- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9432

NTT (TSE:9432): Reevaluating Valuation After Recent Share Price Movement

Reviewed by Simply Wall St

NTT (TSE:9432) is getting some fresh attention from investors after its latest share price movement, leaving many to wonder if this is the start of something bigger or just a pause in the action. It is not driven by a headline event this time, which makes the underlying reasons behind the drift all the more intriguing. When there is no clear news but a noticeable change in price, it often signals that the market is quietly re-evaluating assumptions about growth, risk, or both. For NTT, that means it is time to take a step back and reconsider what is really going on beneath the surface.

Zooming out, NTT’s shares have climbed almost 9% over the last year, with steady upward momentum building since early spring. The company has also posted encouraging financial growth, with annual revenue increasing nearly 3% and net income up over 6%. Buoyed by these numbers, NTT continues to attract interest in a market where consistency is often valued as much as rapid innovation.

So, after a solid year marked by gradual gains, should investors see the current price as a chance to buy into NTT’s growth at a bargain, or is the market already baking in future upside?

Most Popular Narrative: 10.5% Undervalued

The most widely followed narrative suggests that NTT could be trading well below its fair value, reflecting a significant discount based on future earnings and catalysts.

NTT's investment in proprietary technologies (for example, IOWN, advanced LLMs like tsuzumi 2, and photonics) positions it to benefit from surging connectivity and low-latency compute requirements driven by the global rollout of 5G and 6G as well as edge computing. These developments underpin sustainable earnings growth and an expanded addressable market for high-value services, supporting future margin and EBIT expansion.

What is really powering this bold valuation? The narrative hints at a formula packed with cutting-edge technology investments and ambitious financial assumptions that may surprise even seasoned investors. Hungry for a glimpse into the analyst math and the financial projections that fuel this optimism? The numbers at the heart of this story will challenge your expectations.

Result: Fair Value of ¥177.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in mobile service revenues and rising capital expenditures could quickly challenge even the most optimistic outlook for NTT’s growth story.

Find out about the key risks to this NTT narrative.Another View: Discounted Cash Flow Perspective

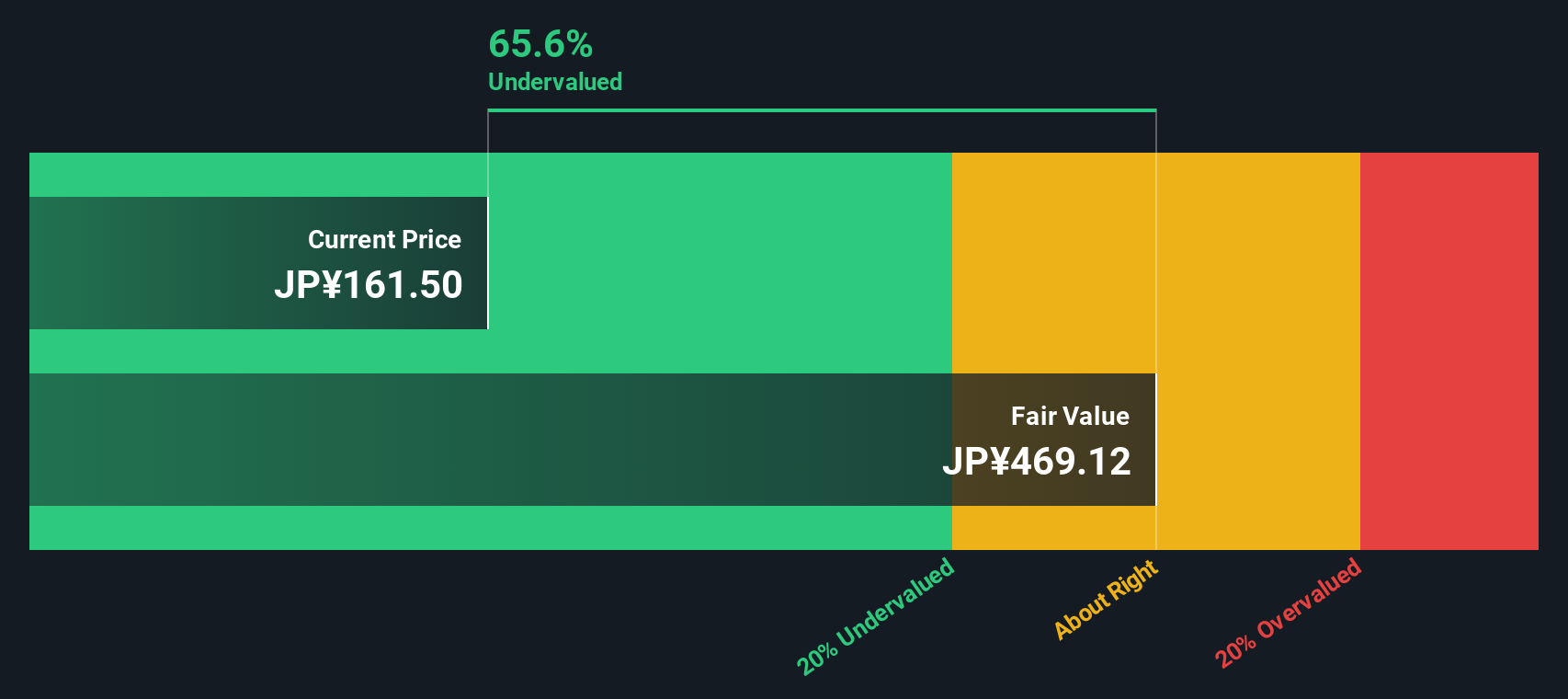

Taking a step back from analyst targets, our DCF model paints a similar picture, suggesting NTT remains undervalued on a fundamental basis. However, does this method capture all the business shifts underway?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NTT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NTT Narrative

If you see things differently or want to draw your own conclusions, dive into the numbers and craft your perspective in just a few minutes. Do it your way.

A great starting point for your NTT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their edge by tracking opportunities across the market. Act now to unlock fresh ideas you will not want to miss out on!

- Supercharge your portfolio with small but mighty companies gaining momentum. Try out penny stocks with strong financials to find leaders in unexpected growth spots.

- Tap into the future of medicine by browsing healthcare AI stocks. Discover how these choices are reshaping patient care and diagnostics with innovative artificial intelligence solutions.

- Capitalize on undervalued gems trading below their intrinsic value. Use our tool to access undervalued stocks based on cash flows and give yourself a head start before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:9432

NTT

Operates as a telecommunications company in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives