Stock Analysis

- Japan

- /

- Food and Staples Retail

- /

- TSE:2692

Exploring ITOCHU-SHOKUHIN And Two More Undiscovered Gems In Japan

Reviewed by Simply Wall St

Japan's stock markets have recently faced challenges, with significant weekly losses and a strengthened yen impacting exporters. Amid these market conditions, uncovering lesser-known stocks with potential growth opportunities can be particularly compelling. In this context, understanding the characteristics that contribute to the resilience and potential success of a company is crucial. Factors such as innovative business models, strong domestic market positioning, or export strategies that mitigate currency fluctuation impacts can be key indicators of underlying value in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.32% | -0.14% | 1.92% | ★★★★★★ |

| Toukei Computer | NA | 5.18% | 11.71% | ★★★★★★ |

| NJS | NA | 4.22% | 1.83% | ★★★★★★ |

| Otec | 7.45% | 2.06% | -0.77% | ★★★★★★ |

| Kondotec | 12.01% | 6.76% | 0.32% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 130.22% | 1.61% | -0.98% | ★★★★★☆ |

| Techno Quartz | 20.44% | 17.25% | 22.76% | ★★★★★☆ |

| CAC Holdings | 14.97% | -0.57% | 5.02% | ★★★★☆☆ |

| GENOVA | 6.23% | 24.87% | 31.14% | ★★★★☆☆ |

| Yukiguni Maitake | 158.67% | -5.22% | -32.27% | ★★★★☆☆ |

We'll examine a selection from our screener results.

ITOCHU-SHOKUHIN (TSE:2692)

Simply Wall St Value Rating: ★★★★★★

Overview: ITOCHU-SHOKUHIN Co., Ltd. is a Japanese company specializing in the wholesale of food products and alcoholic beverages, with a market capitalization of ¥87.16 billion.

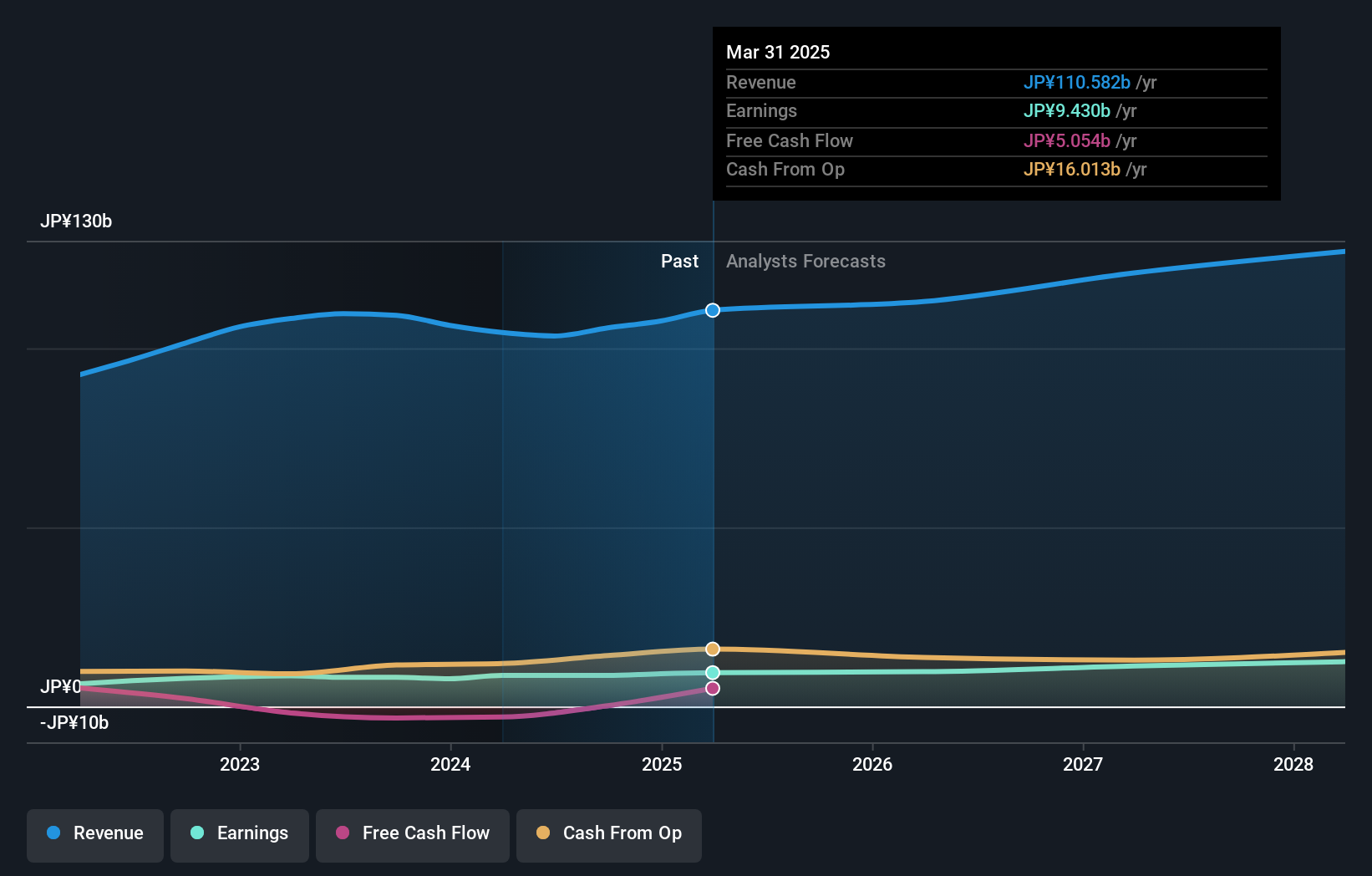

Operations: The company operates primarily in the food wholesale sector, generating significant revenue by managing the cost of goods sold and operational expenses effectively. Over recent periods, it has shown an ability to increase its net income margin, which stood at approximately 0.98% as of the latest report in 2024, reflecting improved profitability from earlier years where it hovered around 0.62%.

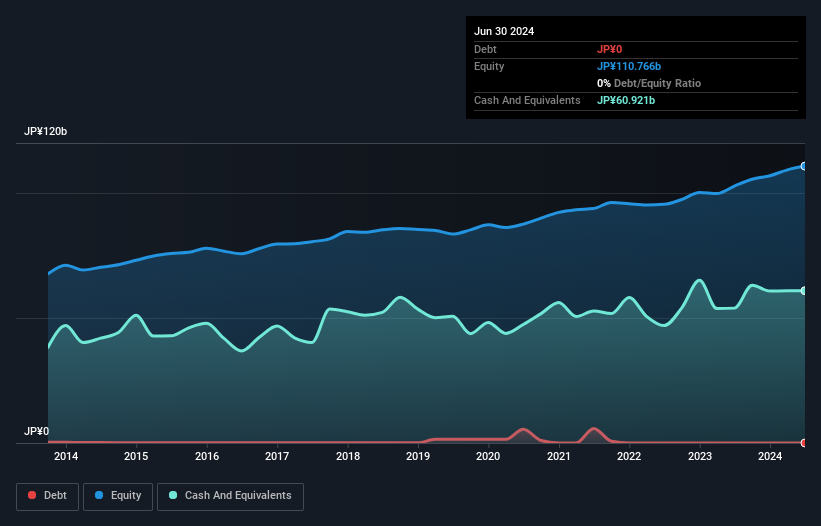

ITOCHU-SHOKUHIN, a lesser-known gem in Japan's consumer retailing sector, is trading at 76.8% below its estimated fair value, making it an intriguing prospect. The company has showcased a robust performance with a 36.2% earnings growth over the past year, outpacing the industry average of 28.6%. Impressively, ITOCHU-SHOKUHIN is debt-free and maintains high-quality earnings—a testament to its financial health and operational efficiency. This combination of value and growth positions it as a potentially rewarding opportunity for investors looking into undiscovered markets.

- Click here to discover the nuances of ITOCHU-SHOKUHIN with our detailed analytical health report.

Review our historical performance report to gain insights into ITOCHU-SHOKUHIN's's past performance.

Shin-Etsu PolymerLtd (TSE:7970)

Simply Wall St Value Rating: ★★★★★★

Overview: Shin-Etsu Polymer Co., Ltd. is a global manufacturer and seller of polyvinyl chloride (PVC) products, with a market capitalization of approximately ¥133.47 billion.

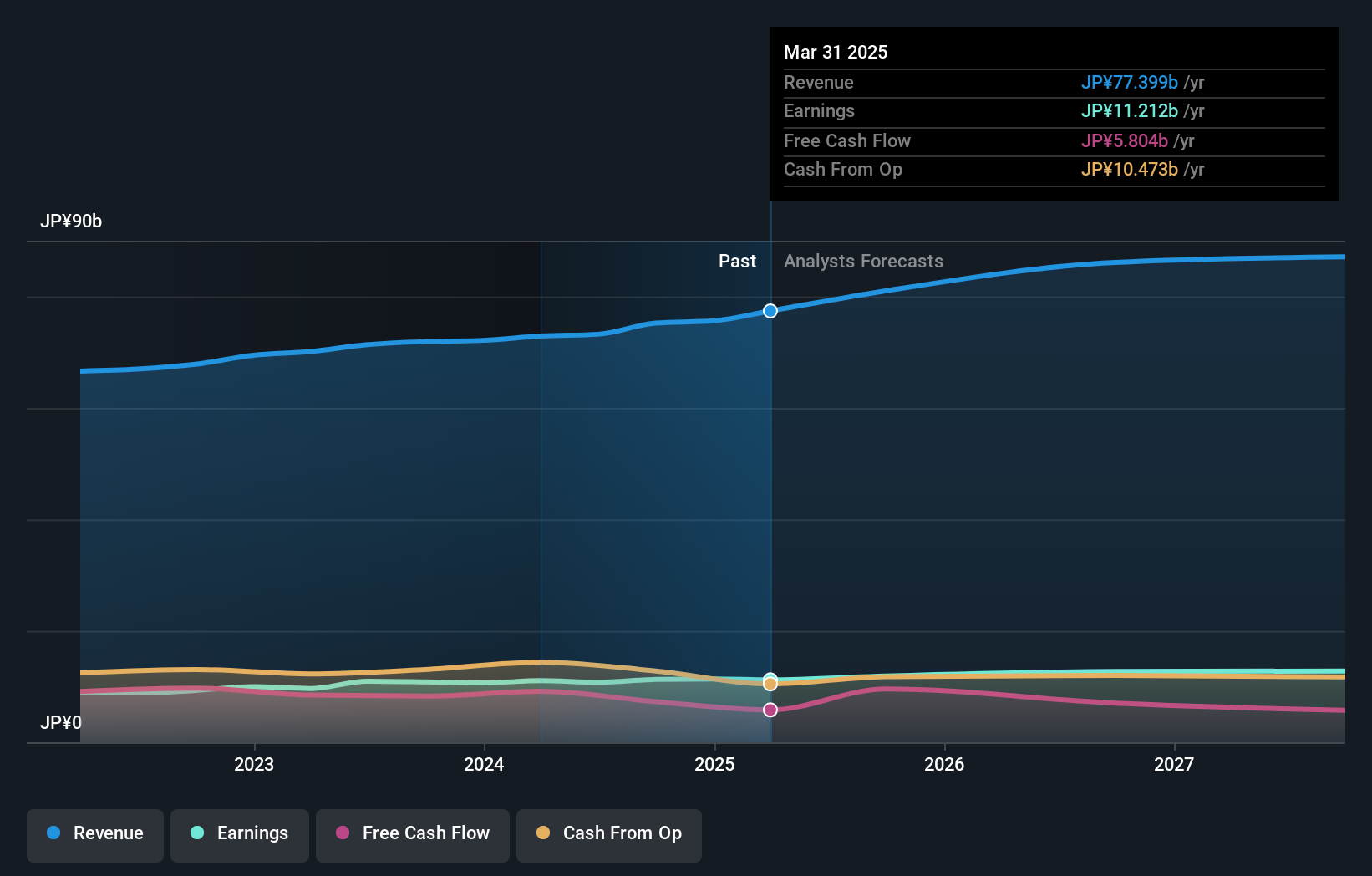

Operations: The company generates revenue primarily through the sale of its products, with a consistent focus on maintaining a robust gross profit margin, which has seen an upward trend over recent years, peaking at approximately 32.19% in early 2020. Significant operating expenses are incurred in general and administrative functions, research and development, as well as sales and marketing efforts to support its business operations.

Shin-Etsu Polymer Co., Ltd., a notable but less recognized player in Japan's industrial sector, has demonstrated robust financial health and growth potential. The company is debt-free, underscoring its strong financial management. Over the past five years, earnings have expanded by 10.1% annually, with forecasts predicting further growth at a rate of 12.24% per year. Despite not outperforming the broader Chemicals industry last year—where it posted a 6.3% earnings growth compared to the industry's 6.9%—its high-quality earnings reflect a solid operational foundation that could appeal to discerning investors looking for emerging opportunities in Japan's market landscape.

TKC (TSE:9746)

Simply Wall St Value Rating: ★★★★★★

Overview: TKC Corporation is a Japanese firm specializing in electronic data processing services for accounting firms and local governments, with a market capitalization of ¥180.69 billion.

Operations: The company generates revenue primarily through the sale of goods and services, consistently achieving a gross profit margin around 70% in recent years. It manages substantial operating expenses, which include significant general and administrative costs, impacting net income margins that have shown an upward trend, reaching approximately 15% by mid-2023.

TKC, a lesser-known Japanese entity, stands out with its robust financial health and growth trajectory. Over the past year, the company's earnings surged by 15%, outpacing the Professional Services industry's growth of 12%. It trades at a compelling 25% below estimated fair value, highlighting potential upside. Additionally, TKC has reduced its debt significantly from 1% to just 0.1% in five years, enhancing its financial stability and appeal as an investment gem.

- Delve into the full analysis health report here for a deeper understanding of TKC.

Assess TKC's past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 741 companies within our Japanese Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2692

ITOCHU-SHOKUHIN

Engages in the wholesale of food products and alcoholic beverages in Japan.

Flawless balance sheet with solid track record and pays a dividend.