- China

- /

- Electronic Equipment and Components

- /

- SZSE:301106

High Growth Tech Stocks Featuring Global Innovations

Reviewed by Simply Wall St

As global markets experience fluctuations, with major U.S. stock indexes rising on hopes of an interest rate cut and the technology-heavy Nasdaq Composite leading gains, investors are closely watching economic indicators such as manufacturing activity and employment trends that could impact small-cap companies. In this environment, identifying high-growth tech stocks that demonstrate resilience through innovation and adaptability can be crucial for navigating market volatility effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 38.67% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Giant Network Group (SZSE:002558)

Simply Wall St Growth Rating: ★★★★★★

Overview: Giant Network Group Co., Ltd. engages in the research, development, operation, and sale of online games both in China and internationally with a market cap of CN¥77.01 billion.

Operations: The company generates revenue primarily through its game-related business, which accounts for CN¥4.07 billion.

Giant Network Group's recent amendments to its corporate governance structures underscore a strategic pivot that could enhance operational efficiency and shareholder transparency. Financially, the company has demonstrated robust growth with a 52% increase in revenue to CNY 3.37 billion and a 32% rise in net income to CNY 1.42 billion over the past nine months. This performance is significantly ahead of its industry, with annual earnings growth projected at an impressive 40.5%, outpacing the broader Chinese market's expectations of 27.3%. These figures reflect not only Giant Network’s ability to scale effectively but also its potential resilience in navigating market fluctuations and capitalizing on emerging tech trends, positioning it well for sustained future growth.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Growth Rating: ★★★★★☆

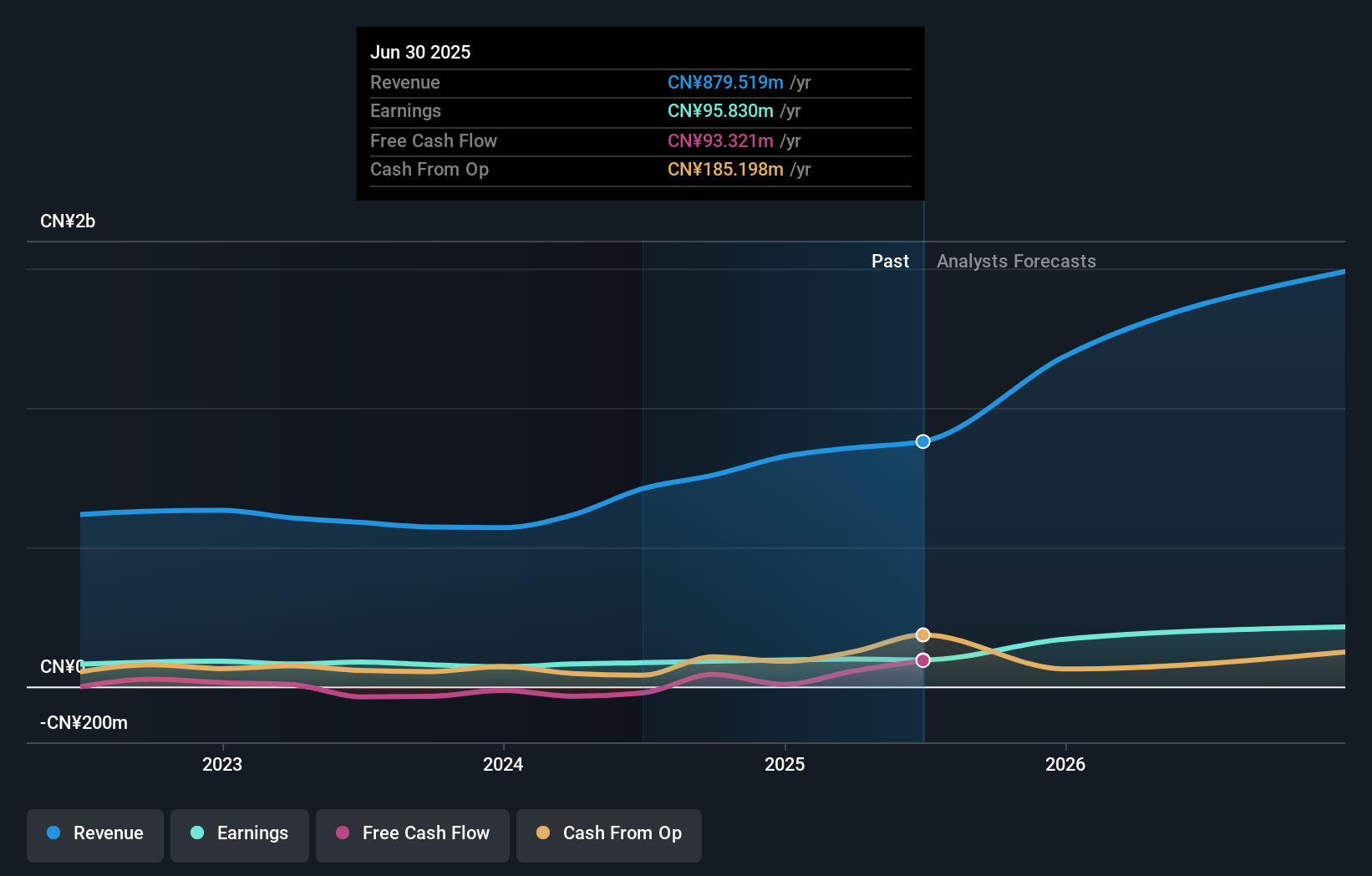

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. operates in the manufacturing and sale of liquid crystal displays and display modules both domestically and internationally, with a market cap of CN¥3.16 billion.

Operations: Smartwin Electronics generates revenue primarily from its electronic components and parts segment, amounting to CN¥908.81 million. The company's operations span both domestic and international markets, focusing on liquid crystal displays and display modules.

Jiangsu Smartwin Electronics TechnologyLtd has demonstrated a compelling trajectory in the tech sector, with its revenue climbing by 14% to CNY 686.53 million and earnings slightly increasing to CNY 78.8 million over the last nine months. This growth is underpinned by a robust annualized revenue increase of 35.1% and an even more impressive earnings surge at an annual rate of 49.9%, significantly outstripping the broader Chinese market's expectations. The company's strategic maneuvers, including recent acquisitions enhancing its stakeholder base, reflect a proactive approach to scaling operations and capitalizing on market opportunities, positioning it well amidst competitive industry dynamics.

Nichicon (TSE:6996)

Simply Wall St Growth Rating: ★★★★☆☆

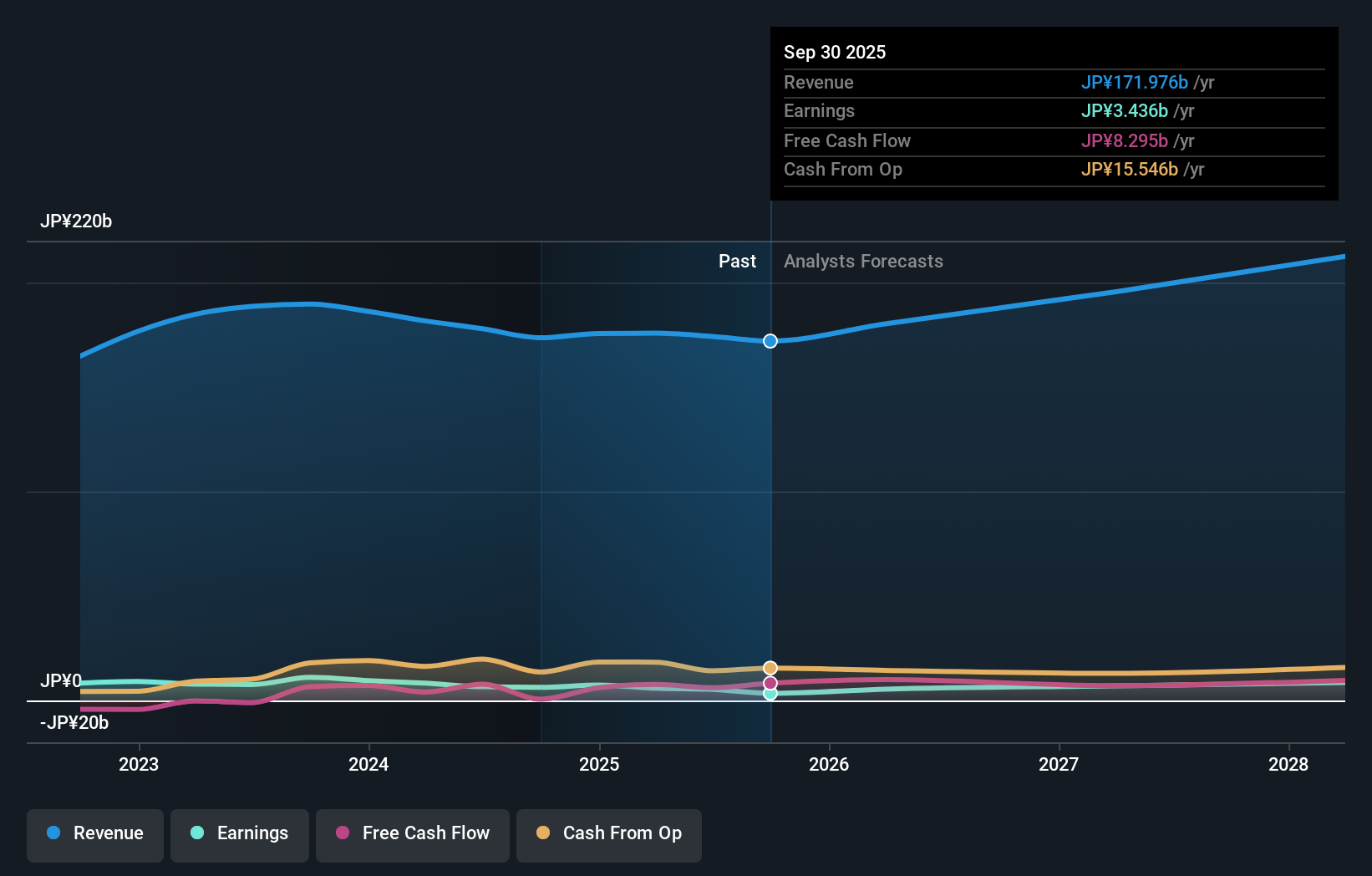

Overview: Nichicon Corporation, with a market cap of ¥115.45 billion, develops and produces electrical components globally through its operations in Japan, the United States, Asia, and Europe.

Operations: The company generates revenue primarily from its Capacitor Business, which accounts for ¥99.93 billion, and the NECST Business, contributing ¥72.70 billion.

Despite a challenging environment, Nichicon has demonstrated resilience with an 8.5% annual revenue growth, outpacing the Japanese market's 4.6%. The company's strategic focus on innovation is evident from its R&D expenses, which have been consistently robust, aligning with its vision to lead in high-tech advancements. Recent dividend increases from JPY 17.00 to JPY 18.00 per share underscore confidence in financial health and commitment to shareholder value. With earnings expected to surge by 32.1% annually, Nichicon is poised for significant advancements in the tech sector.

Next Steps

- Embark on your investment journey to our 244 Global High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301106

Jiangsu Smartwin Electronics TechnologyLtd

Manufactures and sells liquid crystal display and display modules in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026