- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6957

Shibaura Electronics Co.,Ltd.'s (TSE:6957) 25% Jump Shows Its Popularity With Investors

Shibaura Electronics Co.,Ltd. (TSE:6957) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

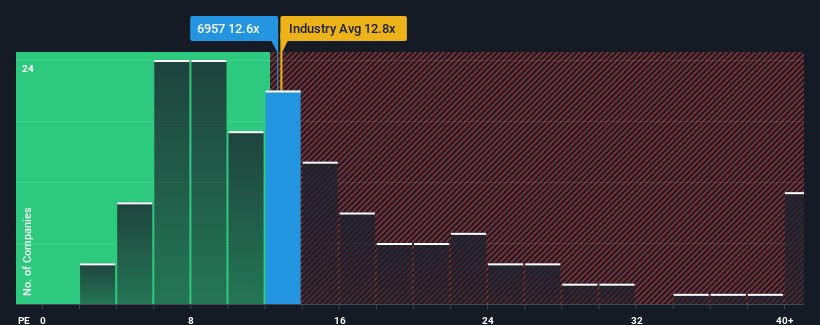

Although its price has surged higher, there still wouldn't be many who think Shibaura ElectronicsLtd's price-to-earnings (or "P/E") ratio of 12.6x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Shibaura ElectronicsLtd has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Shibaura ElectronicsLtd

Does Growth Match The P/E?

In order to justify its P/E ratio, Shibaura ElectronicsLtd would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 3.4% last year. The latest three year period has also seen an excellent 36% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 7.9% per year over the next three years. With the market predicted to deliver 9.4% growth each year, the company is positioned for a comparable earnings result.

With this information, we can see why Shibaura ElectronicsLtd is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Shibaura ElectronicsLtd's P/E?

Its shares have lifted substantially and now Shibaura ElectronicsLtd's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Shibaura ElectronicsLtd maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Shibaura ElectronicsLtd.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6957

Shibaura ElectronicsLtd

Manufactures and sells thermistor elements, and products utilizing thermistor elements in Japan.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.