Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:9908

Top Japanese Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

Amidst a challenging week for Japan's stock markets, with significant losses noted in key indices such as the Nikkei 225 and TOPIX, investors may find solace in dividend stocks, known for their potential to offer steady returns in turbulent times. In light of the yen's strengthening and its impact on exporters, dividend-yielding stocks could provide a more stable investment avenue during periods of market volatility and economic uncertainty.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.91% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.66% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.58% | ★★★★★★ |

| Globeride (TSE:7990) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.67% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.62% | ★★★★★★ |

| Innotech (TSE:9880) | 4.36% | ★★★★★★ |

Click here to see the full list of 416 stocks from our Top Japanese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

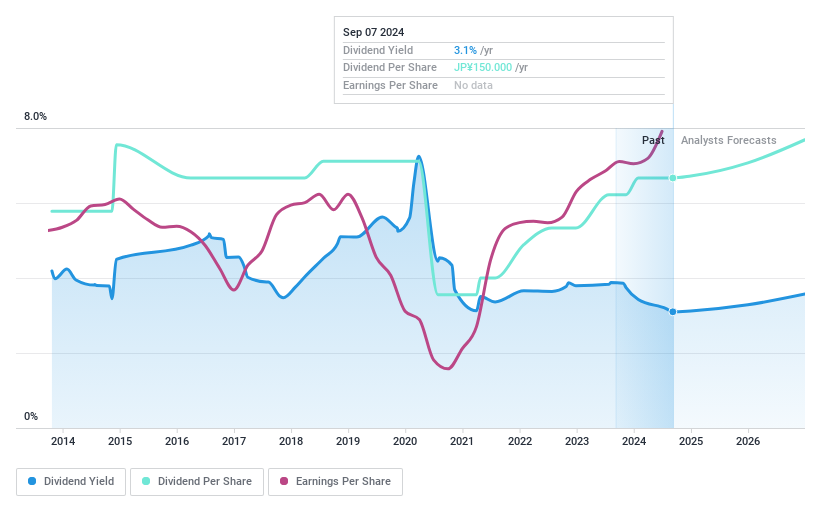

Canon (TSE:7751)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Canon Inc. operates globally, producing and selling office multifunction devices, printers, cameras, medical equipment, and lithography equipment with a market capitalization of ¥4.48 trillion.

Operations: Canon Inc.'s primary revenue streams include ¥2.45 billion from printing, ¥0.87 billion from imaging, ¥0.57 billion from medical equipment, and ¥0.34 billion from industrial products.

Dividend Yield: 3.2%

Canon's recent strategic moves, including a significant share buyback of ¥99.99 billion and product launches like the EOS R1 and EOS R5 Mark II cameras, underscore its commitment to maintaining market leadership and shareholder value. Despite a low dividend yield of 3.25% compared to the top quartile of Japanese dividend payers at 3.55%, Canon's dividends appear sustainable with a modest payout ratio of 23.6% from earnings and 51.1% from cash flows, suggesting financial prudence in returning profits to shareholders amidst volatile historical payments over the last decade.

- Navigate through the intricacies of Canon with our comprehensive dividend report here.

- Our valuation report unveils the possibility Canon's shares may be trading at a discount.

StepLtd (TSE:9795)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Step Co., Ltd., operating cram schools in Japan, has a market capitalization of approximately ¥32.40 billion.

Operations: Step Co., Ltd. primarily generates its revenues from operating cram schools across Japan.

Dividend Yield: 3.7%

StepLtd, trading at 37.9% below its estimated fair value, offers a promising valuation for investors. With a dividend yield of 3.66%, it ranks in the top 25% of Japanese dividend payers. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 58.4% and 45.5%, respectively, indicating sustainability despite its relatively short dividend history of less than ten years. Recent activities include repurchasing shares worth ¥574.84 million, enhancing shareholder value but reflecting an unstable dividend track record over its brief history.

- Click to explore a detailed breakdown of our findings in StepLtd's dividend report.

- The analysis detailed in our StepLtd valuation report hints at an deflated share price compared to its estimated value.

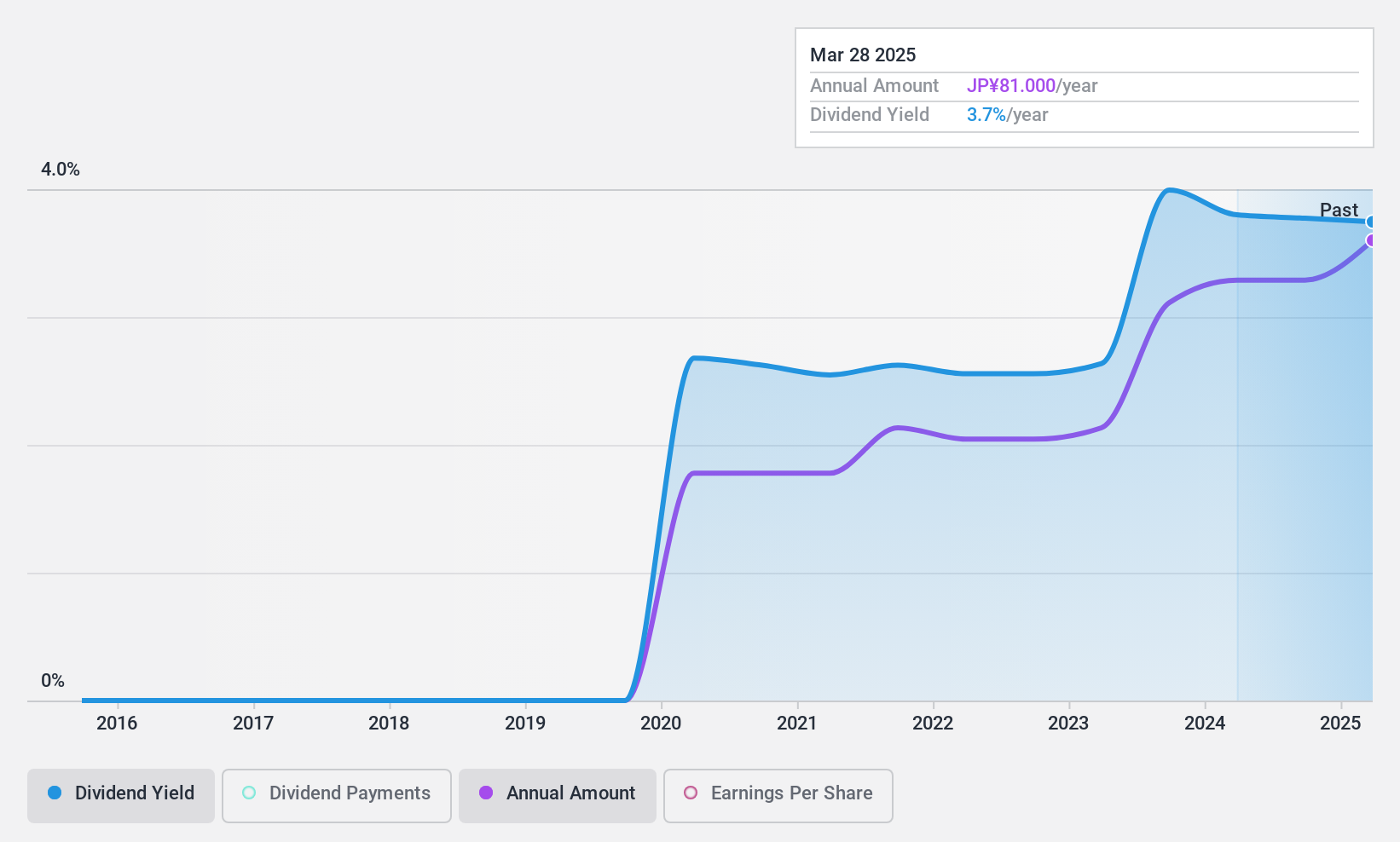

Nihon DenkeiLtd (TSE:9908)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nihon Denkei Co., Ltd. operates in the trading of electronic measuring instruments both in Japan and internationally, with a market capitalization of ¥23.58 billion.

Operations: Nihon Denkei Co., Ltd. generates revenue primarily from trading electronic measuring instruments, with ¥90.25 billion from Japan and ¥16.27 billion from China.

Dividend Yield: 4%

Nihon Denkei Ltd. maintains a stable dividend history over the past decade, with a current yield of 3.96%, placing it among the top 25% of Japanese dividend payers. The company's dividends are securely funded by both earnings and cash flows, evidenced by low payout ratios of 29.1% and 29.8% respectively. Additionally, its price-to-earnings ratio stands at a competitive 8x against the broader Japanese market average of 14.2x, indicating good value relative to peers despite modest annual earnings growth projections of around 4.55%. Recent share buybacks totaling ¥424.3 million underline commitment to shareholder returns but conclude its latest repurchase plan.

- Unlock comprehensive insights into our analysis of Nihon DenkeiLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that Nihon DenkeiLtd is trading behind its estimated value.

Seize The Opportunity

- Dive into all 416 of the Top Japanese Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon DenkeiLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9908

Nihon DenkeiLtd

Trades in electronic measuring instruments in Japan and internationally.

Flawless balance sheet 6 star dividend payer.