- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9432

NTT (TSE:9432) Margin Compression Challenges Value Narrative Despite Low P/E Ratio

Reviewed by Simply Wall St

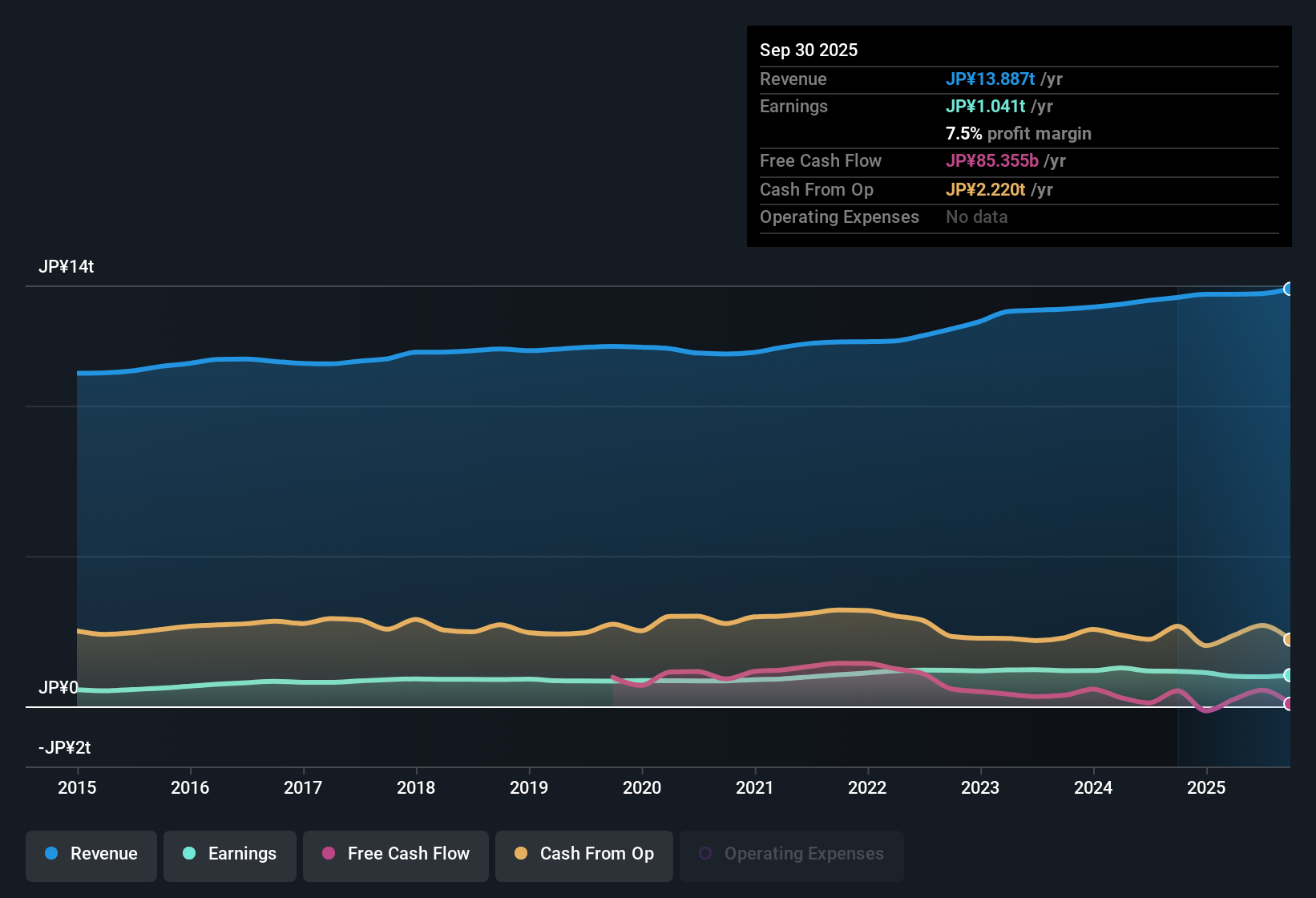

NTT (TSE:9432) posted a net profit margin of 7.5%, down from 8.6% a year ago. Its Price-To-Earnings ratio of 11.9x remains well below the peer average of 19.2x and the Asian Telecom industry’s 16.3x. Earnings have grown at a 2.7% annual pace over the past five years, with forward estimates pointing to a 5.59% annual earnings increase and 2.8% revenue growth. Investors will see the solid relative value and expectations for steady growth as positives. However, recent margin compression and below-market profit growth may temper enthusiasm.

See our full analysis for NTT.Next, we will see how these headline numbers compare to the main market narratives and find out which stories hold up to scrutiny.

See what the community is saying about NTT

Margin Outlook Pivots on Profit Mix

- Analysts expect profit margins to rise from 7.2% today to 8.2% within three years, reinforcing forecasts for improving operational efficiency beyond the current level.

- According to the analysts' consensus view, heavy investment in global data centers and proprietary tech is positioned to drive higher-margin recurring revenue. However,

- Rising costs and integration complexity remain a threat to margin gains, with some legacy revenue streams shrinking even as managed services expand.

- Forecasted margin recovery relies on the timely rollout of next-generation network upgrades and successfully transitioning away from slower fixed-line and legacy telecom services.

- Consensus narrative suggests NTT's profit mix shift will be the key to sustaining and expanding margins despite industry headwinds.

📊 Read the full NTT Consensus Narrative.

Dividend Sustainability Faces Profit Pressures

- NTT’s main flagged risk is the ability to continue its dividend, as high capital expenditures for network upgrades and data center expansions may constrain free cash flow during the transition period.

- Bears argue that continued declines in legacy communication revenues and mounting overseas competition could hinder both earnings growth and the company’s capacity to maintain dividends at current levels.

- Any persistent weakness in DOCOMO’s mobile service profits or unexpected FX headwinds abroad would further pressure NTT’s ability to fund payouts from organic growth alone.

- Historical organizational inefficiencies and slow synergy realization could delay the growth needed to offset these risks, compounding concerns about payout sustainability.

Valuation Discount Stands Out in Sector

- NTT trades at a 11.9x Price-To-Earnings ratio, which is well below both its peer average of 19.2x and the Asian Telecom industry’s 16.3x. This positions the stock as a relative value play even with its moderate growth trajectory.

- Analysts' consensus narrative flags that the current share price of 150.6 is significantly below the 179.14 analyst price target, a gap that bullish investors see as justified by ongoing investments in digital infrastructure and expectations for earnings growth.

- This discount persists despite forecasted EPS growth and margin recovery, suggesting the market is cautious about NTT’s ability to overcome its legacy revenue contraction and competitive pressures.

- If NTT executes on global expansion and manages costs successfully, its valuation could re-rate closer to peer levels as profitability improves.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NTT on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on NTT’s story? Share your perspective and shape a unique analysis in just a few minutes by Do it your way.

A great starting point for your NTT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

NTT’s profit margin compression, legacy revenue declines, and dividend sustainability risks highlight challenges in maintaining reliable shareholder returns.

If regular income and confidence in payout stability are top priorities, take a close look at these 1990 dividend stocks with yields > 3% to discover companies offering robust and dependable dividends, even as the industry changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NTT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9432

NTT

Operates as a telecommunications company in Japan and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion