- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7510

Asian Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by stable inflation in the U.S. and mixed economic signals from Europe and Asia, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In this environment, selecting stocks with strong fundamentals and consistent dividend histories can be particularly appealing for those looking to balance growth opportunities with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.93% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.30% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.84% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.94% | ★★★★★★ |

| NCD (TSE:4783) | 4.53% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.93% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

Click here to see the full list of 1025 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

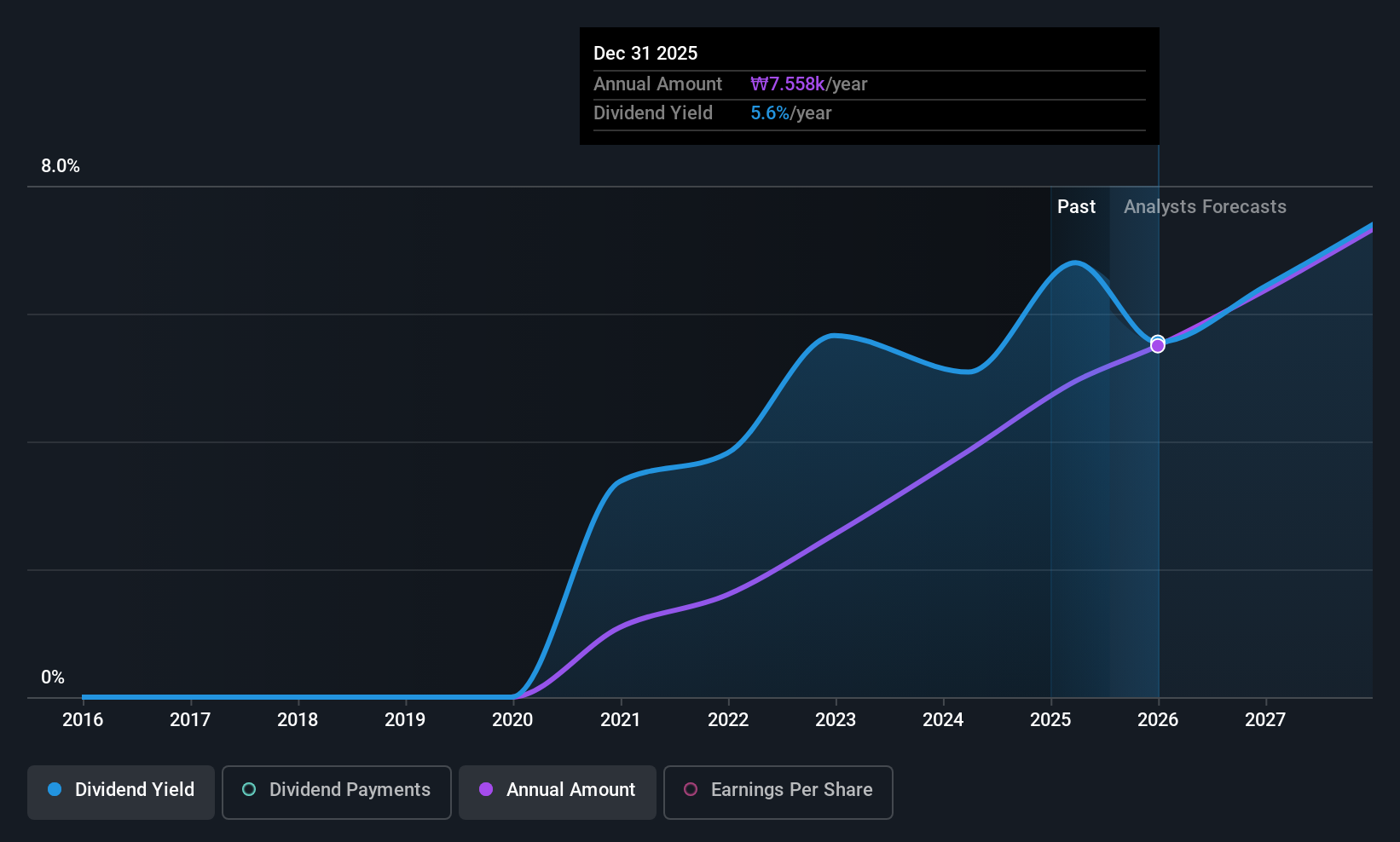

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services in South Korea, with a market cap of approximately ₩8.35 trillion.

Operations: DB Insurance Co., Ltd.'s revenue is primarily derived from its Non-Life Insurance Sector, which generated ₩21.29 billion, followed by the Life Insurance Sector with ₩1.71 billion and the Installment Finance Sector contributing ₩42.99 million.

Dividend Yield: 4.9%

DB Insurance offers a compelling dividend profile with a yield in the top 25% of the Korean market. The company has maintained stable and growing dividends over five years, supported by low payout ratios of 24% for earnings and 16.1% for cash flows, indicating sustainability. Recent strategic alliances, such as with Venbrook Group LLC, could enhance revenue streams further supporting dividend reliability amidst evolving market needs in sectors like real estate and construction.

- Take a closer look at DB Insurance's potential here in our dividend report.

- Upon reviewing our latest valuation report, DB Insurance's share price might be too pessimistic.

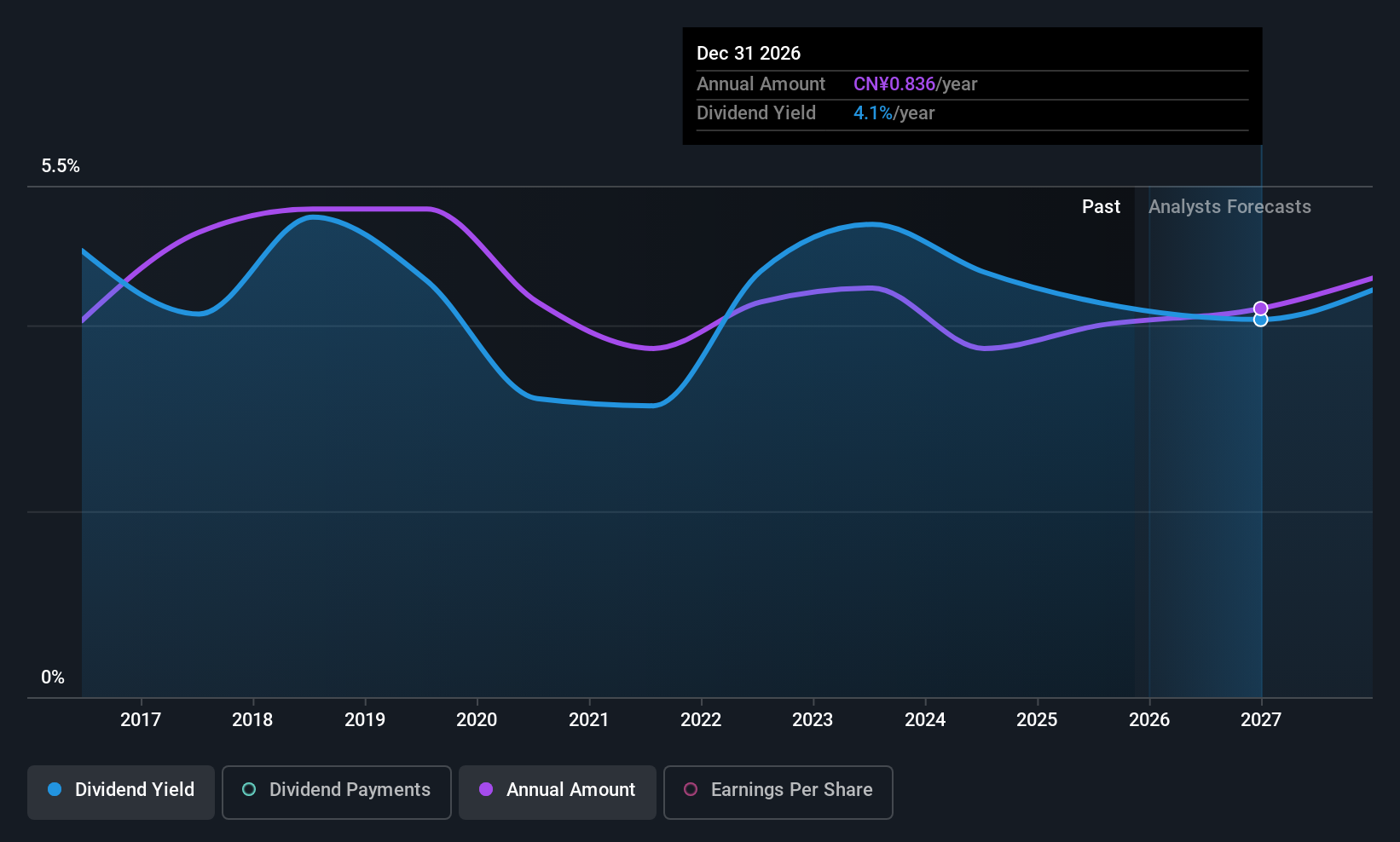

HUAYU Automotive Systems (SHSE:600741)

Simply Wall St Dividend Rating: ★★★★★★

Overview: HUAYU Automotive Systems Company Limited researches, develops, manufactures, and sells automotive parts globally with a market cap of CN¥62.71 billion.

Operations: HUAYU Automotive Systems Company Limited generates its revenue through the research, development, manufacturing, and sale of automotive parts worldwide.

Dividend Yield: 4%

HUAYU Automotive Systems presents a strong dividend profile, with a 4.02% yield placing it in the top 25% of CN market payers. The dividends have grown steadily over the past decade and remain stable, supported by low payout ratios of 37.6% for earnings and 43.3% for cash flows, ensuring sustainability. Recent earnings showed increased revenue to CNY 84.68 billion, reinforcing its ability to maintain reliable dividend payments amidst industry challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of HUAYU Automotive Systems.

- According our valuation report, there's an indication that HUAYU Automotive Systems' share price might be on the cheaper side.

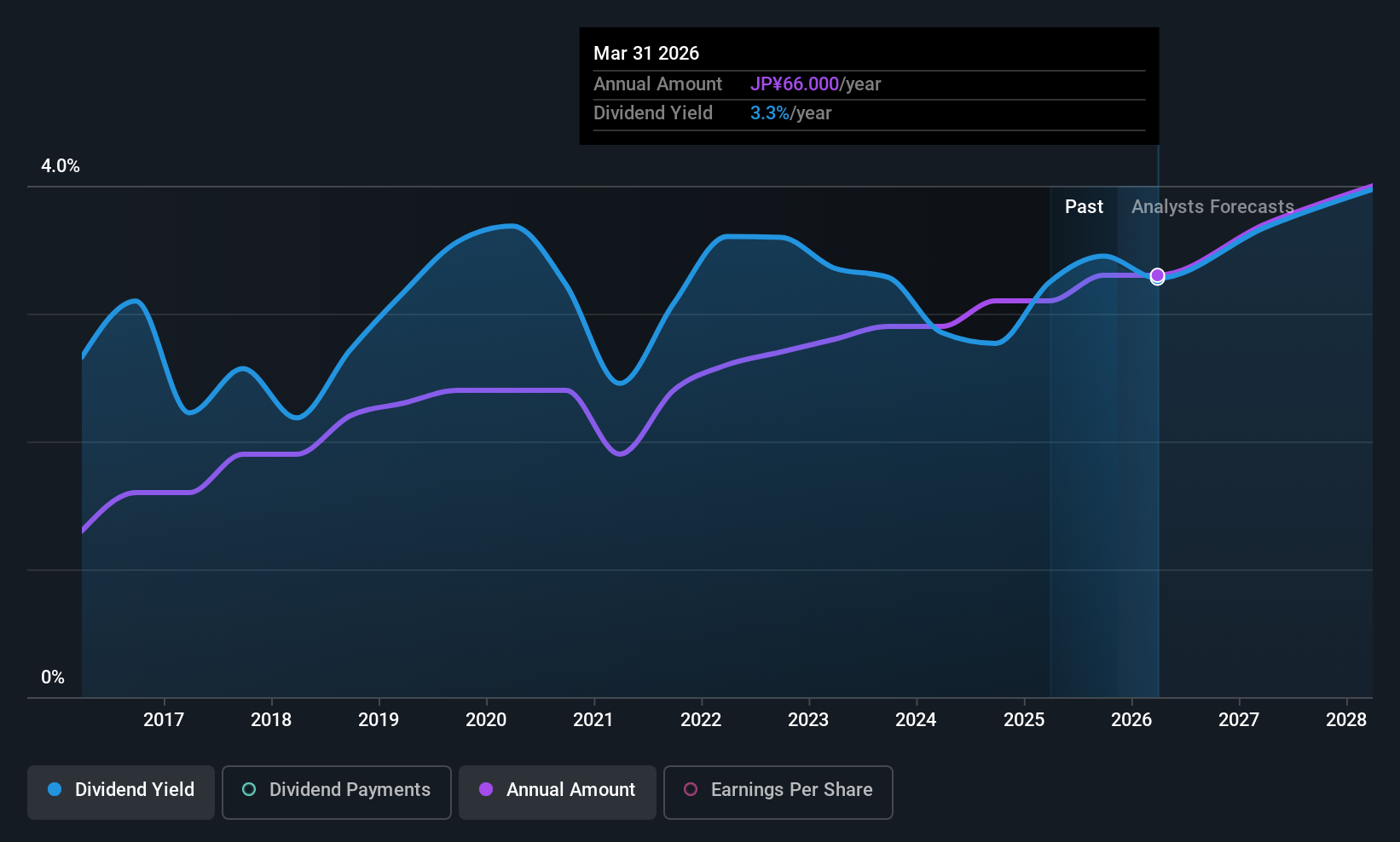

Takebishi (TSE:7510)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takebishi Corporation operates as a technological trading company primarily in Japan, with a market cap of ¥33.58 billion.

Operations: Takebishi Corporation generates revenue through its FA/Device Business, which accounts for ¥73.97 billion, and its Social/Information and Communication Business, contributing ¥29.08 billion.

Dividend Yield: 3.1%

Takebishi's dividend outlook is mixed, with a 3.15% yield below Japan's top payers. Despite a low payout ratio of 41%, dividends have been unstable over the past decade. Recent guidance revisions reflect improved earnings prospects, driven by growth in medical and ODM businesses, resulting in an increased quarterly dividend to ¥33 per share. This aligns with their policy of progressive dividends, aiming for an annual payout of ¥68 per share amidst fluctuating earnings performance.

- Delve into the full analysis dividend report here for a deeper understanding of Takebishi.

- According our valuation report, there's an indication that Takebishi's share price might be on the expensive side.

Taking Advantage

- Click this link to deep-dive into the 1025 companies within our Top Asian Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takebishi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7510

Takebishi

Operates as a technological trading company primarily in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives