- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8084

Should You Buy Ryoden Corporation (TSE:8084) For Its Upcoming Dividend?

Readers hoping to buy Ryoden Corporation (TSE:8084) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. In other words, investors can purchase Ryoden's shares before the 27th of September in order to be eligible for the dividend, which will be paid on the 4th of December.

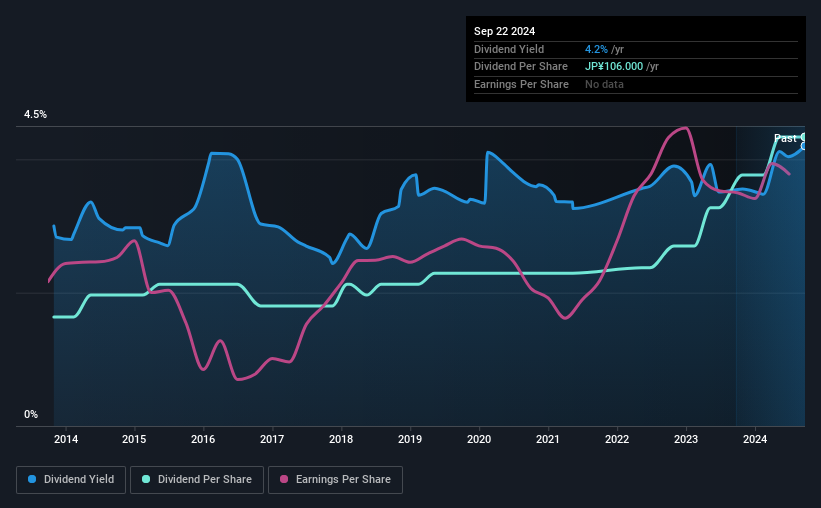

The company's next dividend payment will be JP¥53.00 per share, and in the last 12 months, the company paid a total of JP¥106 per share. Based on the last year's worth of payments, Ryoden stock has a trailing yield of around 4.2% on the current share price of JP¥2522.00. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Ryoden can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Ryoden

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Ryoden's payout ratio is modest, at just 42% of profit. A useful secondary check can be to evaluate whether Ryoden generated enough free cash flow to afford its dividend. The good news is it paid out just 21% of its free cash flow in the last year.

It's positive to see that Ryoden's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Ryoden paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see Ryoden earnings per share are up 7.9% per annum over the last five years. The company is retaining more than half of its earnings within the business, and it has been growing earnings at a decent rate. We think this is generally an attractive combination, as dividends can grow through a combination of earnings growth and or a higher payout ratio over time.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Ryoden has increased its dividend at approximately 10% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Has Ryoden got what it takes to maintain its dividend payments? Earnings per share growth has been growing somewhat, and Ryoden is paying out less than half its earnings and cash flow as dividends. This is interesting for a few reasons, as it suggests management may be reinvesting heavily in the business, but it also provides room to increase the dividend in time. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and Ryoden is halfway there. Ryoden looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

In light of that, while Ryoden has an appealing dividend, it's worth knowing the risks involved with this stock. For example, we've found 1 warning sign for Ryoden that we recommend you consider before investing in the business.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8084

Ryoden

Sells factory automation (FA) systems, cooling and heating systems, information and communication technologies (ICT) and facilities systems, and electronics in Japan and internationally.

Excellent balance sheet established dividend payer.