- Japan

- /

- Transportation

- /

- TSE:9007

Does Odakyu Electric Railway's (TSE:9007) Bigger Dividend Reveal a Shift in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Odakyu Electric Railway Co., Ltd. recently announced a substantial increase in its second quarter dividend to ¥25.00 per share, up from ¥15.00 a year earlier, along with earnings guidance for the fiscal year ending March 31, 2026.

- This move highlights a clear focus on shareholder returns, against a mixed operating backdrop where transportation revenue grew but department store sales declined.

- We'll explore how the dividend increase is influencing Odakyu Electric Railway's investment narrative given its broader business performance drivers.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Odakyu Electric Railway's Investment Narrative?

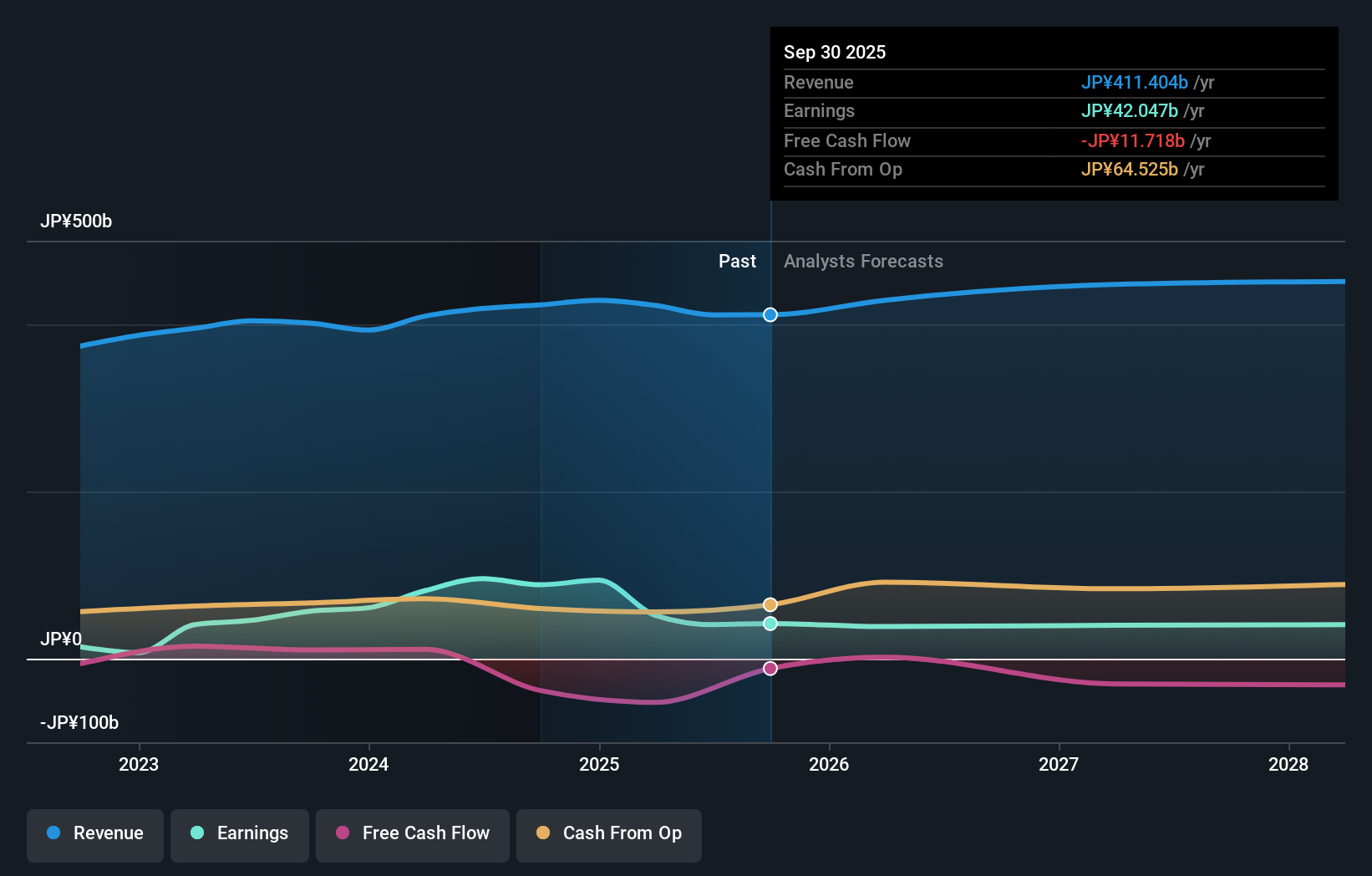

To be comfortable as a shareholder in Odakyu Electric Railway right now, you’d likely need to believe in the company's ability to maintain stable transportation revenues and gradually regain momentum in peripheral businesses like retail and hospitality, despite cyclical swings. The sizeable boost in the upcoming dividend stands out, it signals management’s confidence in near-term cash flow and a willingness to reward shareholders even as some business segments face pressure. This dividend move offers reassurance at a time when steady passenger growth is offset by weaker department store sales and ongoing hotel renovations. For many, the core investment case still hinges on reliable commuter demand and prudent capital allocation, yet risks remain: Odakyu’s slower earnings growth, thin margins, relatively high debt, and recent board turnover could weigh on sentiment if operational improvements lag. The dividend news may soften some short-term concerns, but it doesn’t erase the big picture challenges.

However, rising dividends may not fully offset pressures from declining margins and weak retail performance.

Exploring Other Perspectives

Explore another fair value estimate on Odakyu Electric Railway - why the stock might be worth just ¥1790!

Build Your Own Odakyu Electric Railway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Odakyu Electric Railway research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Odakyu Electric Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Odakyu Electric Railway's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9007

Odakyu Electric Railway

Engages in transportation, real estate, lifestyle services, and other businesses in Japan.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives