- Japan

- /

- Wireless Telecom

- /

- TSE:9434

SoftBank (TSE:9434): Evaluating Valuation as Shares Climb on Telecom Sector Momentum

Reviewed by Simply Wall St

See our latest analysis for SoftBank.

SoftBank’s story this year has been one of building momentum, with a 19.1% share price return year to date and a 25.4% total shareholder return over the past twelve months. Investors are taking note of its resilience and growth potential as the company navigates sector changes and keeps pace with shifting market sentiment.

If SoftBank’s performance has you thinking about new opportunities, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares hovering just below analyst price targets and the company boasting strong returns, investors are left to wonder whether SoftBank is trading at a discount or if the market already reflects its future growth prospects.

Most Popular Narrative: 0.6% Undervalued

SoftBank's most popular narrative sees its fair value pegged at ¥234.93, just above its recent close at ¥233.6, sparking debate over whether the stock has more upside or if optimism is already priced in.

Accelerating investment in AI, fintech, and digital infrastructure boosts recurring revenue streams, margin expansion, and monetization through partnerships and new service offerings. Strategic focus on semiconductors and global collaborations bolsters Japan's tech self-sufficiency while reducing supply chain and geopolitical risks for sustained SoftBank growth.

What key assumptions power this razor-thin undervaluation? Get the inside track on bold growth bets, margin leaps, and profit forecasts the narrative is staking its reputation on. Think you know the pivotal figure used to anchor SoftBank’s price target? There is more to uncover. See what is under the hood of this fair value call.

Result: Fair Value of ¥234.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying price competition and rising costs could undermine SoftBank’s profit growth. This may challenge the optimistic outlook that analysts have projected.

Find out about the key risks to this SoftBank narrative.

Another View: What Do Multiples Say?

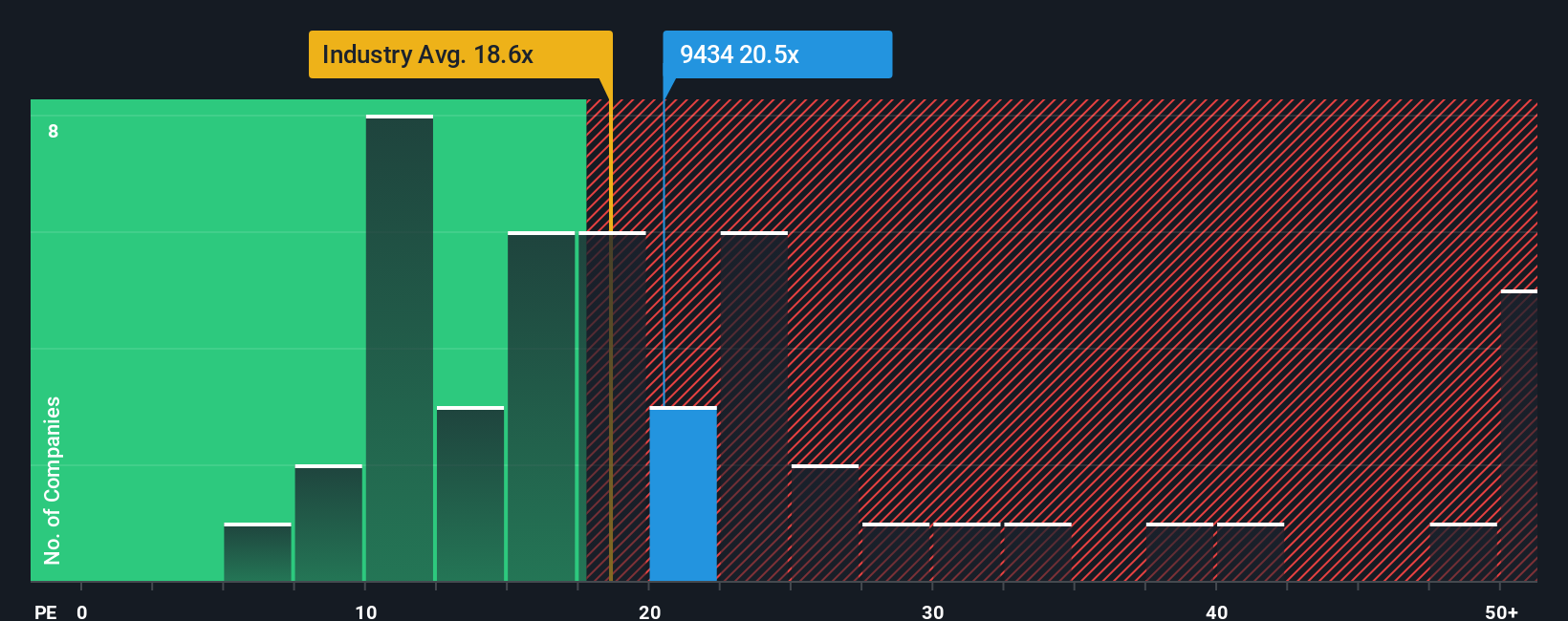

Looking from a different angle, SoftBank currently trades at a price-to-earnings ratio of 20.6x. This is higher than the Asian Wireless Telecom industry’s average of 20.1x, the peer group average of 13.6x, and also above its fair ratio of 18.2x. These figures suggest investors may be paying a premium, possibly leaving little margin for error if expectations shift. Will the market continue to prize growth, or could a move toward the fair ratio mean a reset in valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoftBank Narrative

If you see the story differently or want to form your own conclusions, you can dig into the numbers and craft your own view in just minutes with Do it your way.

A great starting point for your SoftBank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the market’s best opportunities before everyone else. Smart investors always keep their radar on for tomorrow’s winners. Check out these handpicked avenues you do not want to miss.

- Boost your income by tapping into reliable companies with strong yields using these 15 dividend stocks with yields > 3%.

- Join the AI revolution by reviewing these 26 AI penny stocks poised for growth in automation, data, and intelligent innovation.

- Get ahead of the curve and browse these 26 quantum computing stocks set to transform technology horizons with cutting-edge breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9434

SoftBank

Provides mobile communications and fixed-line telecommunications and ISP services in Japan.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives