- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6862

Some Shareholders Feeling Restless Over MINATO HOLDINGS INC.'s (TSE:6862) P/S Ratio

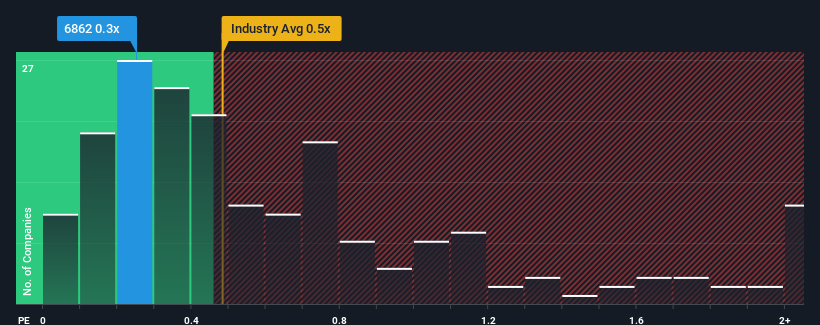

There wouldn't be many who think MINATO HOLDINGS INC.'s (TSE:6862) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Electronic industry in Japan is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for MINATO HOLDINGS

What Does MINATO HOLDINGS' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, MINATO HOLDINGS has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think MINATO HOLDINGS' future stacks up against the industry? In that case, our free report is a great place to start .How Is MINATO HOLDINGS' Revenue Growth Trending?

In order to justify its P/S ratio, MINATO HOLDINGS would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 2.0% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth is heading into negative territory, declining 0.4% over the next year. Meanwhile, the broader industry is forecast to expand by 7.8%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that MINATO HOLDINGS' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears that MINATO HOLDINGS currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You need to take note of risks, for example - MINATO HOLDINGS has 5 warning signs (and 2 which can't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6862

MINATO HOLDINGS

Engages in the memory module, telework solution, digital device peripherals, device programming, display solution, intelligent stereo camera, system development and website construction, mobile accessories, financial consulting, and electronics design businesses in Japan and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.