- China

- /

- Paper and Forestry Products

- /

- SZSE:300606

Uncovering Undiscovered Gems With Solid Potential This November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have captured investor attention, with the Russell 2000 Index surging significantly yet still shy of its previous record highs. In this dynamic environment, identifying stocks with solid fundamentals and growth potential becomes crucial for investors seeking opportunities amid changing economic policies and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Dongguan Golden Sun AbrasivesLtd (SZSE:300606)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dongguan Golden Sun Abrasives Co., Ltd. is engaged in the research, development, manufacturing, and sale of grinding and polishing materials, intelligent equipment, and precision structural parts manufacturing services in China with a market cap of CN¥3.29 billion.

Operations: Golden Sun's revenue streams primarily include the sale of grinding and polishing materials, intelligent equipment, and precision structural parts manufacturing services. The company has a market capitalization of CN¥3.29 billion.

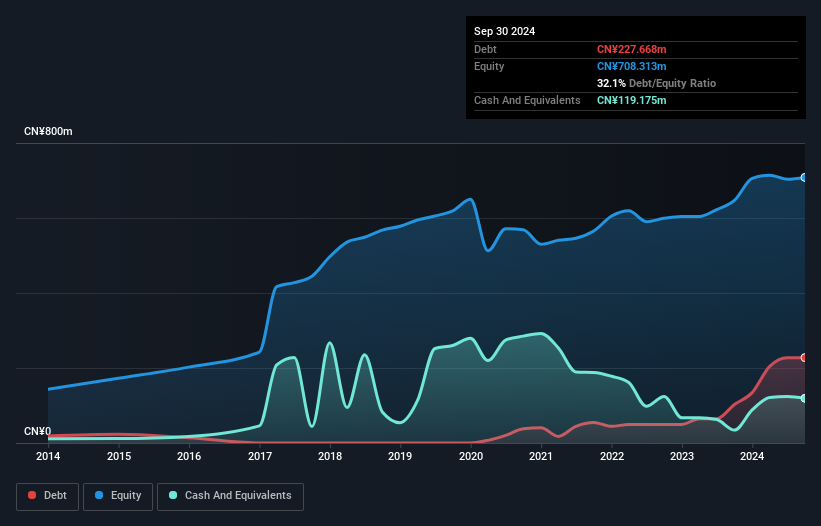

Golden Sun Abrasives, a smaller player in its industry, has shown mixed performance recently. Over the past five years, its earnings have decreased by 9.9% annually. Despite this, the company reported a net income of CNY 20 million for the nine months ending September 2024, down from CNY 32 million the previous year. The debt-to-equity ratio rose to 32% over five years but remains manageable with interest payments well covered by EBIT at a multiple of 24 times. While earnings growth lagged behind industry averages last year, Golden Sun's high-quality earnings suggest potential resilience amidst volatility.

El Al Israel Airlines (TASE:ELAL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: El Al Israel Airlines Ltd., along with its subsidiaries, offers passenger and cargo transportation services and has a market capitalization of ₪3.24 billion.

Operations: El Al Israel Airlines generates revenue primarily from passenger aircrafts, contributing $2.83 billion, and cargo aircrafts, adding $70.31 million.

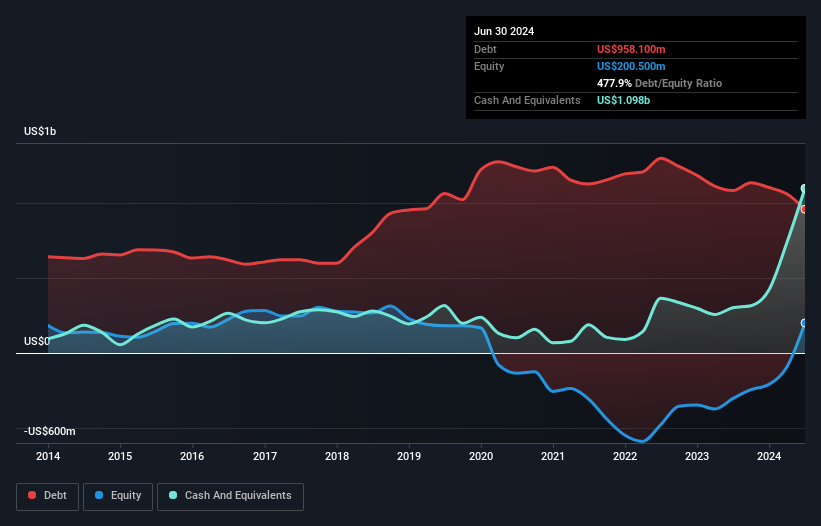

El Al Israel Airlines, a smaller player in the aviation sector, has been making waves with impressive financial strides. Over the past year, its earnings surged by 229%, significantly outpacing the industry average of 58%. The company reported strong net income of US$146.6 million for Q2 2024, up from US$58.2 million in the previous year. Despite a volatile share price recently, El Al's interest payments are well covered by EBIT at 4.1 times coverage and it boasts more cash than total debt. However, shareholders experienced substantial dilution over the last year amidst these financial achievements.

- Navigate through the intricacies of El Al Israel Airlines with our comprehensive health report here.

Okinawa Cellular Telephone (TSE:9436)

Simply Wall St Value Rating: ★★★★★★

Overview: Okinawa Cellular Telephone Company offers telecommunication and mobile phone services in Japan with a market cap of ¥202.15 billion.

Operations: The company generates revenue primarily from telecommunication and mobile phone services in Japan. It has a market capitalization of ¥202.15 billion.

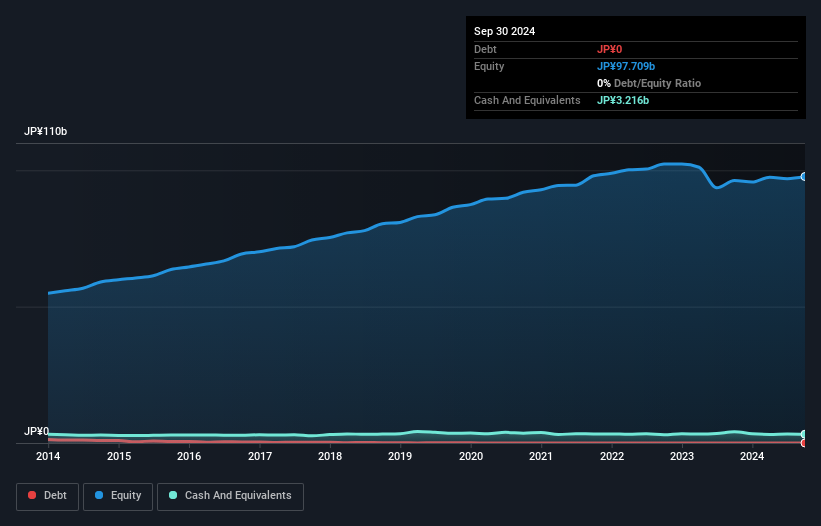

Okinawa Cellular, a smaller player in the telecom sector, is debt-free, contrasting its past with a 0.07% debt-to-equity ratio five years ago. It trades at about 30.8% below estimated fair value and has high-quality earnings, with recent growth of 2.4%, outpacing the industry’s -12.6%. The company is profitable and free cash flow positive, indicating solid financial health despite capital expenditures of ¥9 billion as of September 2024. Recently, Okinawa increased its share buyback plan by 200,000 shares to total authorization of 1.6 million shares worth ¥5 billion, reflecting confidence in its valuation and future prospects.

Key Takeaways

- Investigate our full lineup of 4667 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300606

Dongguan Golden Sun AbrasivesLtd

Research, develops, manufactures, and sells grinding and polishing materials, intelligent equipment, and provision of precision structural parts manufacturing services in China.

Excellent balance sheet with acceptable track record.