- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7746

Some Confidence Is Lacking In Okamoto Glass Co., Ltd. (TSE:7746) As Shares Slide 27%

To the annoyance of some shareholders, Okamoto Glass Co., Ltd. (TSE:7746) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 12% share price drop.

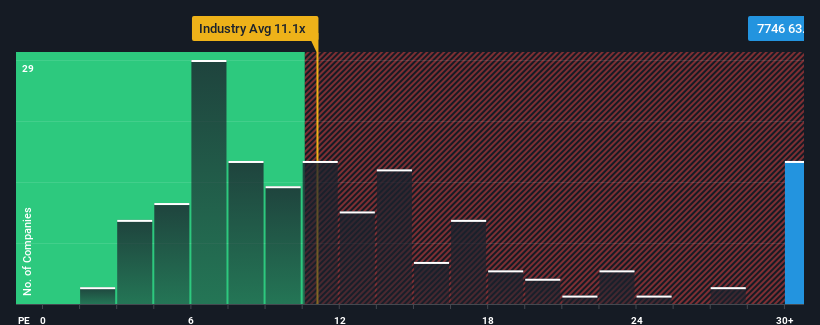

In spite of the heavy fall in price, Okamoto Glass' price-to-earnings (or "P/E") ratio of 63.5x might still make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 12x and even P/E's below 8x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Okamoto Glass certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Okamoto Glass

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Okamoto Glass' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 52%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 10% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Okamoto Glass is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Okamoto Glass' P/E

Even after such a strong price drop, Okamoto Glass' P/E still exceeds the rest of the market significantly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Okamoto Glass revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Okamoto Glass is showing 3 warning signs in our investment analysis, and 2 of those are a bit concerning.

Of course, you might also be able to find a better stock than Okamoto Glass. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7746

Okamoto Glass

Manufactures and sells special-purpose glass for industrial use and multi-layer film evaporation products.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives