- Japan

- /

- Telecom Services and Carriers

- /

- TSE:3774

IIJ’s Starlink Partnership Might Change The Case For Investing In Internet Initiative Japan (TSE:3774)

Reviewed by Sasha Jovanovic

- Internet Initiative Japan Inc. (IIJ) announced that it and its subsidiary will begin providing Starlink satellite services as an authorized reseller to corporate customers in Japan starting December 1, 2025, with plans for further international expansion.

- This move brings satellite-based connectivity solutions into IIJ's portfolio, enabling enterprise clients to access reliable internet in areas with limited terrestrial networks and improving disaster resilience options.

- We will explore how IIJ's entry into satellite connectivity as a Starlink reseller could shape the company’s investment narrative going forward.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Internet Initiative Japan's Investment Narrative?

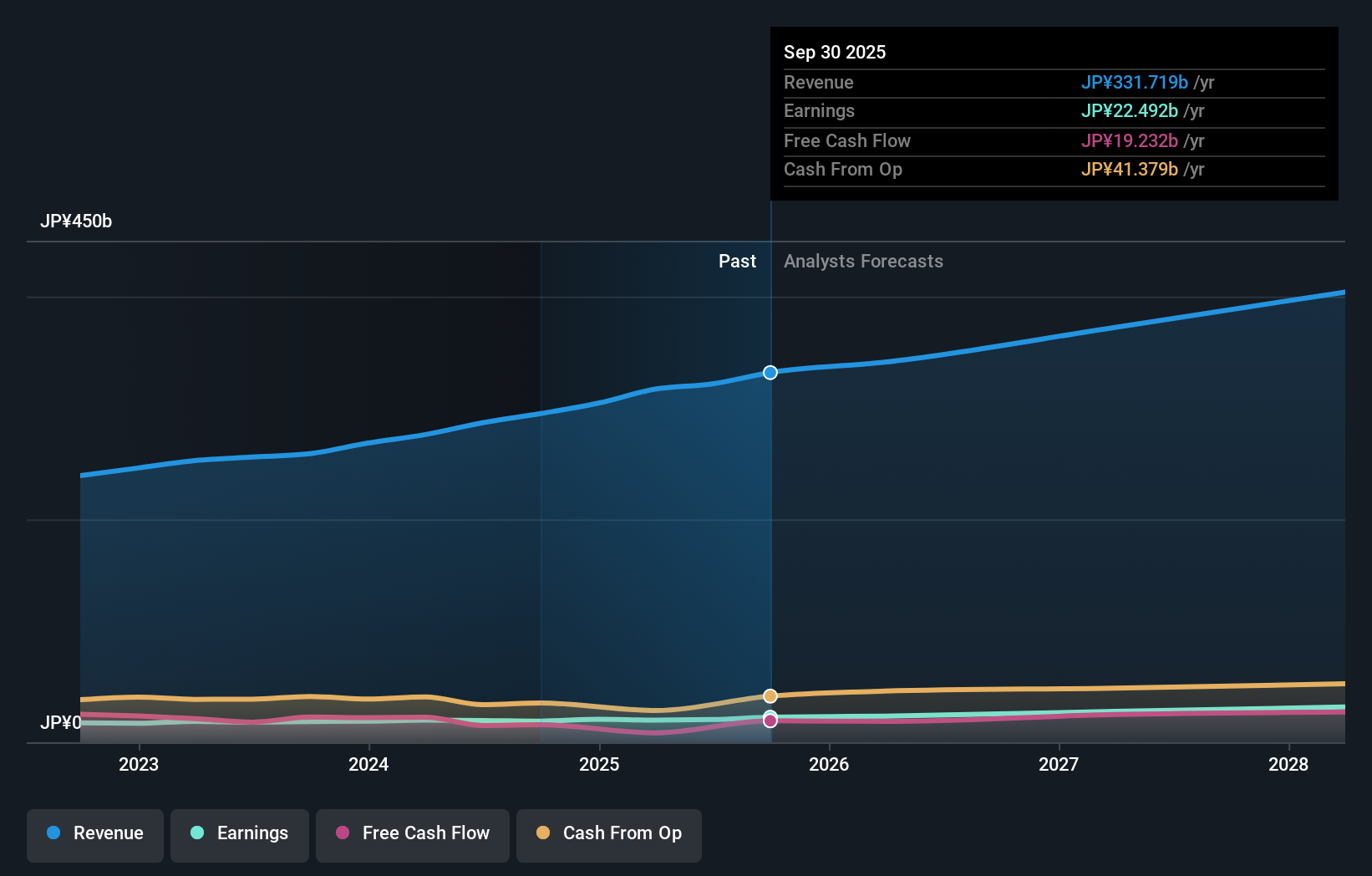

As a shareholder in Internet Initiative Japan, you have to believe in the company’s ability to evolve alongside the fast-moving connectivity sector. IIJ’s new role as a Starlink reseller could inject fresh energy into its investment story, since satellite internet strengthens its offering for clients operating in remote or disaster-prone regions. This could influence the near-term narrative, especially with the next earnings report around the corner, but it is unlikely to shift the most important short-term catalysts right away, the company’s growth continues to hinge on steady revenue, operating profit trends, and successful international expansion. Key risks, like its above-average valuation against sector peers and recent return figures trailing the broader market, remain relevant. The Starlink move may help diversify revenue, but execution risk in new markets is something to keep an eye on.

On the flip side, investors should be aware that IIJ’s valuation remains above industry averages.

Exploring Other Perspectives

Explore 2 other fair value estimates on Internet Initiative Japan - why the stock might be worth just ¥3426!

Build Your Own Internet Initiative Japan Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Internet Initiative Japan research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Internet Initiative Japan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Internet Initiative Japan's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3774

Internet Initiative Japan

Provides Internet connectivity, WAN, outsourcing, and systems integration services in Japan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives