- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Should Citizen Watch's (TSE:7762) North American Momentum and Dividend Hike Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Citizen Watch Co., Ltd. announced in November 2025 that it has raised its full-year consolidated earnings guidance and will increase its second-quarter cash dividend to ¥23.50 per share, up from ¥22.50 a year earlier, with payment scheduled to start December 5, 2025.

- This upgraded outlook is attributed to strong North American sales of the CITIZEN and BULOVA brands, improved e-commerce performance, and higher unit selling prices, reflecting resilient demand despite wider economic uncertainty.

- We'll explore how the earnings guidance increase, driven by North American sales strength, shapes Citizen Watch's broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Citizen Watch's Investment Narrative?

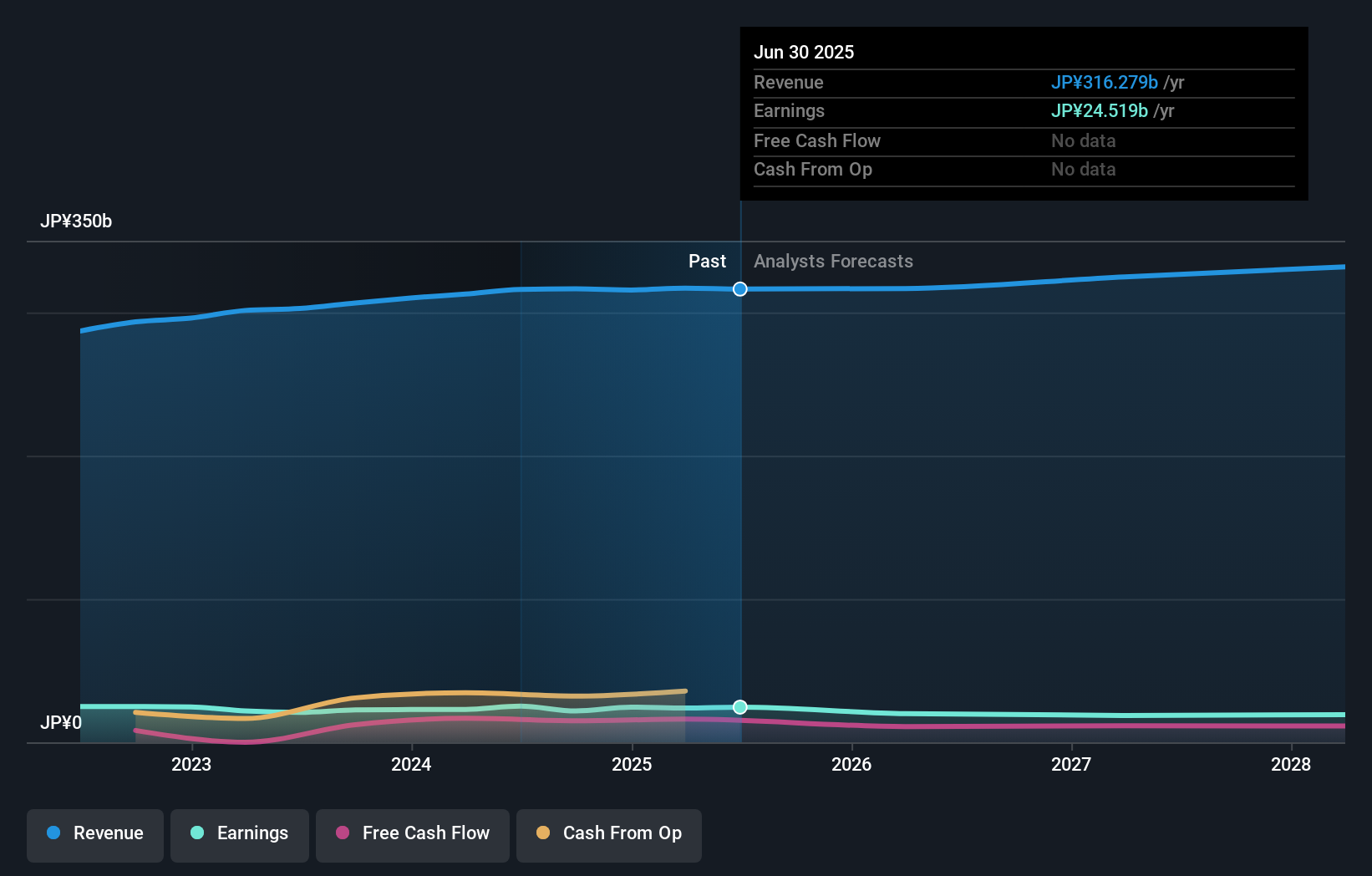

For anyone considering Citizen Watch, the central thesis to believe in is the company's ability to capture consumer demand for its leading watch brands, especially in North America, and translate that into resilient profitability, even as market forecasts suggest slower revenue growth and declining earnings ahead. The November 2025 guidance upgrade and dividend increase directly counter some earlier risks, like fading demand or margin pressure, giving investors short-term optimism. These moves reinforce the company's position as a value pick, with its price-to-earnings ratio still below sector averages and a consistent dividend payout. Still, the removal from the Nikkei 225 hangs over the stock, and expectations for declining profit growth remain a caution flag. The recent strength may rebalance the risk/reward in the near term, but longer-term structural challenges have not vanished.

But despite recent upgrades, declining profit forecasts remain a risk that investors must watch. Citizen Watch's shares are on the way up, but they could be overextended by 49%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Citizen Watch - why the stock might be worth just ¥51290!

Build Your Own Citizen Watch Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citizen Watch research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Citizen Watch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citizen Watch's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success