- Japan

- /

- Transportation

- /

- TSE:9022

JR Central (TSE:9022) Delivers 27% Profit Margin, Challenging Growth Skepticism

Reviewed by Simply Wall St

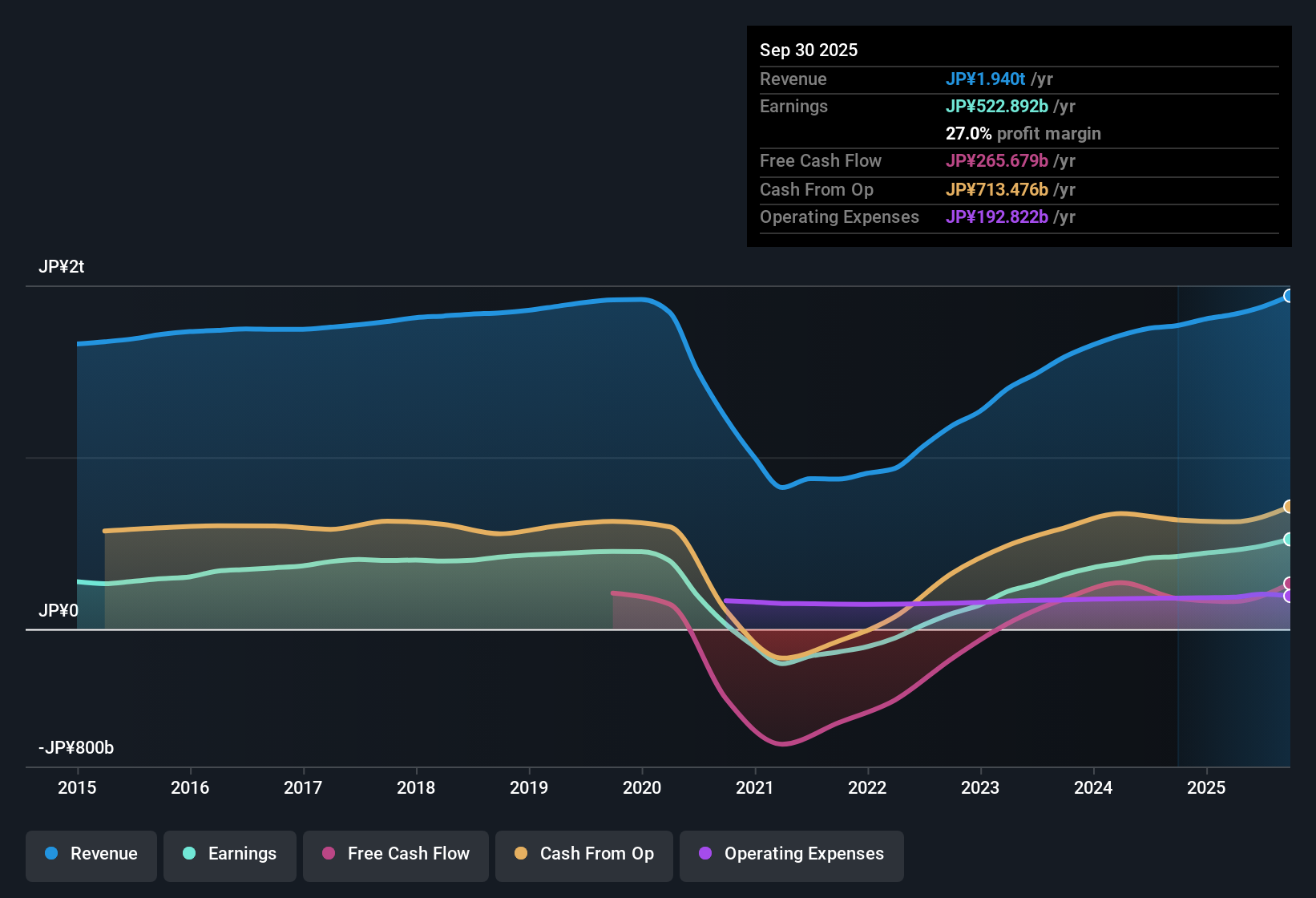

Central Japan Railway (TSE:9022) posted a net profit margin of 27%, topping last year’s 23.9%, and has averaged stunning 59.4% annual earnings growth over the past five years. The most recent yearly earnings growth slowed to 23.6%, still outpacing many peers, with EPS quality rated high and the stock trading at a lean 7x price-to-earnings, well below industry averages. Yet, consensus points to revenue growth lagging the Japanese market, and forecasts call for earnings to fall by 3.6% per year over the next three years, raising questions about whether strong historical profitability can overcome the risks in forward expectations.

See our full analysis for Central Japan Railway.Next, we’ll see how Central Japan Railway’s headline results compare to the prevailing market views, highlighting where the story fits and where the data may surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stand Well Above Peers

- Net profit margin hit 27%, not only topping last year’s 23.9% but also running noticeably ahead of the peer group. This supports the stock’s reputation for operational efficiency, even as forecasted growth softens.

- While the prevailing view emphasizes that these high margins reflect past earnings power, there is tension because future growth rates are set at only 1.3% revenue growth per year. This is expected to underwhelm and suggests sustained profitability may be harder to maintain.

- Investors attracted to best-in-class margins may be challenged by the prospect of slower expansion.

- This contrast fuels debate around whether historic profitability alone justifies continued optimism despite weak growth projections.

P/E Discount Signals Mixed Valuation

- Trading at a price-to-earnings ratio of 7x, Central Japan Railway sits well below its peer group (12.4x) and industry average (12.5x). This initially makes the stock appear favorably valued for its profit quality.

- The prevailing analysis notes this valuation gap could be a reward for solid historical performance, but it also reflects investor caution since the share price (¥3,793) is still well above the latest DCF fair value estimate of ¥538.06.

- Comparative value against peers is strong, though some caution that the market is pricing in the risk of earnings declines.

- A low multiple might attract value-seeking investors, but the gap versus DCF measures and future earnings projections tempers the story.

Growth Outlook Falls Short of Market

- Forecasts point to just 1.3% annual revenue growth for Central Japan Railway, far behind the Japanese market’s expected 4.5% pace. Earnings are projected to fall by 3.6% per year over the next three years.

- The prevailing view highlights that this muted guidance is what really weighs on sentiment, raising questions for investors who previously relied on the growth streak.

- Bears argue that lagging top-line expansion and the prospect of sustained earnings contraction put pressure on the share price.

- Any positive move will depend on management’s ability to reverse the slide and restore momentum relative to sector benchmarks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Central Japan Railway's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Central Japan Railway’s slowing earnings growth and muted revenue projections have cast doubt on its ability to sustain its past momentum compared to its peers.

If you want to sidestep stagnation, check out stable growth stocks screener (2117 results) for consistently growing companies that deliver steady performance even when others falter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9022

Central Japan Railway

Engages in the railway and related businesses in Japan.

Proven track record and fair value.

Market Insights

Community Narratives