- Japan

- /

- Transportation

- /

- TSE:9005

Tokyu (TSE:9005) Valuation in Focus After Upgraded Earnings Outlook Spurs Investor Interest

Reviewed by Simply Wall St

Tokyu (TSE:9005) just raised its full-year earnings guidance, boosting expectations for operating revenue, profit, and net income. This move comes just before its Q2 2026 earnings call and is drawing extra attention from investors.

See our latest analysis for Tokyu.

The upward revision in Tokyu’s earnings guidance sparked renewed optimism, with the share price jumping 2.5% today and gaining 5% this week. Still, the one-year total shareholder return stands at -8%, which shows that long-term momentum remains mixed despite robust recent trading.

Curious to broaden your perspective? Why not see what other investors are finding in fast growing stocks with high insider ownership.

Against this backdrop of upgraded forecasts and a recent rally, investors now face a key question: is Tokyu still undervalued, or is the market already factoring in all the good news and future growth prospects?

Most Popular Narrative: 12.9% Undervalued

Tokyu's most widely followed narrative sees its fair value notably above the current share price, making recent market optimism look conservative by comparison.

Tokyu's expansion into high-demand areas like Shibuya with competitive real estate projects can drive rental income growth and ultimately boost revenue. Active measures to manage rising construction costs and inflation through strategic portfolio management can protect profit margins and enhance overall earnings.

Want to know what numbers justify this bullish stance? The market’s fair value calls rest on forecasts for Tokyu's future profits, margins, and ambitious financial targets not yet priced in. Curious which growth assumptions drive this confidence? See what could shake up Tokyu’s valuation outlook.

Result: Fair Value of ¥2,060 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen setbacks, such as surging construction costs or economic headwinds, could significantly challenge Tokyu’s projected earnings and raise questions about the current bullish valuation.

Find out about the key risks to this Tokyu narrative.

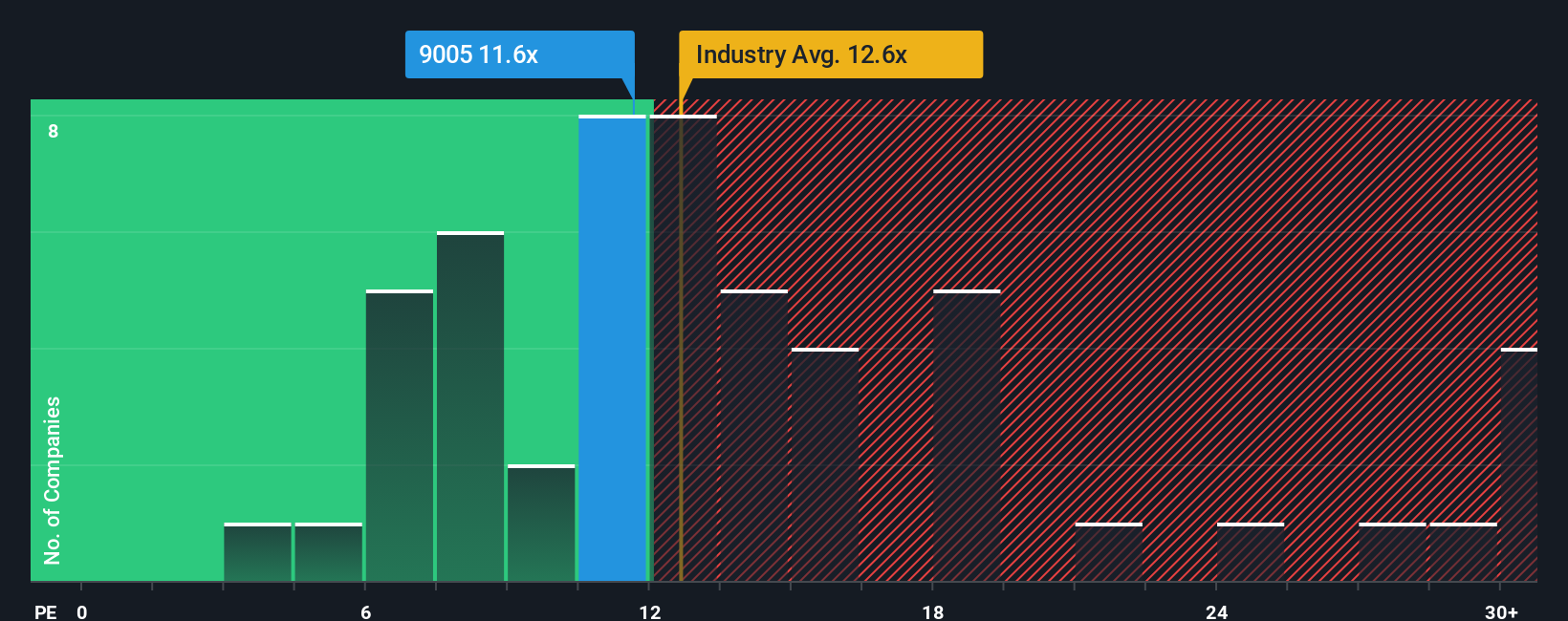

Another View: Signals from Price-to-Earnings Comparisons

Looking from a different angle, Tokyu’s current price-to-earnings ratio sits at 13.7x. This is higher than the transportation industry average (12.5x) and its peer average (13.5x), but still below its fair ratio of 15.9x. This could signal opportunity, but it also hints that investors are already pricing in positive news and forecasts. Will the market reward any further optimism, or are expectations set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyu Narrative

If you see things differently or want to look deeper into the numbers, you can craft your own take on Tokyu’s story in just a few minutes. Do it your way.

A great starting point for your Tokyu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Give yourself an edge in the market by tapping into exclusive screens that highlight stocks with hidden growth, stability, or breakthrough potential before others catch on.

- Lock in rising income by tracking these 14 dividend stocks with yields > 3% offering yields above 3% and a proven record of payouts.

- Catch the next wave of innovation and growth with these 25 AI penny stocks as they power advancements across multiple industries.

- Seize opportunities in emerging sectors by reviewing these 82 cryptocurrency and blockchain stocks at the forefront of digital transformation and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9005

Tokyu

Engages in the transportation, real estate, life service, and hotel and resort businesses in Japan and internationally.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives