- Japan

- /

- Wireless Telecom

- /

- TSE:9984

Is It Too Late To Consider SoftBank After Its 2025 Rally And Mixed Valuation Signals?

Reviewed by Bailey Pemberton

- If you are wondering whether SoftBank Group's huge run means you have already missed the opportunity, or if the stock still has room to surprise on the upside, you are in the right place.

- Despite a recent pullback, with the share price down 4.4% over the last week and 9.1% over the last month, SoftBank is still up 85.3% year to date and 96.1% over the past year.

- These moves sit against a backdrop of SoftBank reshaping itself into a more focused investment powerhouse, from headline grabbing AI and chip related bets to ongoing portfolio simplification and buybacks. Together, these shifts are changing how the market prices the company and how investors think about its long term risk and reward profile.

- On our valuation framework, SoftBank Group scores a 3 out of 6, suggesting pockets of undervaluation but also areas where the price already bakes in optimism. Next, we break down what the main valuation approaches indicate today, before finishing with a more holistic way to judge what the stock may be worth.

Approach 1: SoftBank Group Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting future dividends per share and discounting them back to today, then comparing that value with the current market price.

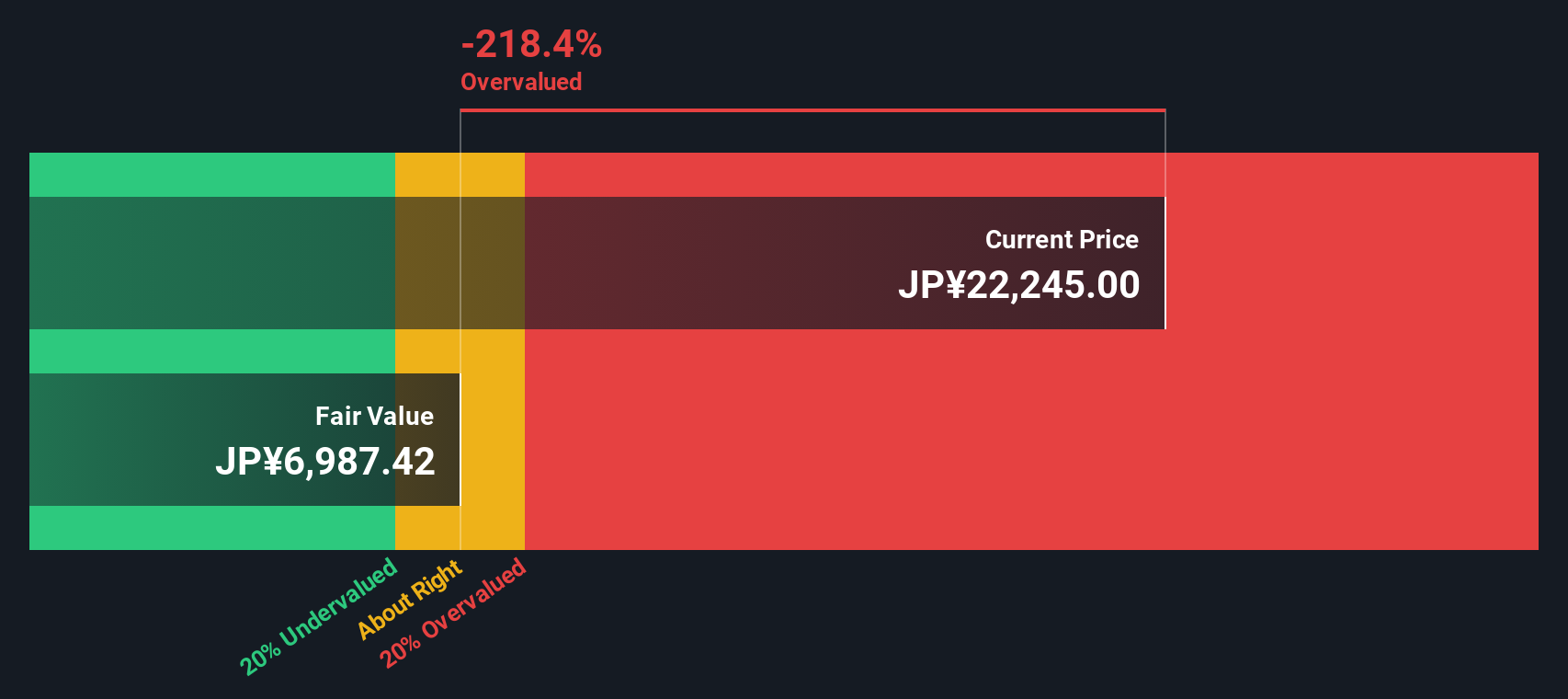

For SoftBank Group, the model uses an annual dividend per share of about ¥46.14 and a relatively low return on equity of 4.18%. The payout ratio is very high at roughly 206%, which suggests dividends are running well ahead of underlying earnings and may be difficult to sustain without ongoing asset sales or exceptional gains.

To avoid assuming unrealistic expansion, dividend growth is capped at 0.60% a year, even though recent performance would imply a higher 4.09% growth rate. This conservative growth input feeds into the DDM and produces an intrinsic value around ¥1,099 per share.

Compared with the current share price, this implies the stock is about 1,457.8% above the level justified by its dividend outlook. This indicates that SoftBank may be trading far above what income focused investors might consider reasonable.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests SoftBank Group may be overvalued by 1457.8%. Discover 918 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SoftBank Group Price vs Earnings

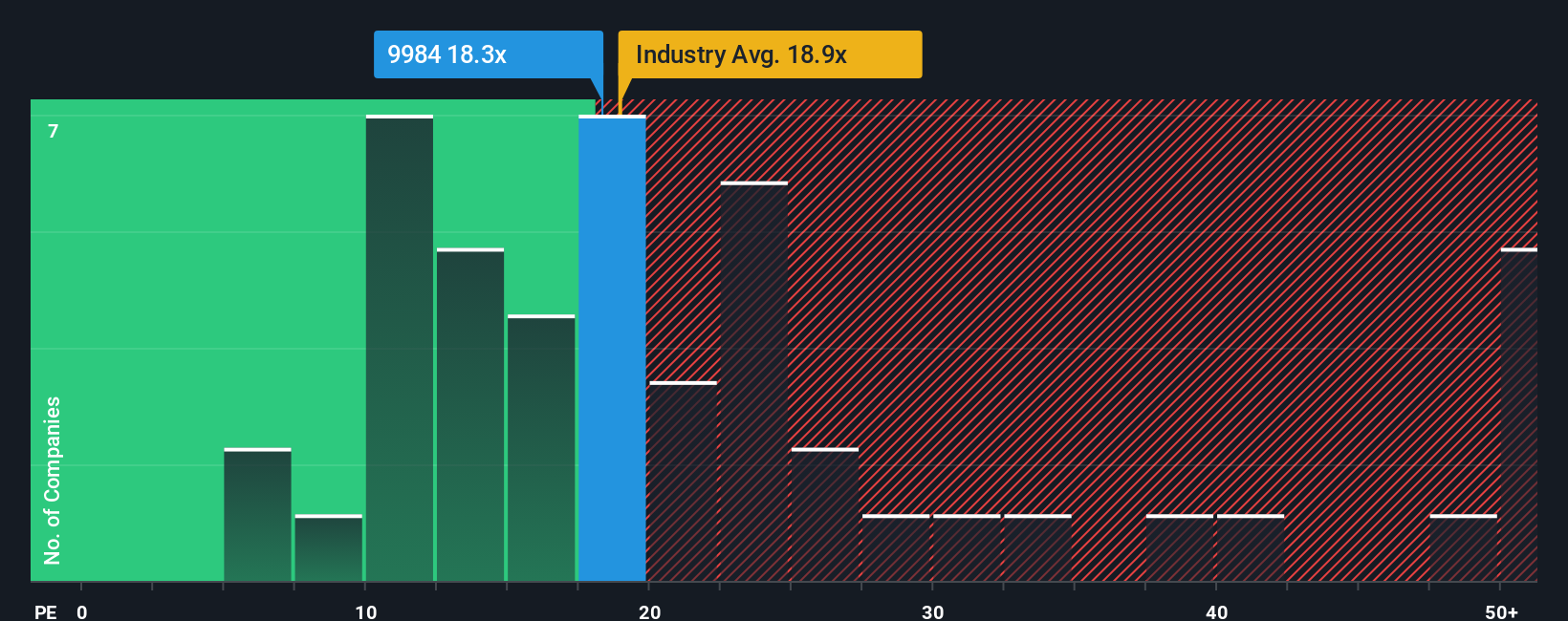

For companies that are generating profits, the price to earnings, or PE, ratio is a practical way to gauge valuation because it directly links what investors pay to what the business earns today. In general, faster earnings growth and lower risk justify a higher PE, while slower growth or higher uncertainty usually calls for a lower, more cautious multiple.

SoftBank Group currently trades on a PE of 7.98x, which is well below both the Wireless Telecom industry average of about 17.62x and the broader peer group average of 16.56x. On the surface, that discount suggests the market is still assigning a meaningful risk premium to SoftBank’s complex portfolio and uneven earnings profile, despite the recent share price rally.

Simply Wall St’s Fair Ratio framework estimates a “normal” PE for SoftBank of 10.58x, based on its specific mix of earnings growth, profitability, industry, market cap and risk factors. This tailored Fair Ratio is more informative than a simple comparison with peers, because it adjusts for company specific strengths and weaknesses rather than assuming all telecom and investment platforms deserve the same multiple. Comparing 7.98x to the 10.58x Fair Ratio points to SoftBank trading at a notable discount to what its fundamentals imply.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1466 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoftBank Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of SoftBank Group’s story with the numbers behind its future revenue, earnings, margins and fair value.

A Narrative is your own investment storyline that ties what you believe about a company’s business drivers, risks and opportunities to a concrete financial forecast and, ultimately, to an estimate of what the stock is really worth today.

On Simply Wall St, Narratives are an easy, accessible tool on the Community page that millions of investors use to turn their views into structured forecasts, compare their Fair Value to the current market Price to inform their own buy or sell decisions, and then have those views update dynamically as new news, earnings and guidance are released.

For SoftBank Group, one investor might build a bullish Narrative that focuses on large-scale AI infrastructure investments and sees fair value around ¥22,781, while another, more cautious investor might focus on leverage and IPO risk and land closer to ¥9,400. Narratives make these different perspectives transparent, comparable and easier to analyze.

Do you think there's more to the story for SoftBank Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion