- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6965

How a Major Buyback Amid Mixed Profits at Hamamatsu Photonics (TSE:6965) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In the past fiscal year ending September 30, 2025, Hamamatsu Photonics K.K. reported a 4% increase in net sales but experienced significant declines in operating and ordinary profits, while also conducting a stock split and announcing a substantial share buyback program targeting up to 15 million shares, or approximately 5% of its total issued shares.

- This combination of capital policy actions signals a focus on enhancing shareholder returns and strengthening market positioning during a period of mixed financial results.

- With the significant share buyback initiative as a central development, we'll explore how this shapes Hamamatsu Photonics' overall investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Hamamatsu Photonics K.K's Investment Narrative?

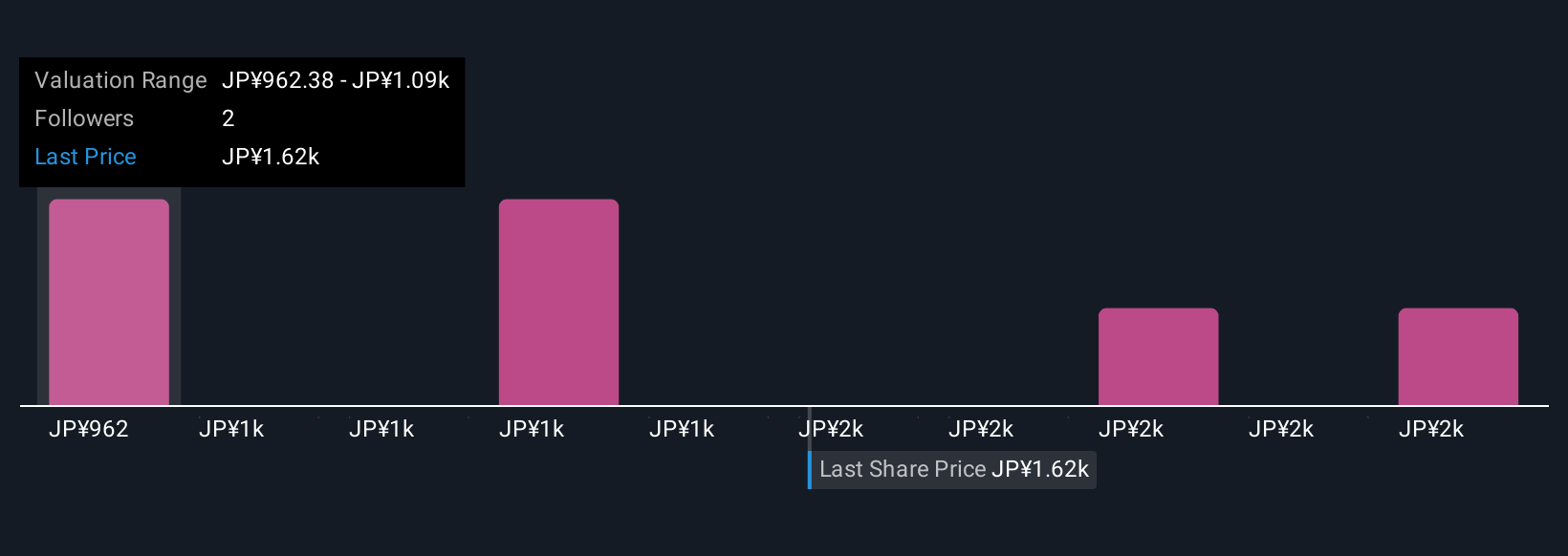

For anyone considering Hamamatsu Photonics K.K., the key idea to hold is that the business sits at the center of photonics innovation and research, but right now faces pressure from profitability headwinds, high valuations and lagging returns. The latest news, featuring a 4% rise in net sales for fiscal 2025 but notable drops in profits, is paired with a bold share buyback equal to about 5% of the company’s outstanding shares. This capital management move carries weight: it potentially eases some near-term downside by providing direct support to the share price and reinforcing management’s commitment to shareholder value. However, the bigger story still revolves around whether management can turn around margins and deliver on its profit recovery guidance. With price volatility high and the stock trading well above peer and sector averages, the main short-term catalysts and risks remain centered on improved operating performance and how effectively capital return policies offset current earnings pressures.

On the flip side, margin pressure continues to be a critical issue investors should watch. Hamamatsu Photonics K.K's share price has been on the slide but might be up to 17% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 5 other fair value estimates on Hamamatsu Photonics K.K - why the stock might be worth 43% less than the current price!

Build Your Own Hamamatsu Photonics K.K Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamamatsu Photonics K.K research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Hamamatsu Photonics K.K research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamamatsu Photonics K.K's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamamatsu Photonics K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6965

Hamamatsu Photonics K.K

Manufactures and sells photomultiplier tubes, imaging devices, light sources, opto-semiconductors, and imaging and analyzing systems in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives