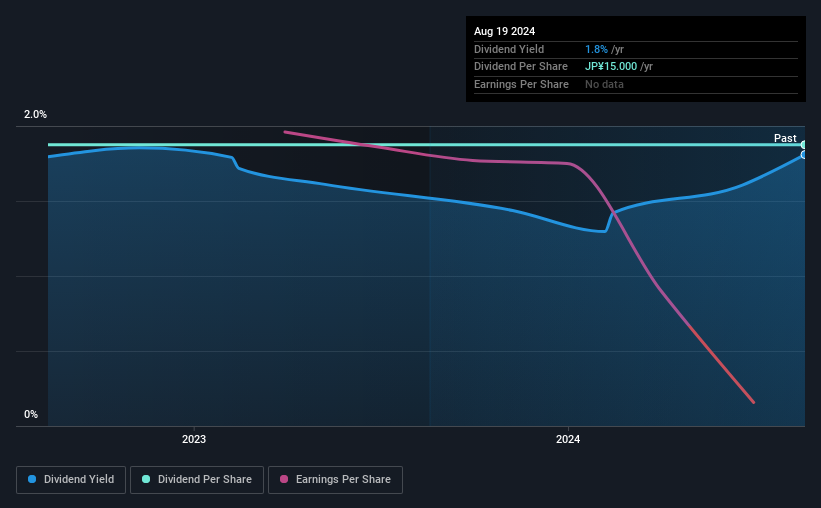

Tohbu Network's Distributions May Be Difficult To Sustain

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even though Tohbu Network isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

EPS has fallen by an average of 141.3% in the past, so this could continue over the next year. While this means that the company will be unprofitable, we generally believe cash flows are more important, and the current cash payout ratio is quite healthy, which gives us comfort.

Tohbu Network Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The payments haven't really changed that much since 2 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Over the last year, Tohbu Network's EPS has fallen by 141%. Decreases in earnings as large as this could start to put some pressure on the dividend if they are sustained for several years. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Tohbu Network's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Tohbu Network that you should be aware of before investing. Is Tohbu Network not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Tohbu Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9036

Excellent balance sheet with low risk.

Market Insights

Community Narratives