Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Japan Logistic Systems Corp. (TYO:9060) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Japan Logistic Systems

What Is Japan Logistic Systems's Net Debt?

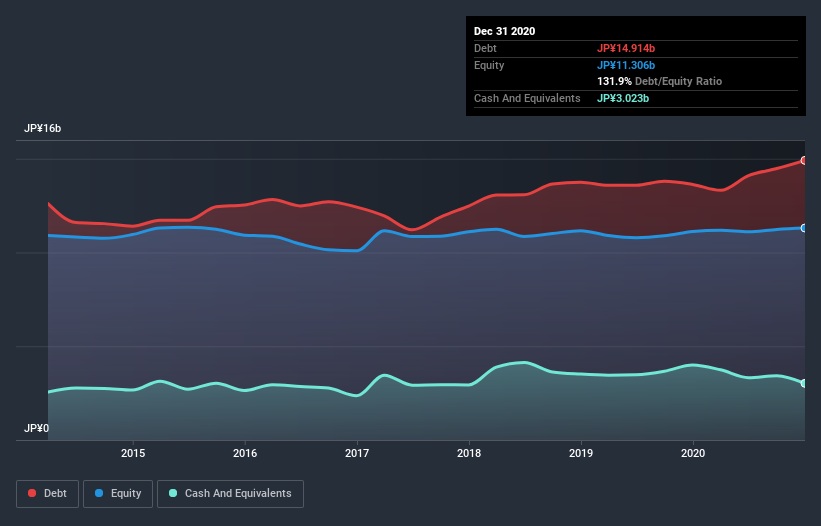

The chart below, which you can click on for greater detail, shows that Japan Logistic Systems had JP¥14.0b in debt in December 2020; about the same as the year before. However, it also had JP¥3.02b in cash, and so its net debt is JP¥11.0b.

How Healthy Is Japan Logistic Systems' Balance Sheet?

The latest balance sheet data shows that Japan Logistic Systems had liabilities of JP¥13.9b due within a year, and liabilities of JP¥14.0b falling due after that. On the other hand, it had cash of JP¥3.02b and JP¥7.41b worth of receivables due within a year. So it has liabilities totalling JP¥17.5b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the JP¥5.01b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Japan Logistic Systems would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt to EBITDA of 4.2 Japan Logistic Systems has a fairly noticeable amount of debt. But the high interest coverage of 8.3 suggests it can easily service that debt. Unfortunately, Japan Logistic Systems saw its EBIT slide 4.5% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Japan Logistic Systems will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Japan Logistic Systems produced sturdy free cash flow equating to 55% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Mulling over Japan Logistic Systems's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Looking at the bigger picture, it seems clear to us that Japan Logistic Systems's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Japan Logistic Systems is showing 2 warning signs in our investment analysis , and 1 of those is significant...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Japan Logistic Systems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:9060

Japan Logistic Systems

Operates in cargo vehicle transport, freight forwarding, warehousing, packing and wrapping, and logistics system consulting businesses in Japan and internationally.

Average dividend payer slight.

Market Insights

Community Narratives