As Japan's stock markets experience a downturn, with the Nikkei 225 Index and TOPIX Index both declining, investors are keeping a close eye on easing domestic inflation and potential shifts in monetary policy by the Bank of Japan. In this climate, identifying promising small-cap stocks can be crucial for those looking to capitalize on undervalued opportunities; these "undiscovered gems" often possess strong fundamentals and growth potential that align well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sumiseki HoldingsInc (TSE:1514)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumiseki Holdings Inc. is involved in the import, purchase, and sale of coal in Japan with a market capitalization of approximately ¥47.99 billion.

Operations: Sumiseki Holdings generates revenue primarily from its Coal Business, which accounts for ¥16.94 billion, supplemented by smaller contributions from its Quarrying and New Material businesses at ¥546 million and ¥269 million respectively. The company focuses on optimizing its cost structure to enhance profitability within these segments.

Sumiseki Holdings, a notable player among Japan's smaller stocks, presents an intriguing profile with its debt-free status, contrasting its previous 1% debt-to-equity ratio five years ago. Trading at a significant 87% below estimated fair value suggests potential undervaluation. The company's earnings growth of 105% over the past year outpaces the Trade Distributors industry average of 4.5%, indicating robust performance. However, recent share price volatility may concern some investors despite high-quality earnings and positive free cash flow. This blend of financial health and market dynamics positions Sumiseki as a compelling consideration in its sector.

FP Partner (TSE:7388)

Simply Wall St Value Rating: ★★★★★☆

Overview: FP Partner Inc. offers insurance services for individuals and corporations in Japan, with a market capitalization of ¥66.55 billion.

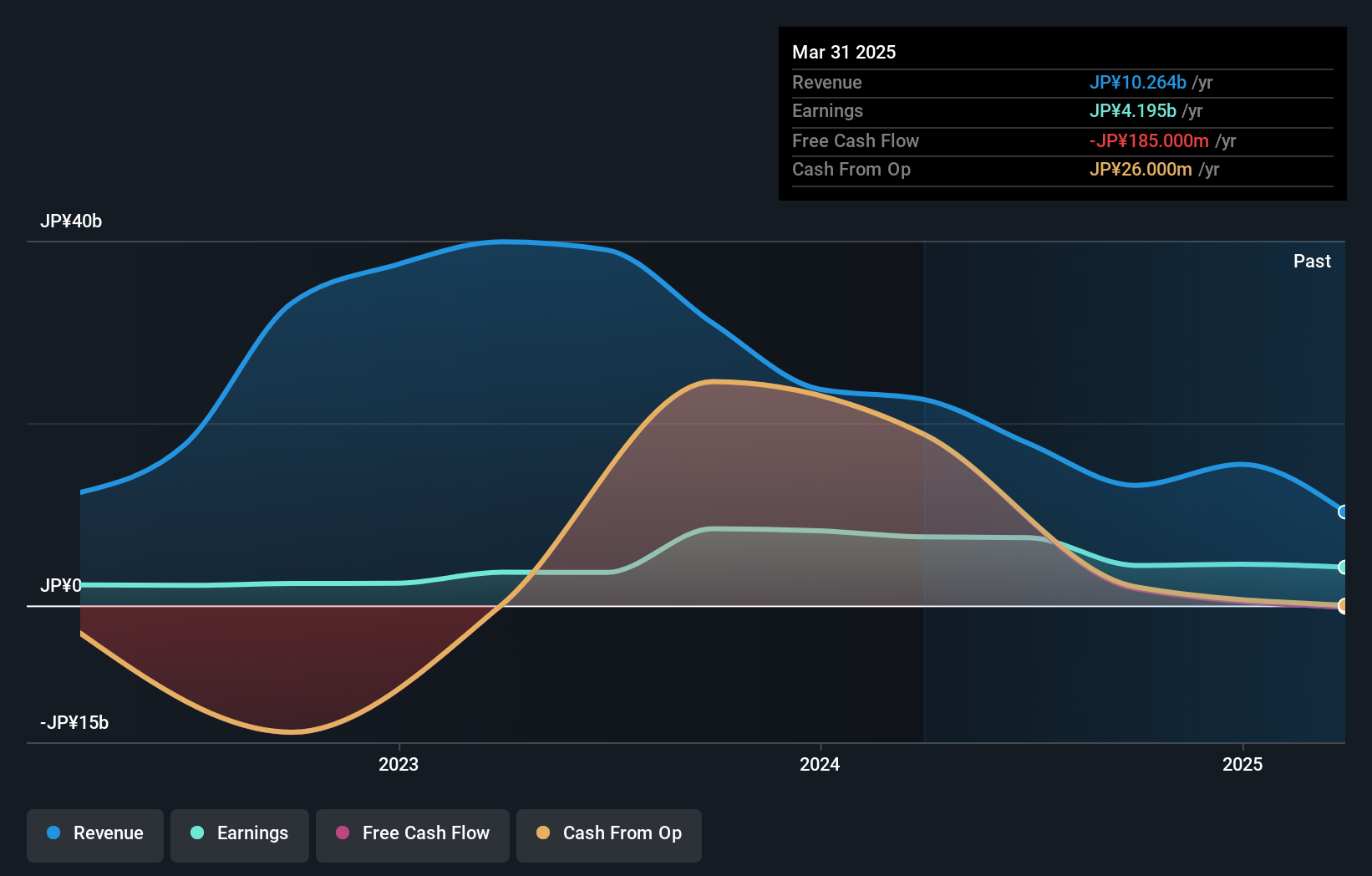

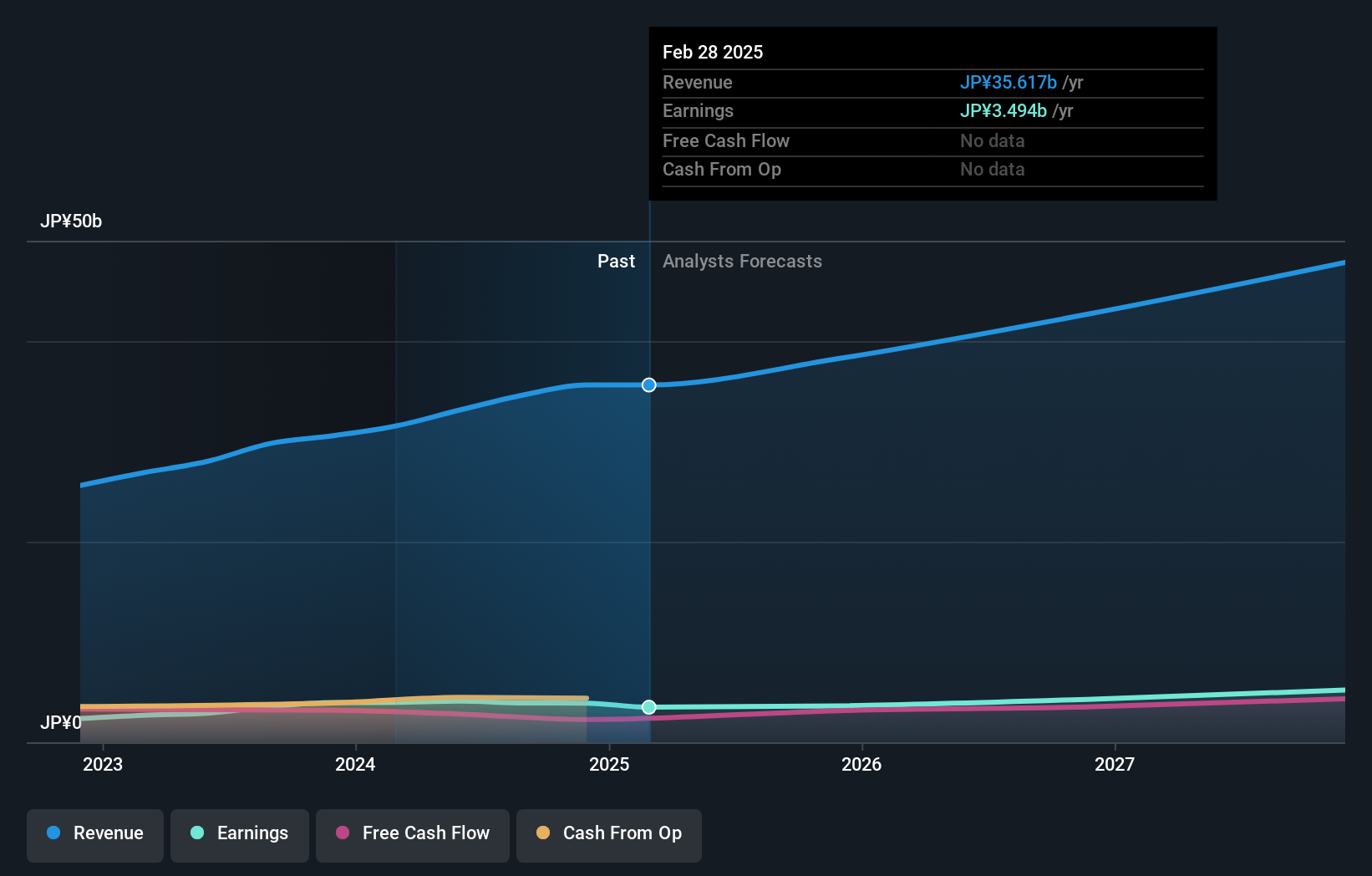

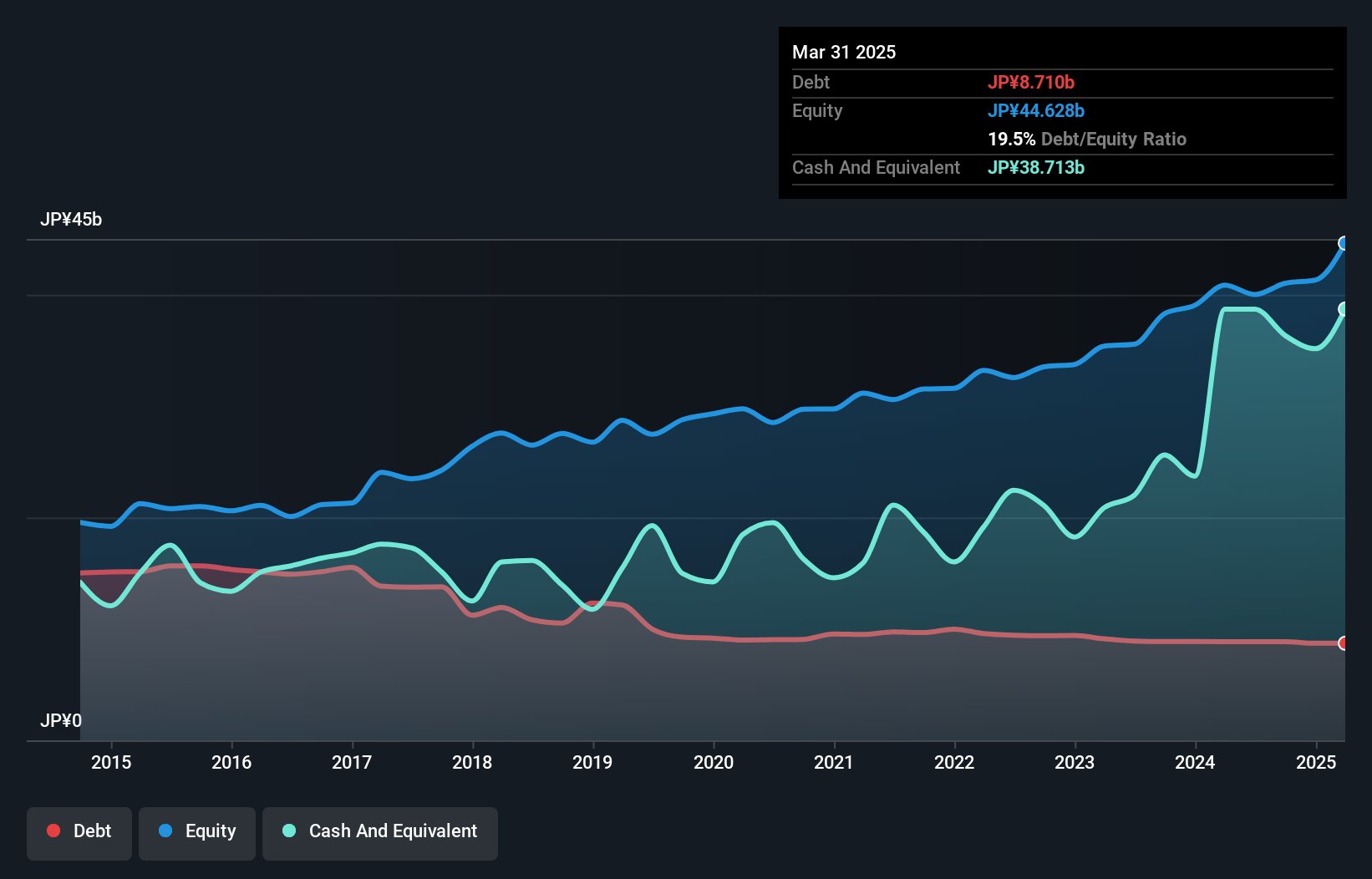

Operations: FP Partner Inc. generates revenue primarily through its Insurance Agency Business, which recorded ¥34.63 billion. The company's financial performance is influenced by its ability to manage costs and achieve a net profit margin of 8.5%.

FP Partner, a notable player in Japan's insurance sector, has been navigating a dynamic market environment. The company's earnings have grown 36.8% annually over the past five years, despite recent volatility in its share price. Trading at 56.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. However, the company recently lowered its full-year earnings guidance due to shifts in product demand and external economic factors like high U.S. interest rates affecting sales of high-margin products. Notably, FP Partner completed a share buyback of 1.44%, valued at ¥1 billion, reflecting confidence in its long-term prospects amidst these challenges.

- Unlock comprehensive insights into our analysis of FP Partner stock in this health report.

Gain insights into FP Partner's historical performance by reviewing our past performance report.

Tsuzuki Denki (TSE:8157)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsuzuki Denki Co., Ltd. specializes in the design, development, construction, and maintenance of network and information systems with a market capitalization of approximately ¥44.68 billion.

Operations: Tsuzuki Denki generates revenue primarily from its Information Network Solution Service, amounting to ¥82.10 billion. The company's net profit margin reflects its operational efficiency and profitability in managing costs relative to revenue.

Tsuzuki Denki, a smaller player in the electronics sector, has shown impressive earnings growth of 22% over the past year, outpacing the industry average of 7%. The company appears to be trading at nearly 40% below its estimated fair value. With a debt-to-equity ratio reduced from 36.4% to 22.1% over five years and more cash than total debt, financial stability seems solid. A notable ¥2 billion one-off gain influenced recent results, while operating income is projected at ¥6.25 billion for fiscal year-end March 2025. Dividends are set at ¥46 per share for the full year, reflecting strategic adjustments.

- Delve into the full analysis health report here for a deeper understanding of Tsuzuki Denki.

Assess Tsuzuki Denki's past performance with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 727 Japanese Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7388

FP Partner

Provides insurance services for individuals and corporations in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives