- Japan

- /

- Wireless Telecom

- /

- TSE:9434

SoftBank (TSE:9434): Assessing Valuation After an 11% Share Price Move in Japan’s Telecom Sector

Reviewed by Simply Wall St

SoftBank (TSE:9434) shares have seen some movement recently, drawing attention to how investor sentiment is shifting around Japan's telecom sector. With the stock up 11% for the year, many are watching for the next catalyst.

See our latest analysis for SoftBank.

This year’s 11% share price return puts SoftBank in the spotlight, especially as the company navigates Japan’s fast-evolving telecom landscape. Investors seem optimistic about its growth story, reflected in a strong 22% total shareholder return over the last twelve months and an impressive 131% five-year total return. Although short-term momentum has dipped in recent weeks, the long-term trajectory signals sustained value for patient holders.

If this kind of momentum sparks your curiosity, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But after such strong multi-year gains and a recent 11% rally, the real question is whether SoftBank’s current share price reflects its future potential, or if a genuine buying opportunity still exists for investors.

Most Popular Narrative: 7% Undervalued

SoftBank’s current share price stands notably below the most popular fair value estimate, hinting at considerable upside potential. This valuation is anchored in key profit, margin, and growth drivers that have caught investors’ eyes.

Accelerating investment in AI, fintech, and digital infrastructure boosts recurring revenue streams, margin expansion, and monetization through partnerships and new service offerings. Strategic focus on semiconductors and global collaborations bolsters Japan's tech self-sufficiency while reducing supply chain and geopolitical risks for sustained SoftBank growth.

Curious about what powers this bullish outlook? The secret sauce: bold top-line growth assumptions, expanding margins, and a future valuation ratio rarely seen among Japan’s wireless giants. Discover which surprising future upgrades tip the scales so strongly in SoftBank’s favor as this narrative breaks it all down.

Result: Fair Value of ¥234.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition and rising costs could limit SoftBank’s margin growth, creating headwinds if pricing power declines further.

Find out about the key risks to this SoftBank narrative.

Another View: Price-to-Earnings Tells a Different Story

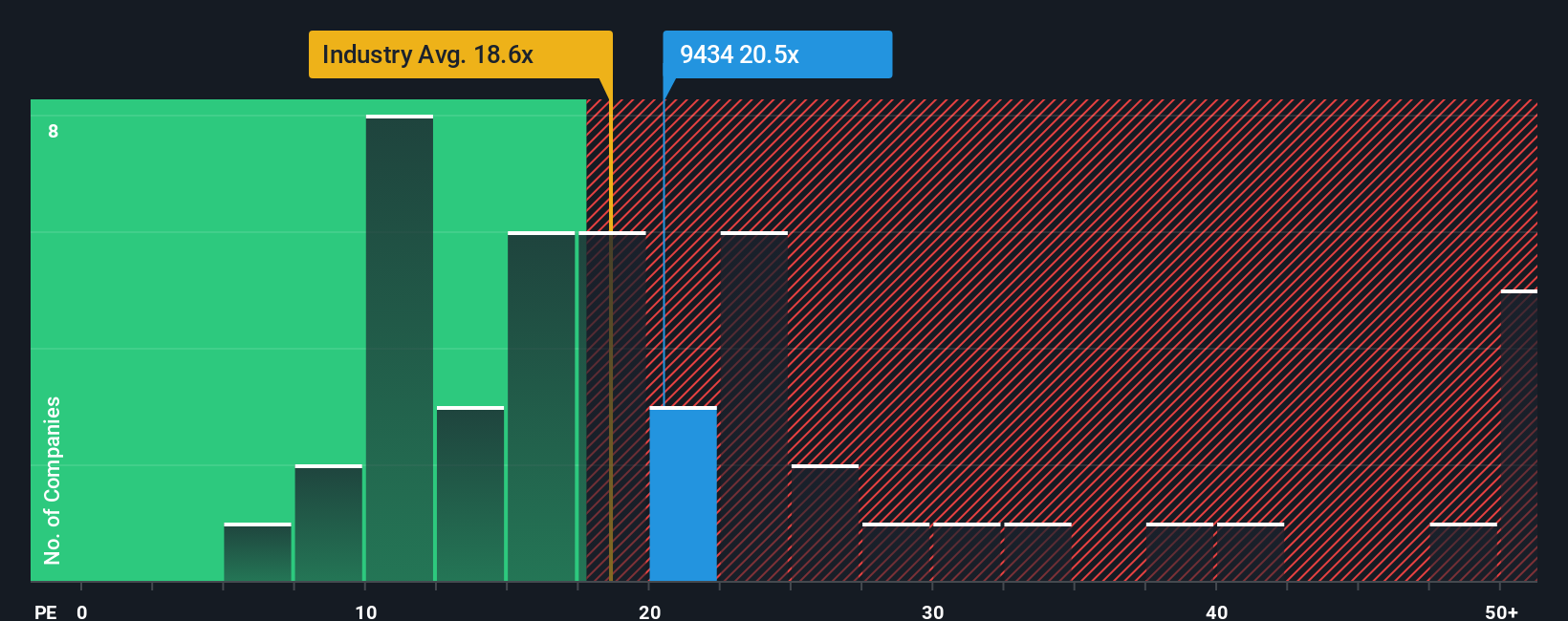

Taking a look through the lens of the price-to-earnings ratio, SoftBank trades at 20.7x, higher than both its industry average of 18.6x and the peer average of 16.6x. Even when compared to the fair ratio of 20x, the stock carries a slight premium, hinting that much of its upside might already be priced in. This could suggest the market is more cautious about risk than optimistic about opportunity.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoftBank Narrative

If you think differently or would rather dive into the numbers your own way, you can quickly shape your own take. Start building yours now: Do it your way

A great starting point for your SoftBank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity slip by. The smartest investors hunt for winning stocks across all sectors and trends. Put yourself ahead with these screeners:

- Fuel your income strategy and tap into steady cash flow by reviewing these 17 dividend stocks with yields > 3% offering yields above 3% and robust payout histories.

- Stay ahead of the innovation curve by checking out these 27 AI penny stocks positioned to benefit from rapid advances in artificial intelligence applications.

- Uncover market mispricings quickly by targeting companies trading below fair value and browsing these 877 undervalued stocks based on cash flows built for forward-thinking investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9434

SoftBank

Provides mobile communications and fixed-line telecommunications and ISP services in Japan.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives