- Japan

- /

- Wireless Telecom

- /

- TSE:9984

Can SoftBank’s 158% Stock Surge in 2025 Be Justified by Its AI Ambitions?

Reviewed by Bailey Pemberton

If you’ve been eyeing SoftBank Group’s stock lately, you’re not alone. With shares closing at 23,880 yen and a jaw-dropping 158.6% return year-to-date, investors are wondering if the recent surge is just the start of a larger story or the peak before a plateau. Over the past month alone, SoftBank jumped another 25.7%, following a consistent upward climb for more than a year. That kind of performance is hard to ignore, and it’s got everyone buzzing about what’s driving this momentum and whether it’s justified.

A big part of the story comes down to SoftBank’s ambitious investments in artificial intelligence and technology platforms. While the company has reshaped its portfolio and struck several high-profile partnerships this year, investor appetite seems to be fueled by the hope that SoftBank’s vision-led strategy could unlock even more value in the future. Still, it’s worth noting a touch of caution in the air. Some of the excitement is balanced by lingering questions about risk and sustainability, especially after such a dramatic run-up in price. As positive sentiment pushes the stock higher, it also shifts the conversation to where the value really lies today.

So, is SoftBank Group actually undervalued at these prices? According to a commonly used value score, SoftBank didn’t register as undervalued in any of the six main valuation checks, giving it a score of 0. That may surprise some, and it raises an important question: Are there hidden factors the score misses, or is the market simply betting on a bold future? Up next, we will break down the different ways SoftBank’s valuation is analyzed and explore whether these methods really capture the whole picture, or if there’s a smarter approach for long-term investors.

SoftBank Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SoftBank Group Discounted Cash Flow (DCF) Analysis

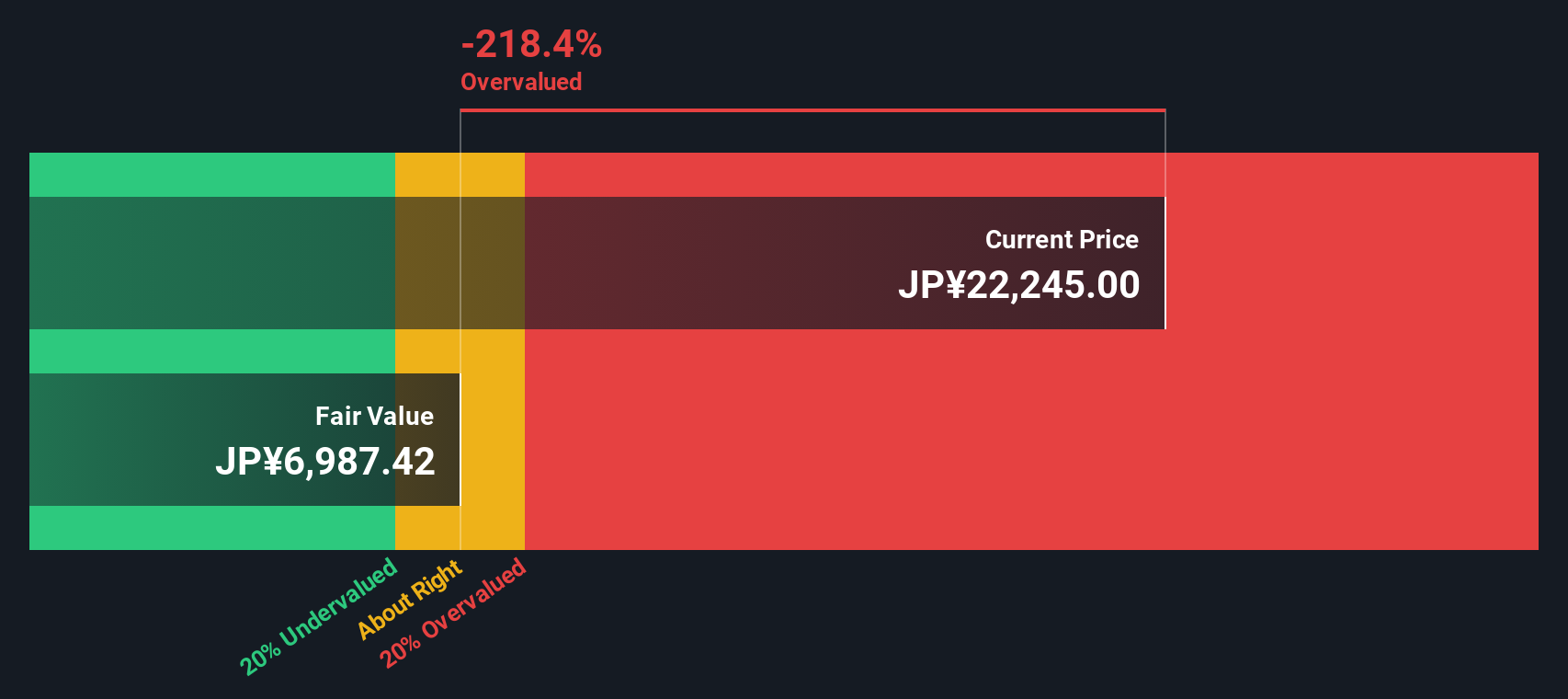

The Discounted Cash Flow (DCF) valuation model projects a company’s future cash flows and discounts them back to today’s value, aiming to estimate what the business is truly worth based on its capacity to generate wealth over time. For SoftBank Group, this approach relies on a 2 Stage Free Cash Flow to Equity model, using both analyst forecasts and extrapolations for longer-term projections.

Right now, SoftBank’s most recent Free Cash Flow (FCF) is negative, at -787 billion yen, reflecting significant capital outflow. Analyst projections for the next few years remain volatile. For example, FCF is still negative in 2026 at -1,685 billion yen, and only turns positive in 2029, where a recovery to 432 billion yen is anticipated, followed by a further increase to 669 billion yen by 2035 (all values in ¥).

Pushing these forecasts through the DCF model, the intrinsic value of SoftBank Group’s shares comes out at around 6,987 yen. With the current stock price sitting at 23,880 yen, this suggests the stock trades at a 241.8% premium to its fair value. According to this method, it appears significantly overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SoftBank Group may be overvalued by 241.8%. Find undervalued stocks or create your own screener to find better value opportunities.

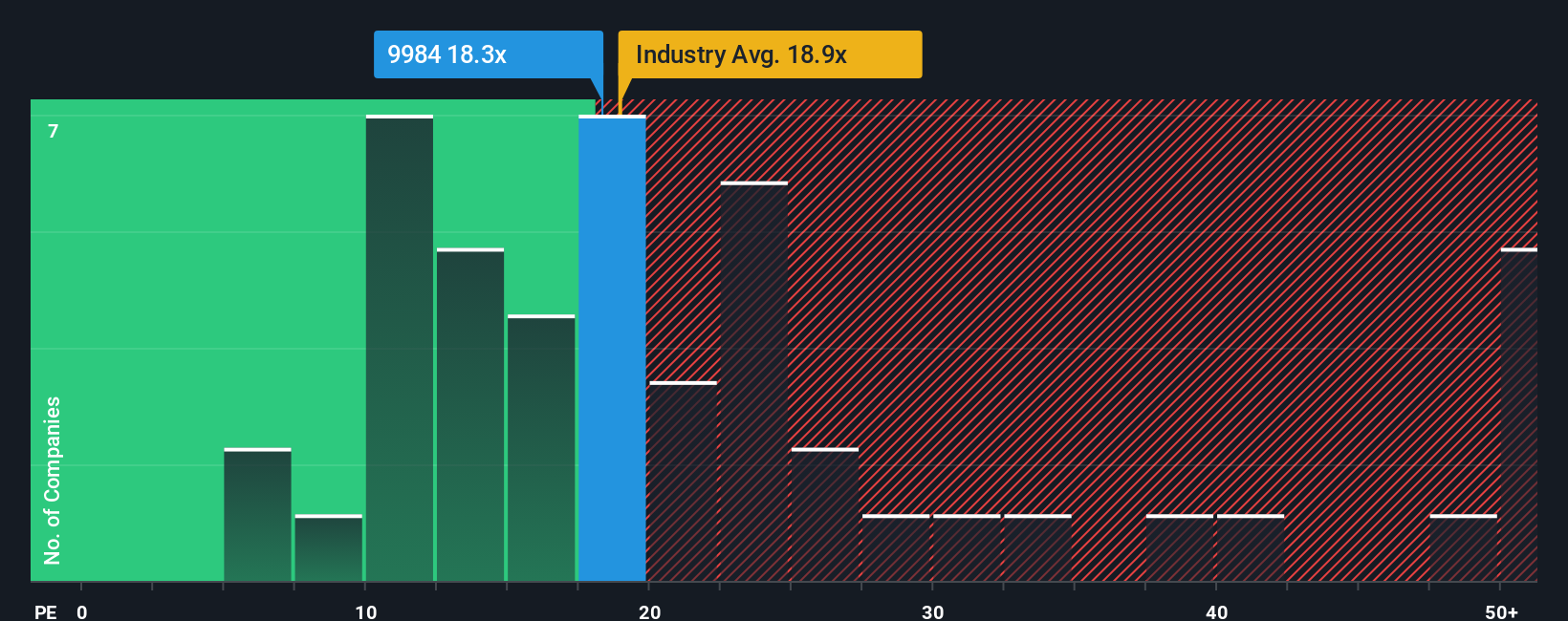

Approach 2: SoftBank Group Price vs Earnings

For profitable companies like SoftBank Group, the Price-to-Earnings (PE) ratio is a widely used valuation metric because it sheds light on how much investors are willing to pay per yen of earnings. A lower PE might point to a bargain, while a higher one often reflects higher growth expectations or a lower perceived risk. However, what counts as a "normal" PE can shift with factors like a company's growth prospects and the stability of its profits. Fast growers or risky ventures often command different multiples than stable, slow-growing peers.

Currently, SoftBank Group’s PE ratio stands at 19.65x. That's above the peer average of 16.83x and also higher than the Wireless Telecom industry average of 18.39x. It’s easy to assume a stock looks expensive or cheap by these headline numbers, but a more tailored comparison comes from the Simply Wall St Fair Ratio, which for SoftBank sits at 17.94x. Unlike basic averages, the Fair Ratio incorporates a deeper set of factors: earnings growth outlook, risk profile, profit margins, industry dynamics, and even the company’s market cap. This creates a more nuanced picture of what a “fair” valuation looks like, beyond the simple peer or industry lens.

With SoftBank’s current PE ratio just 1.71x above the Fair Ratio, the stock trades at a modest premium to its fair value. While it’s not significantly overvalued, it is priced slightly above the level the fundamentals would suggest.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoftBank Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story or perspective on a company, tying together what you believe about its future growth, risk, and profitability, and how those beliefs translate into numbers like fair value, future revenue, and margins.

With Narratives, you’re not just crunching numbers; you’re connecting the company's business developments, strategy, and market environment to an actual forecast, and then seeing what that means for its share price, or identifying what would make it a buy or sell for you. Narratives are available for anyone to use on Simply Wall St’s Community page, making this approach accessible to millions of investors who want to take more control of their decisions.

The power of Narratives lies in how dynamically they update whenever new news or earnings land, ensuring your perspective is always up to date with the latest information. By comparing your personalized fair value to the current market price, Narratives help you decide whether to buy, hold, or sell based on your own research and evolving convictions.

For SoftBank Group, for example, some investors see strong long-term value driven by AI partnerships and robust asset monetization, suggesting a high fair value, while others focus on regulatory and earnings risks, leading them to a far more cautious outlook and much lower fair value.

Do you think there's more to the story for SoftBank Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives