- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6981

Murata Manufacturing (TSE:6981): Evaluating Valuation After Completing Major Share Buyback Program

Reviewed by Kshitija Bhandaru

Murata Manufacturing (TSE:6981) has just wrapped up a substantial share buyback, completing the repurchase of over 34 million shares in the past quarter. This move often signals management’s commitment to capital efficiency and shareholder value.

See our latest analysis for Murata Manufacturing.

Momentum in Murata Manufacturing’s shares has been building lately, with the buyback and a recent global tech summit appearance both capturing investor attention. The stock’s 30% share price return over the last 90 days stands out. Its 3.5% total shareholder return over the past year points to steadier, long-term gains.

If Murata’s recent moves have you curious about broader market trends, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying, buybacks complete, and analyst targets hinting at modest upside, investors must now ask: Is Murata Manufacturing trading at a discount, or has the market already priced in all of its future growth?

Price-to-Earnings of 23.7x: Is it justified?

Murata Manufacturing’s current price-to-earnings ratio of 23.7x places its shares at a noticeably higher valuation than most companies in Japan’s electronics sector, given the last close at ¥2,817.

The price-to-earnings ratio reflects how much investors are willing to pay for each yen of the company’s earnings. For a tech manufacturer with a history of profit growth and stable operations, this multiple becomes a crucial gauge of investor confidence and future expectations.

Compared to the Japanese electronics industry average of just 14.7x, Murata’s premium is significant. However, when aligned with the estimated fair price-to-earnings ratio of 23.8x, it suggests that the current valuation could find justification if earnings stability and growth continue.

Explore the SWS fair ratio for Murata Manufacturing

Result: Price-to-Earnings of 23.7x (OVERVALUED)

However, a slowdown in annual revenue growth or a dip in net income momentum could challenge the case for Murata’s current premium valuation.

Find out about the key risks to this Murata Manufacturing narrative.

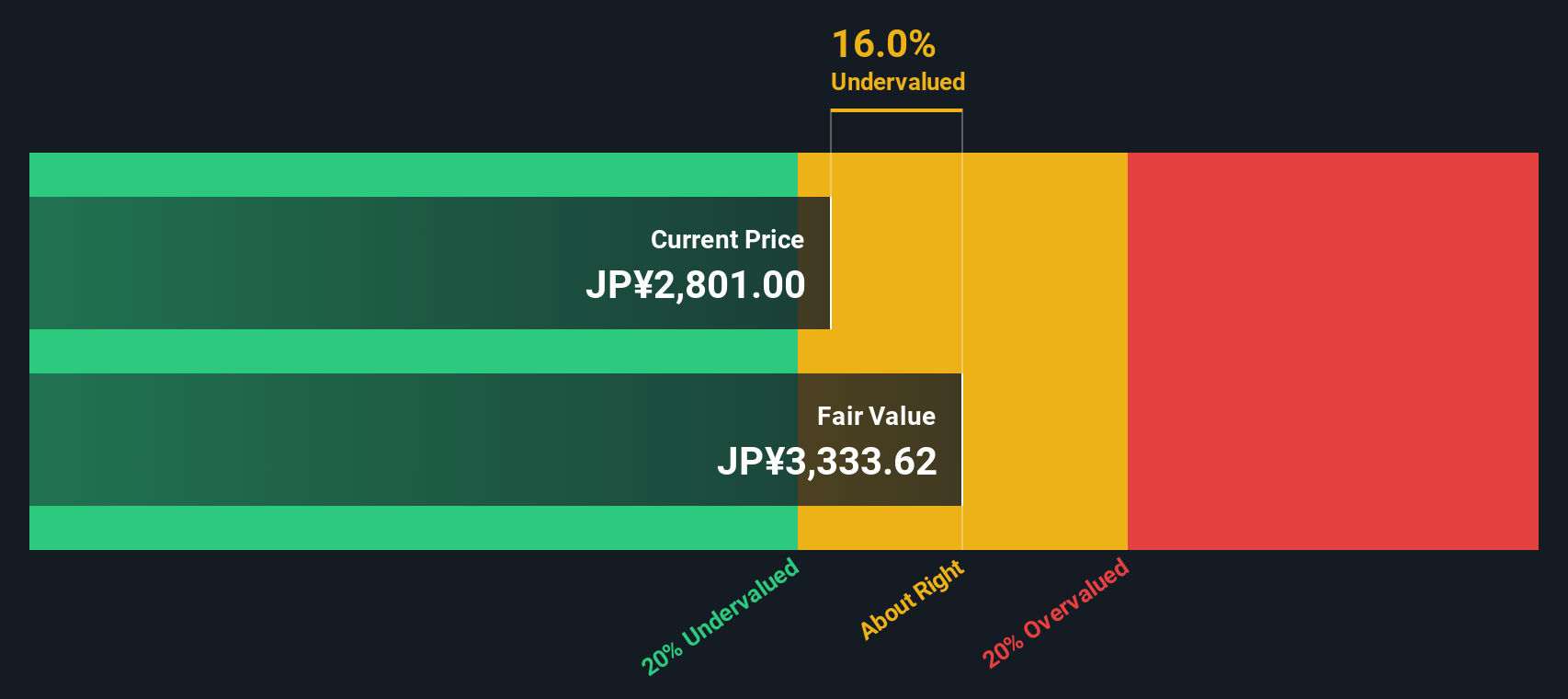

Another View: Discounted Cash Flow Signals Upside

Looking at Murata Manufacturing through the lens of our DCF model, the current share price of ¥2,817 actually sits about 15% below the estimated fair value of ¥3,325.65. This approach suggests there could be meaningful upside, in contrast to what the earnings multiple alone implies. Which valuation will the market ultimately recognize?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Murata Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Murata Manufacturing Narrative

If you want to dig into the numbers and draw your own conclusions, you can build a personalized view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Murata Manufacturing.

Looking for more investment ideas?

Don’t let your portfolio miss the next big opportunity. Get ahead of the curve by tapping into promising markets and innovative industries using the Simply Wall Street Screener.

- Capitalize on high-yield opportunities by targeting stable companies from these 18 dividend stocks with yields > 3%. These companies deliver impressive returns through strong dividends.

- Seize growth in artificial intelligence by uncovering the top emerging names with these 24 AI penny stocks. These are set to lead tomorrow’s tech landscape.

- Stay alert for hidden bargains by scanning these 878 undervalued stocks based on cash flows. This can help you spot stocks trading well below their intrinsic value before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6981

Murata Manufacturing

Develops, manufactures, and sells ceramic-based passive electronic components and solutions in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives