- Japan

- /

- Transportation

- /

- FKSE:9035

Daiichi Koutsu SangyoLtd (FKSE:9035) Share Prices Have Dropped 29% In The Last Three Years

While it may not be enough for some shareholders, we think it is good to see the Daiichi Koutsu Sangyo Co.,Ltd. (FKSE:9035) share price up 24% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 29% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Daiichi Koutsu SangyoLtd

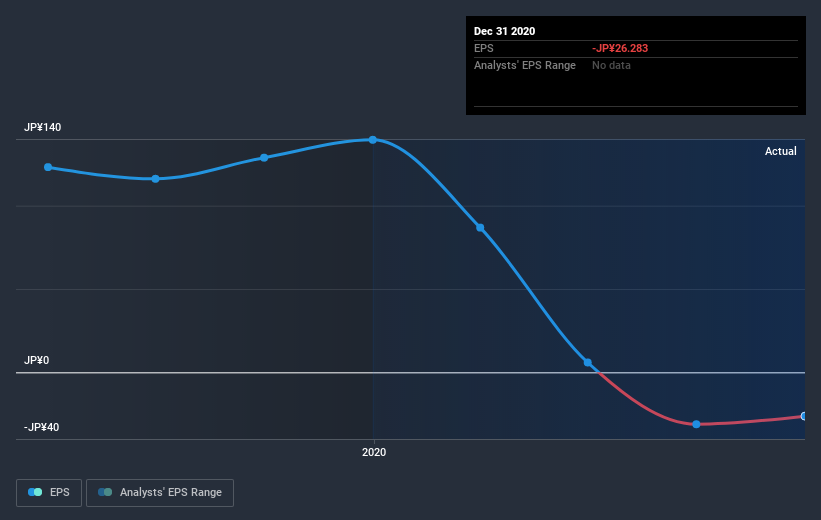

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Daiichi Koutsu SangyoLtd saw its share price decline over the three years in which its EPS also dropped, falling to a loss. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Daiichi Koutsu SangyoLtd's key metrics by checking this interactive graph of Daiichi Koutsu SangyoLtd's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Daiichi Koutsu SangyoLtd's TSR for the last 3 years was -21%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Daiichi Koutsu SangyoLtd provided a TSR of 20% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 2% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Daiichi Koutsu SangyoLtd better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Daiichi Koutsu SangyoLtd you should be aware of, and 2 of them are a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

When trading Daiichi Koutsu SangyoLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About FKSE:9035

Daiichi Koutsu SangyoLtd

Provides passenger transportation services through taxi and bus in Japan.

Average dividend payer slight.

Market Insights

Community Narratives