- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6965

Hamamatsu Photonics (TSE:6965): Assessing Valuation as Board Weighs Potential New Share Issuance

Reviewed by Simply Wall St

Hamamatsu Photonics K.K (TSE:6965) has called a December 19 board meeting to discuss issuing new shares, a move that could reshape its capital structure and influence how investors think about future growth.

See our latest analysis for Hamamatsu Photonics K.K.

The stock has been choppy this year, with an 11.94% 1 month share price return but a slightly negative year to date move. The 3 year total shareholder return of minus 44.20% shows longer term momentum has clearly faded, even as the latest share price of ¥1,682.5 reflects renewed speculation about how fresh equity could fund future growth.

If this capital raise has you rethinking your exposure to optical and sensor technology, it might be a good time to scan other high growth tech and AI names via high growth tech and AI stocks for comparison.

Yet with modest revenue growth, a long slide in returns, and the stock still trading below analyst targets, investors face a key question: is Hamamatsu undervalued ahead of fresh capital, or is the market already pricing in future growth?

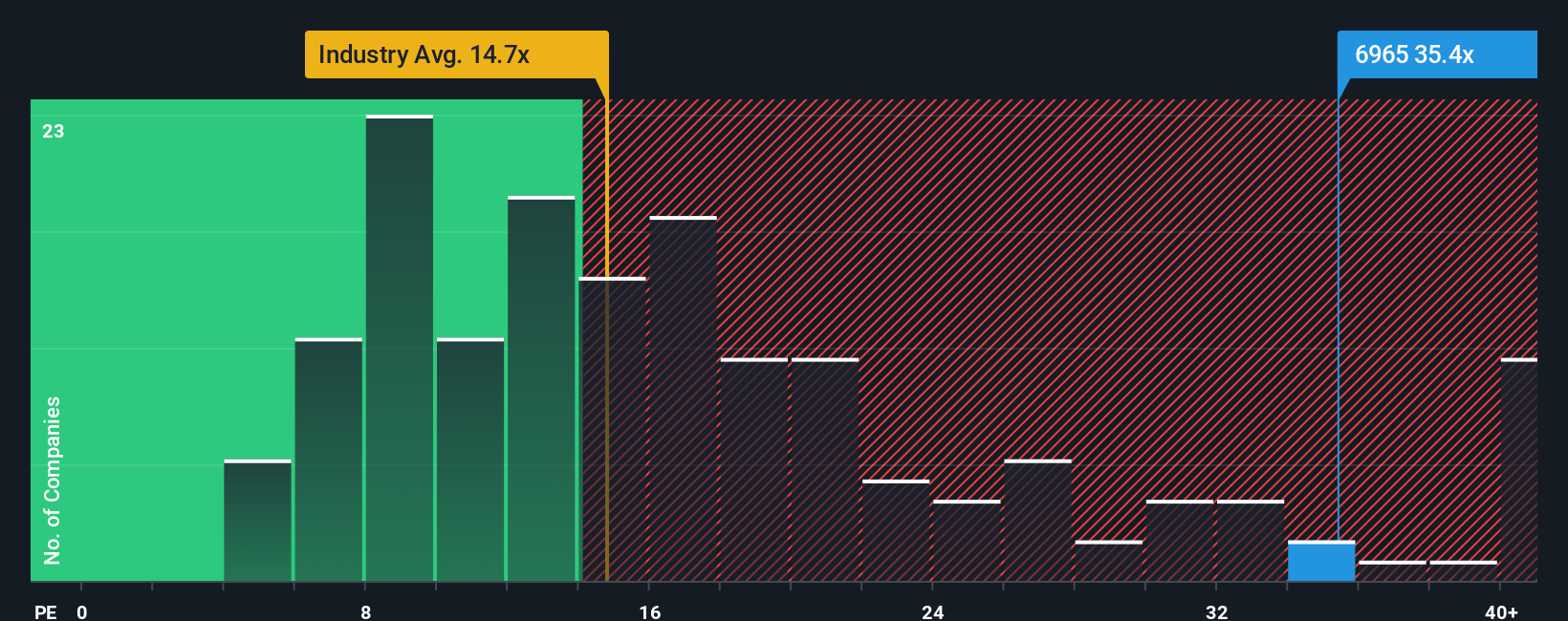

Price-to-Earnings of 35.4x: Is it justified?

On a price-to-earnings basis, Hamamatsu trades at 35.4x earnings, which leaves the stock looking expensive relative to its domestic electronics peers.

The price-to-earnings ratio compares the current share price to per share earnings, so a higher multiple generally implies the market is pricing in stronger or more durable profit growth.

For Hamamatsu, the 35.4x multiple is below the 42.1x average of its direct peer group. This suggests investors are not paying a premium versus similar names. It still sits well above the broader Japanese electronic industry average of 14.7x and the estimated fair price-to-earnings ratio of 21x, which implies the market is assigning a rich valuation that could compress if expectations ease.

Explore the SWS fair ratio for Hamamatsu Photonics K.K

Result: Price-to-Earnings of 35.4x (OVERVALUED)

However, lingering share price weakness and any disappointment around the size or terms of the capital raise could quickly challenge the market’s renewed optimism.

Find out about the key risks to this Hamamatsu Photonics K.K narrative.

Another View: Market vs Fair Ratio

While the current price to earnings of 35.4x looks rich against the industry, it still sits well above our fair ratio of 21x, yet below peer levels of 42.1x. In practice, that gap hints at downside if sentiment fades, but also some relative support. The question is which of these factors matters more in the near term?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hamamatsu Photonics K.K for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hamamatsu Photonics K.K Narrative

If you see things differently or want to dig into the numbers yourself, you can easily build a custom view in just a few minutes, Do it your way.

A great starting point for your Hamamatsu Photonics K.K research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more actionable ideas?

Before the market moves without you, use the Simply Wall Street Screener to uncover fresh opportunities that complement or even outperform your view on Hamamatsu.

- Capture potential bargains trading below intrinsic value by targeting these 909 undervalued stocks based on cash flows that could rerate as sentiment and fundamentals align.

- Position for the next wave of innovation by focusing on these 24 AI penny stocks that are set to benefit from accelerating real world adoption.

- Strengthen your income strategy with these 12 dividend stocks with yields > 3% that can support returns even when share prices stall.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hamamatsu Photonics K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6965

Hamamatsu Photonics K.K

Manufactures and sells photomultiplier tubes, imaging devices, light sources, opto-semiconductors, and imaging and analyzing systems in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion