- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7739

Canon Electronics (TSE:7739) Margin Decline Challenges Defensive Earnings Narrative

Reviewed by Simply Wall St

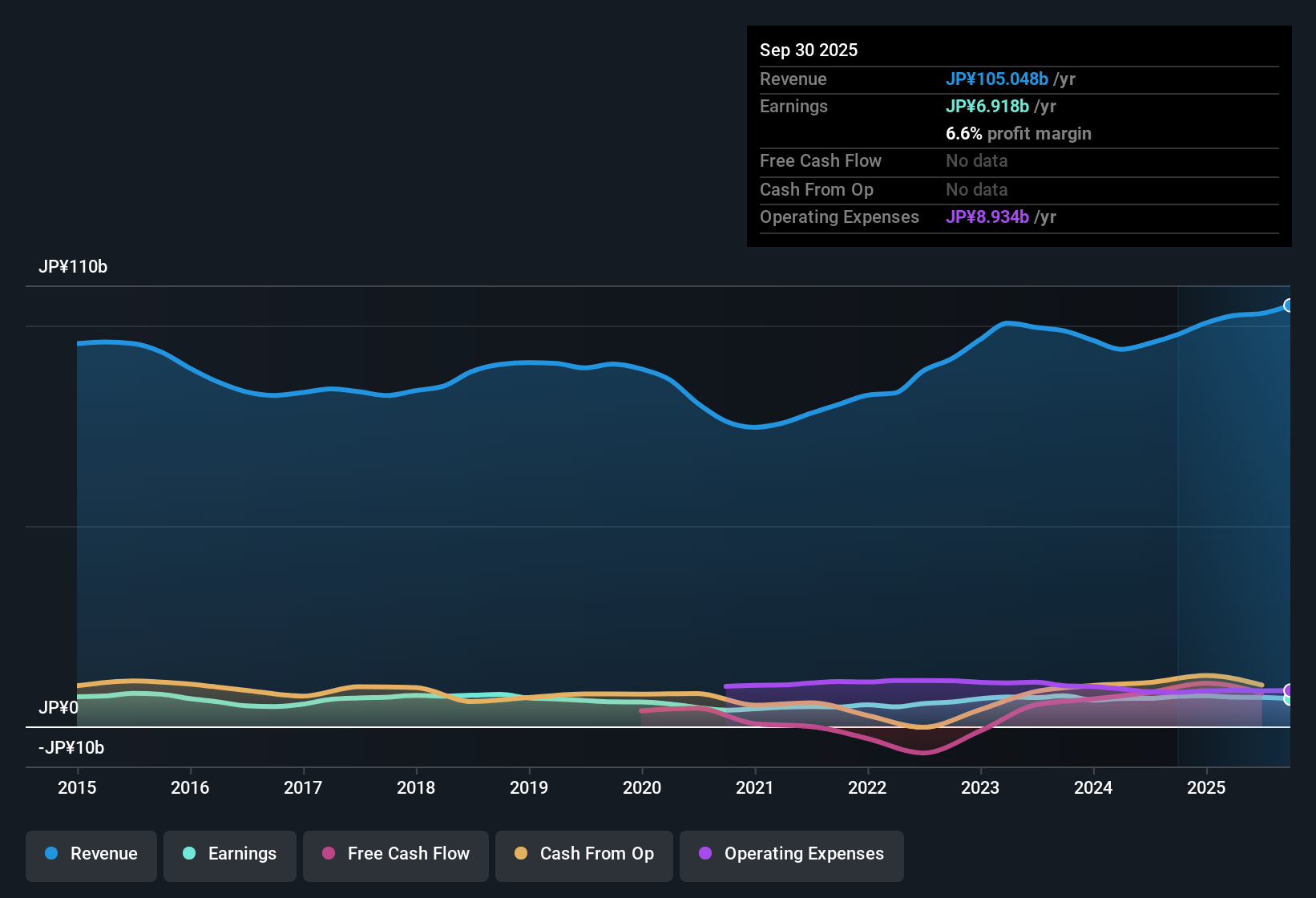

Canon Electronics (TSE:7739) reported a net profit margin of 6.6%, pulling back from 7.7% in the previous period, while earnings expanded at an average annual rate of 10.9% over the last five years. Despite a recent decline in earnings growth, the company’s high quality earnings, price-to-earnings ratio of 16.3x (below the peer average but above the industry), and share price of ¥2,753, which trades below its estimated fair value of ¥3,606.36, are drawing investors’ attention. As investors weigh potential value opportunities, they are keeping a close eye on long-term profit growth, the discounted share price, and whether the current dividend can be sustained.

See our full analysis for Canon Electronics.Next up, we’ll dig into how these numbers stack up against the broader narratives circulating in the market. This analysis will reveal where the consensus might be confirmed and where surprises could shake up expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Compression Highlights Profit Mix Shift

- Net profit margin dropped to 6.6% from 7.7% in the previous period, marking a clear decline in profitability even as five-year average earnings growth held at 10.9%.

- What’s surprising is that while the narrative emphasizes defense through stable legacy operations, the step down in margin suggests cost pressure or less favorable revenue mix. This

- contrasts with the bullish claim that baseline earnings are reliably underpinned by core business lines, since margins are moving the opposite direction even with top-line durability.

- raises the question of whether diversification alone is enough to counteract industry-wide competition and the recent margin squeeze.

Dividend Reliability Puts Income Focus in Spotlight

- The main risk flagged across filings is dividend sustainability, especially given near-term earnings pressure and the lack of any confirmed dividend increase in the disclosed results.

- Critics highlight that although consistent payouts attract income-oriented investors, the latest margin pressure could challenge ongoing dividend reliability.

- Since the drop from a 7.7% to a 6.6% net profit margin signals less financial headroom to maintain or grow dividends in the short run.

- Meanwhile, the bullish angle of Canon as a defensive, dividend-paying “safe haven” feels less conclusive as profitability softens.

Share Price Remains Below DCF Fair Value

- The stock trades at ¥2,753, which is below its DCF fair value of ¥3,606.36. This discount stands out even as the price-to-earnings ratio of 16.3x sits under peer average but above the industry.

- This disconnect between valuation metrics and recent profitability supports a view that Canon Electronics may warrant a defensive premium due to its brand and stability.

- However, the lack of an evident high-growth narrative limits the stock’s upside appeal, even as the discount to fair value offers a potential cushion for value-focused investors.

- The current pricing signals that investors are pricing in stability, yet not willing to pay up until there is clearer evidence that growth or margins will rebound.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Canon Electronics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a strong long-term earnings trend, Canon Electronics’ shrinking profit margins and uncertain dividend outlook signal that income stability may be at risk.

Seeking more reliable returns? Consider these 2002 dividend stocks with yields > 3% to find companies with a better track record of sustaining and growing payouts, even when conditions get tough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7739

Canon Electronics

Develops, produces, and sells precision machines and instruments, and electric and electronic machines and instruments in Japan, North America, Europe, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives