- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6962

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of trade tensions and economic indicators, investors are closely watching how these factors influence market sentiment and indices performance. With U.S. job growth falling short of estimates and tariff uncertainties impacting stock movements, dividend stocks can offer a measure of stability by providing consistent income streams in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

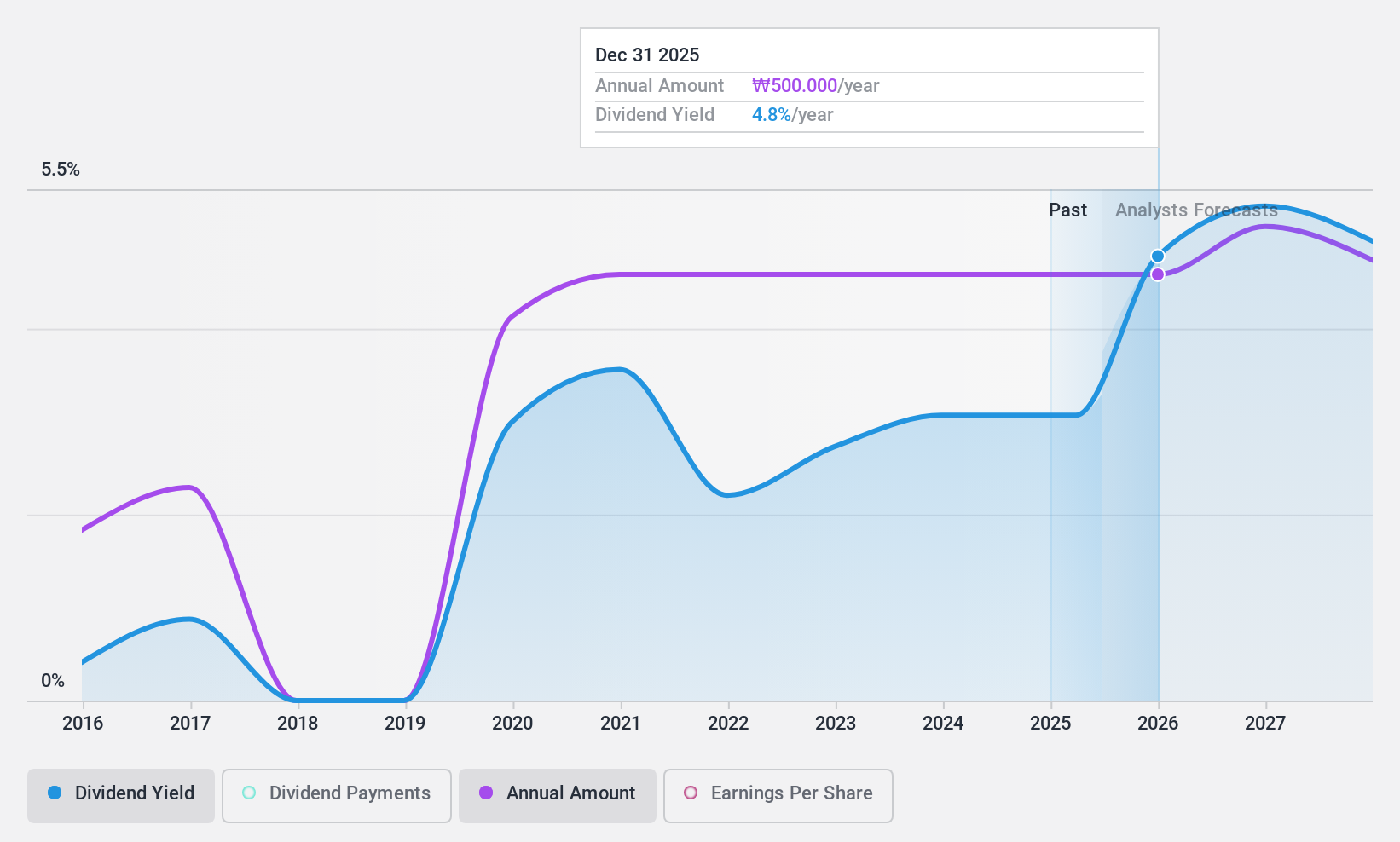

Hansae (KOSE:A105630)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hansae Co., Ltd. manufactures and sells finished clothing products in Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti with a market cap of ₩528.12 billion.

Operations: Hansae Co., Ltd. generates its revenue primarily from clothing manufacturing, amounting to ₩1.75 trillion.

Dividend Yield: 3.6%

Hansae's recent earnings report shows a slight increase in sales but a decline in net income, impacting its dividend sustainability. Despite a low payout ratio of 20.8%, dividends aren't well covered by free cash flows, with a high cash payout ratio of 263.7%. While the dividend yield of 3.63% is below the top quartile in Korea, Hansae has maintained stable and reliable dividend payments over the past decade, albeit not fully supported by earnings or cash flow.

- Get an in-depth perspective on Hansae's performance by reading our dividend report here.

- The analysis detailed in our Hansae valuation report hints at an deflated share price compared to its estimated value.

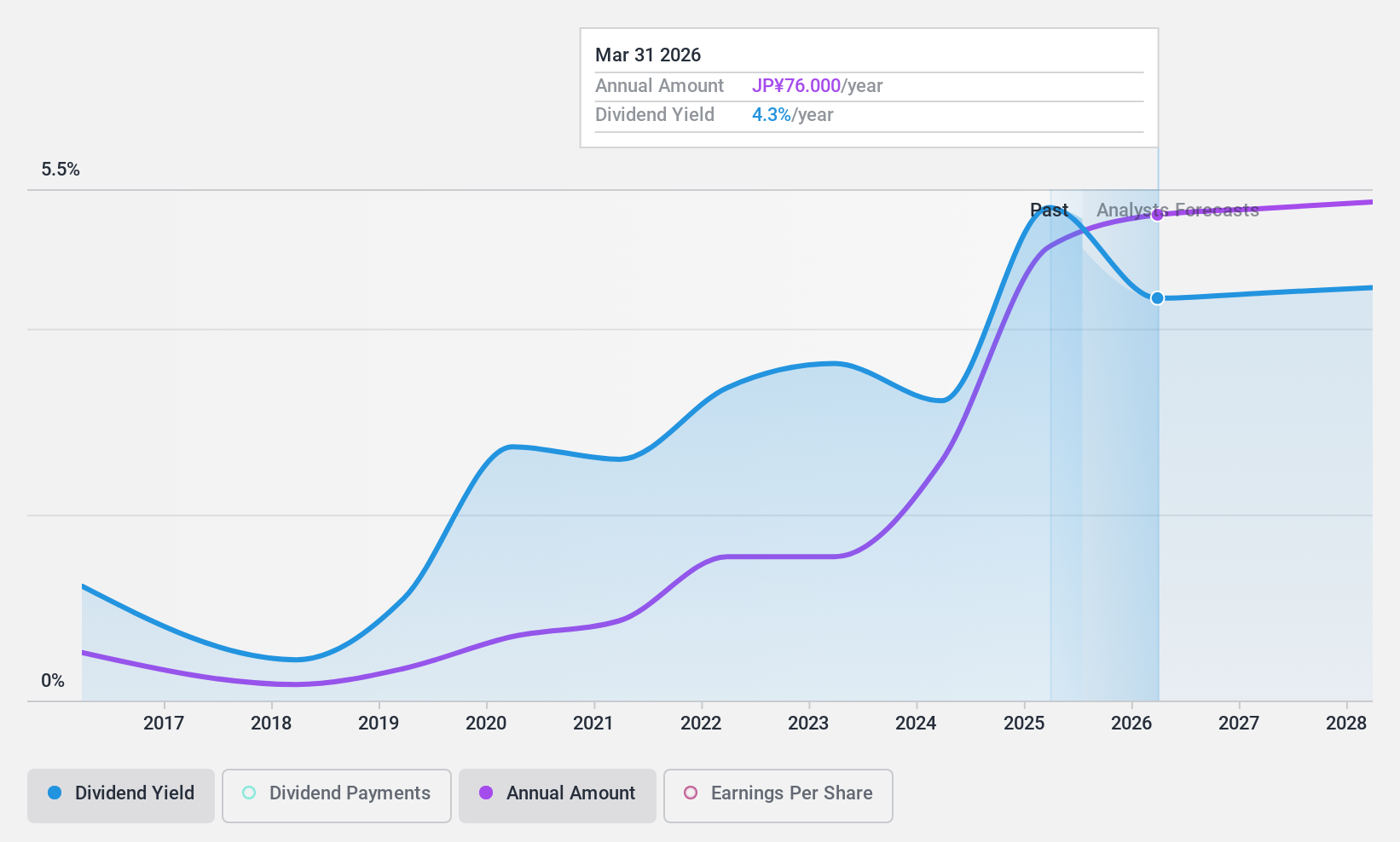

TOA (TSE:1885)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TOA Corporation, with a market cap of ¥94.41 billion, offers construction and engineering services in Japan.

Operations: TOA Corporation's revenue segments include construction and engineering services in Japan.

Dividend Yield: 3.9%

TOA's dividend payments have been volatile and unreliable over the past decade, yet they are well-covered by earnings and cash flows, with a low payout ratio of 22.8%. Despite this instability, TOA recently increased its year-end dividend forecast to ¥71.00 per share due to improved financial performance. The company's shares trade below estimated fair value and offer a top-tier dividend yield in Japan's market. However, future earnings are expected to decline slightly.

- Navigate through the intricacies of TOA with our comprehensive dividend report here.

- Our valuation report here indicates TOA may be undervalued.

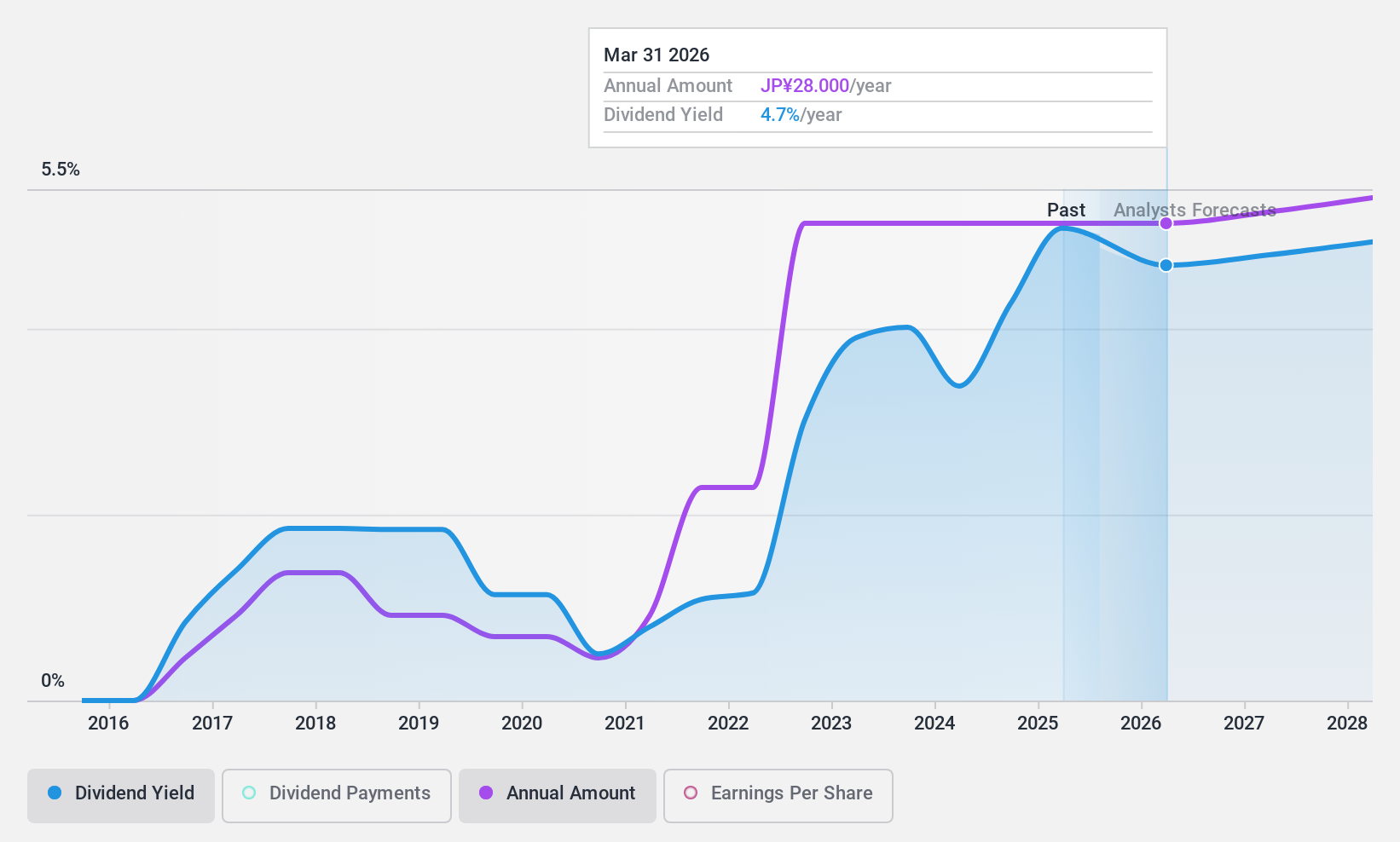

Daishinku (TSE:6962)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daishinku Corp. manufactures and sells electronic components and equipment across Japan, North America, Europe, China, Taiwan, and Asia, with a market cap of ¥19.27 billion.

Operations: Daishinku Corp.'s revenue is derived from its operations in the manufacture and sale of electronic components and equipment across various regions including Japan, North America, Europe, China, Taiwan, and Asia.

Dividend Yield: 4.3%

Daishinku's dividend yield of 4.34% ranks in the top 25% of Japan's market, yet its payments have been volatile and unreliable over the past decade. Although dividends are well-covered by earnings with a low payout ratio of 42%, they are not supported by free cash flows. The recent share buyback program aims to enhance shareholder returns and capital efficiency, reflecting efforts to improve financial stability despite large one-off items affecting results.

- Unlock comprehensive insights into our analysis of Daishinku stock in this dividend report.

- In light of our recent valuation report, it seems possible that Daishinku is trading behind its estimated value.

Where To Now?

- Reveal the 1963 hidden gems among our Top Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6962

Daishinku

Engages in the manufacture and sale of electronic components and equipment in Japan, North America, Europe, China, Taiwan, and Asia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives