- Japan

- /

- Wireless Telecom

- /

- TSE:9434

Does SoftBank’s (TSE:9434) Robust Dividend Plan Reflect Management Confidence in Long-Term Capital Allocation?

Reviewed by Sasha Jovanovic

- On October 23, 2025, SoftBank Corp. announced dividends amounting to ¥205.27 billion on common shares and provided specific per-share payments across all share classes for the six months ending March 31, 2026.

- Alongside confirming dividend figures, SoftBank also issued forward guidance for continued dividends in the second half of the fiscal year, highlighting the company’s commitment to returning value to shareholders through regular distributions.

- With the board’s recent approval of sizable dividend payments and forward guidance, we’ll explore how this signals management’s confidence in ongoing shareholder returns within SoftBank’s broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

SoftBank Investment Narrative Recap

For investors to feel comfortable as SoftBank shareholders, belief in the company’s ability to deliver steady returns from its established telecom base while unlocking value through AI, fintech, and digital infrastructure is essential. The newly affirmed, substantial dividend and ongoing guidance reinforce the management’s emphasis on reliable cash returns but do not materially affect the most pressing short-term catalyst: monetizing AI and cloud services for enterprise growth. The primary risk, margin pressure from rising operating and network costs, remains unchanged despite the dividend update.

The most relevant announcement is SoftBank’s official confirmation of its JPY 205.27 billion dividend for common shares, alongside forward guidance for the second half. This continued predictability around shareholder distributions complements recent efforts to drive enterprise digital revenue, providing reassurance as the company manages investments in rapidly evolving technology and infrastructure. However, the tension between disciplined capital returns and the rising expense of network expansion means investors should remain aware of ...

Read the full narrative on SoftBank (it's free!)

SoftBank's narrative projects ¥7,548.0 billion in revenue and ¥650.7 billion in earnings by 2028. This requires a 4.2% yearly revenue growth and a ¥149.5 billion earnings increase from current earnings of ¥501.2 billion.

Uncover how SoftBank's forecasts yield a ¥235 fair value, a 7% upside to its current price.

Exploring Other Perspectives

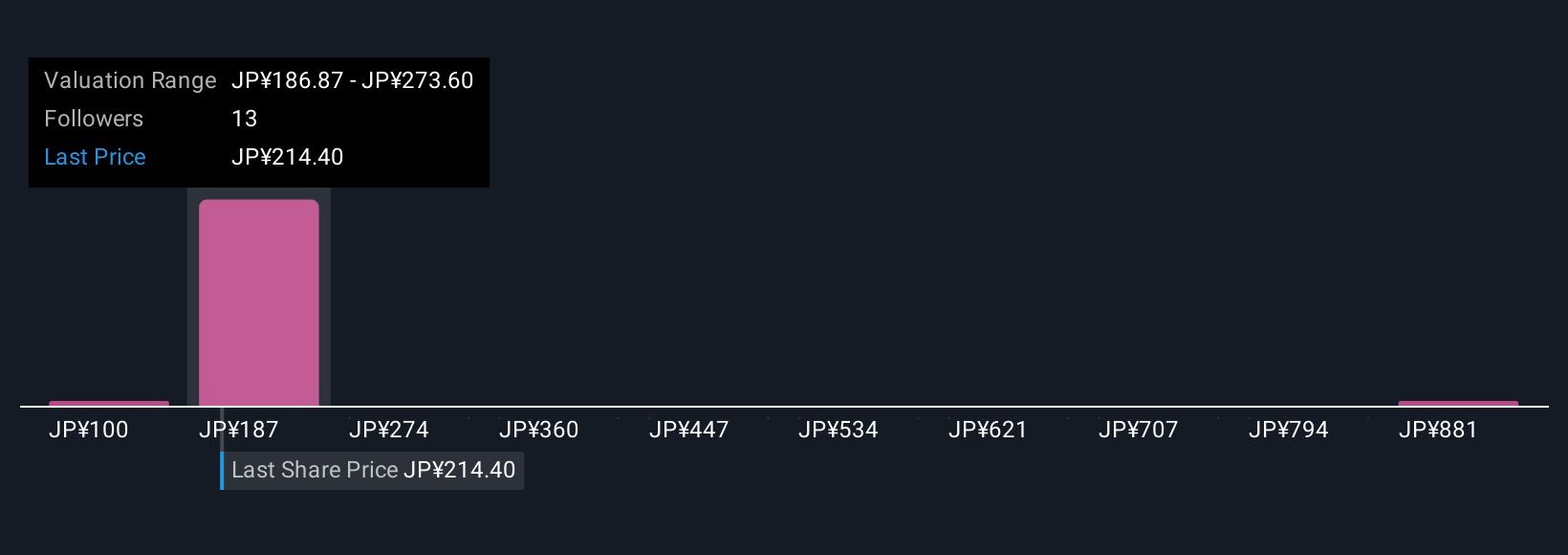

Simply Wall St Community members submitted five fair value estimates for SoftBank ranging from ¥100.14 to ¥245.17 per share. While some see significant upside, concerns about compression of profit margins from surging cost pressures remain front of mind for many market participants, offering you several distinct perspectives to consider.

Explore 5 other fair value estimates on SoftBank - why the stock might be worth less than half the current price!

Build Your Own SoftBank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoftBank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SoftBank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoftBank's overall financial health at a glance.

No Opportunity In SoftBank?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9434

SoftBank

Provides mobile communications and fixed-line telecommunications and ISP services in Japan.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives