- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6997

Earnings Miss: Nippon Chemi-Con Corporation Missed EPS By 96% And Analysts Are Revising Their Forecasts

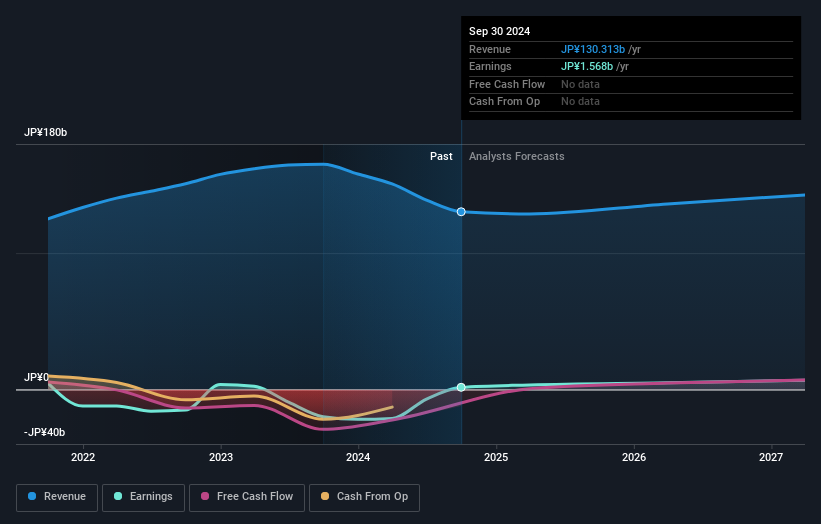

Nippon Chemi-Con Corporation (TSE:6997) missed earnings with its latest half-year results, disappointing overly-optimistic forecasters. Results showed a clear earnings miss, with JP¥60b revenue coming in 2.9% lower than what the analystsexpected. Statutory earnings per share (EPS) of JP¥3.66 missed the mark badly, arriving some 96% below what was expected. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for Nippon Chemi-Con

Following last week's earnings report, Nippon Chemi-Con's four analysts are forecasting 2025 revenues to be JP¥128.8b, approximately in line with the last 12 months. Statutory earnings per share are predicted to shoot up 108% to JP¥153. Before this earnings report, the analysts had been forecasting revenues of JP¥129.1b and earnings per share (EPS) of JP¥153 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

There were no changes to revenue or earnings estimates or the price target of JP¥1,013, suggesting that the company has met expectations in its recent result. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Nippon Chemi-Con analyst has a price target of JP¥1,120 per share, while the most pessimistic values it at JP¥820. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 2.4% by the end of 2025. This indicates a significant reduction from annual growth of 7.1% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.3% annually for the foreseeable future. It's pretty clear that Nippon Chemi-Con's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at JP¥1,013, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Nippon Chemi-Con going out to 2027, and you can see them free on our platform here..

Before you take the next step you should know about the 2 warning signs for Nippon Chemi-Con (1 is concerning!) that we have uncovered.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Chemi-Con might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6997

Nippon Chemi-Con

Manufactures and sells aluminum and other capacitors, precision mechanical components, and electronics equipment in Japan, China, the Americas, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026