China National Gold Group Gold JewelleryLtd And 2 Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

In a week marked by mixed performances across major global indices, growth stocks in the U.S. led the charge with significant gains, while value-oriented sectors like energy and materials faced declines. Amidst this backdrop of market divergence and economic updates, dividend stocks continue to attract attention for their potential to provide steady income streams and stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1927 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

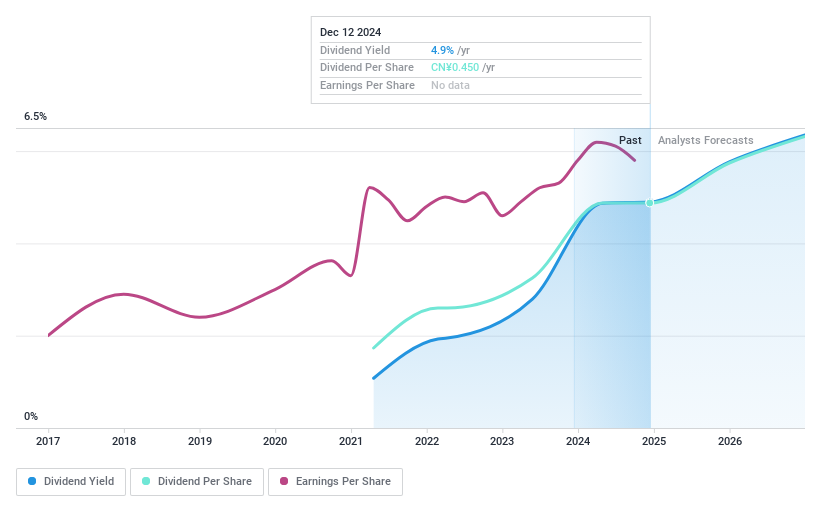

China National Gold Group Gold JewelleryLtd (SHSE:600916)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China National Gold Group Gold Jewellery Co., Ltd. operates in the gold jewelry industry and has a market capitalization of CN¥15.25 billion.

Operations: China National Gold Group Gold Jewellery Co., Ltd. has revenue segments in millions of CN¥.

Dividend Yield: 5%

China National Gold Group Gold Jewellery Ltd. offers a dividend yield of 4.96%, positioning it in the top 25% of dividend payers in the Chinese market. Despite only four years of dividend history, payments have been reliable and stable, supported by a payout ratio of 77.6% and a low cash payout ratio of 24.5%. Recent earnings showed modest growth with net income at CNY 745.57 million for nine months ending September 2024, indicating sustainable dividend coverage from earnings and cash flows.

- Click here and access our complete dividend analysis report to understand the dynamics of China National Gold Group Gold JewelleryLtd.

- The analysis detailed in our China National Gold Group Gold JewelleryLtd valuation report hints at an deflated share price compared to its estimated value.

Komatsu (TSE:6301)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komatsu Ltd. is a global manufacturer and seller of construction, mining, and utility equipment, operating across Japan, the Americas, Europe, China, Asia, Oceania, the Middle East, Africa, and CIS countries with a market cap of ¥3.91 trillion.

Operations: Komatsu Ltd.'s revenue is primarily derived from its operations in construction, mining, and utility equipment across diverse regions including Japan, the Americas, Europe, China, Asia, Oceania, the Middle East, Africa, and CIS countries.

Dividend Yield: 3.9%

Komatsu's dividend yield of 3.94% ranks in the top 25% of JP market payers, with recent increases to JPY 83 per share from JPY 72. Despite a history of volatility, dividends are well-covered by earnings (payout ratio: 22.9%) and cash flows (cash payout ratio: 61.4%). Trading at a significant discount to fair value, Komatsu anticipates strong financial performance with projected net income of ¥376 billion for fiscal year ending March 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Komatsu.

- Our valuation report here indicates Komatsu may be undervalued.

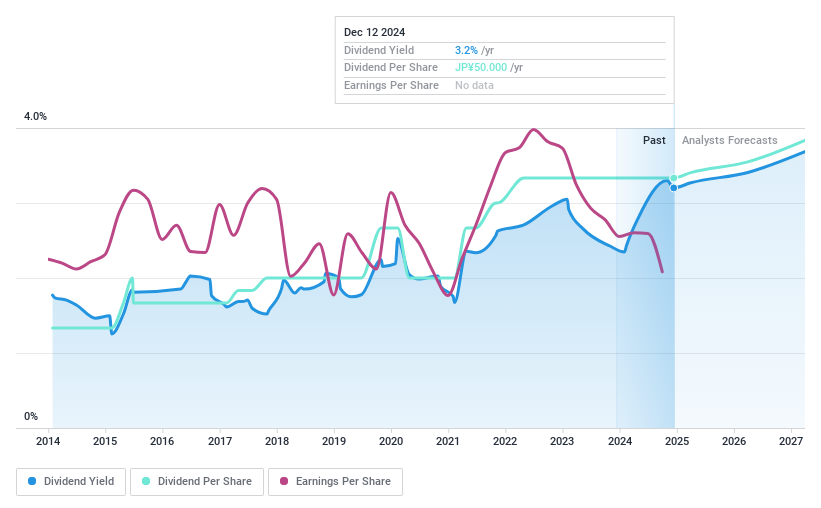

Kyocera (TSE:6971)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kyocera Corporation develops, produces, and distributes products based on fine ceramic technologies across Japan, the rest of Asia, Europe, the United States, and internationally, with a market cap of approximately ¥2.18 trillion.

Operations: Kyocera Corporation's revenue is primarily derived from its Solutions Business, which includes the Document Solutions Unit (¥471.49 billion), Machine Tools (¥311.93 billion), and Communications Unit (¥224.84 billion), as well as its Core Components Business, comprising the Semiconductor Components Unit (¥307.47 billion) and Industrial & Automotive Components Unit (¥229.27 billion), alongside contributions from the Electronic Components Business (¥358.44 billion).

Dividend Yield: 3.2%

Kyocera's dividend of JPY 25 per share remains stable, though its yield of 3.23% is below the JP market's top tier. Despite a high payout ratio of 87.3%, dividends are covered by earnings and cash flows, with a cash payout ratio at 65.4%. Recent guidance revisions reflect challenges in demand recovery for key segments, yet ongoing investments in battery technology signal commitment to growth and innovation amidst fluctuating earnings performance.

- Get an in-depth perspective on Kyocera's performance by reading our dividend report here.

- Our valuation report unveils the possibility Kyocera's shares may be trading at a premium.

Summing It All Up

- Delve into our full catalog of 1927 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komatsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6301

Komatsu

Manufactures and sells construction, mining, and utility equipment in Japan, the Americas, Europe, China, Rest of Asia, Oceania, the Middle East, Africa, and CIS countries.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives