- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6861

Keyence (TSE:6861): Assessing Valuation as Investor Sentiment Shifts After a Muted Stretch

Reviewed by Simply Wall St

Keyence (TSE:6861) has captured investor attention yet again following another quiet session, with no major headlines but a recent stock drift stirring curiosity among those weighing their next move. Sometimes, it is not an earthshaking announcement but a gradual shift in sentiment or a faded catalyst that pushes shareholders to reassess their convictions. In a market full of noise, such muted price action can be its own kind of signal, prompting a closer look beneath the surface at what has really changed or remained the same.

Over the past year, Keyence's share price has quietly slipped, with returns down around 12% since last summer. The past month has been relatively stable compared to earlier quarters, reflecting a market that is waiting for a spark. While the company continues to post single-digit annual revenue and net income growth, the longer-term track record has been modest over three years and stronger over five years, but this has not done much to reignite momentum or reset expectations.

With the shares trading well below many measures of estimated value, are investors looking at a genuine opportunity, or has the market already factored in everything Keyence has to offer from this point onward?

Price-to-Earnings of 33.8x: Is it justified?

Keyence is currently trading at a price-to-earnings (P/E) ratio of 33.8, placing it well above the Japanese Electronic industry average of 14.6. This sizable premium suggests that investors are paying significantly more for each unit of current earnings compared to industry peers.

The price-to-earnings ratio measures how much investors are willing to pay for a company’s earnings. It is a commonly used metric for valuing technology companies like Keyence, where future earnings growth and quality of profits are under scrutiny. A high P/E typically indicates expectations of robust growth, strong profitability, or high-quality earnings. However, it can also point to overheating expectations or a possible disconnect with underlying fundamentals.

With Keyence’s P/E standing so far above both industry and peer averages, the market seems to be pricing in continued superior growth or profitability. At the same time, this means current shareholders are shouldering the risk that expected growth or margins might not come through strongly enough to justify such a high multiple.

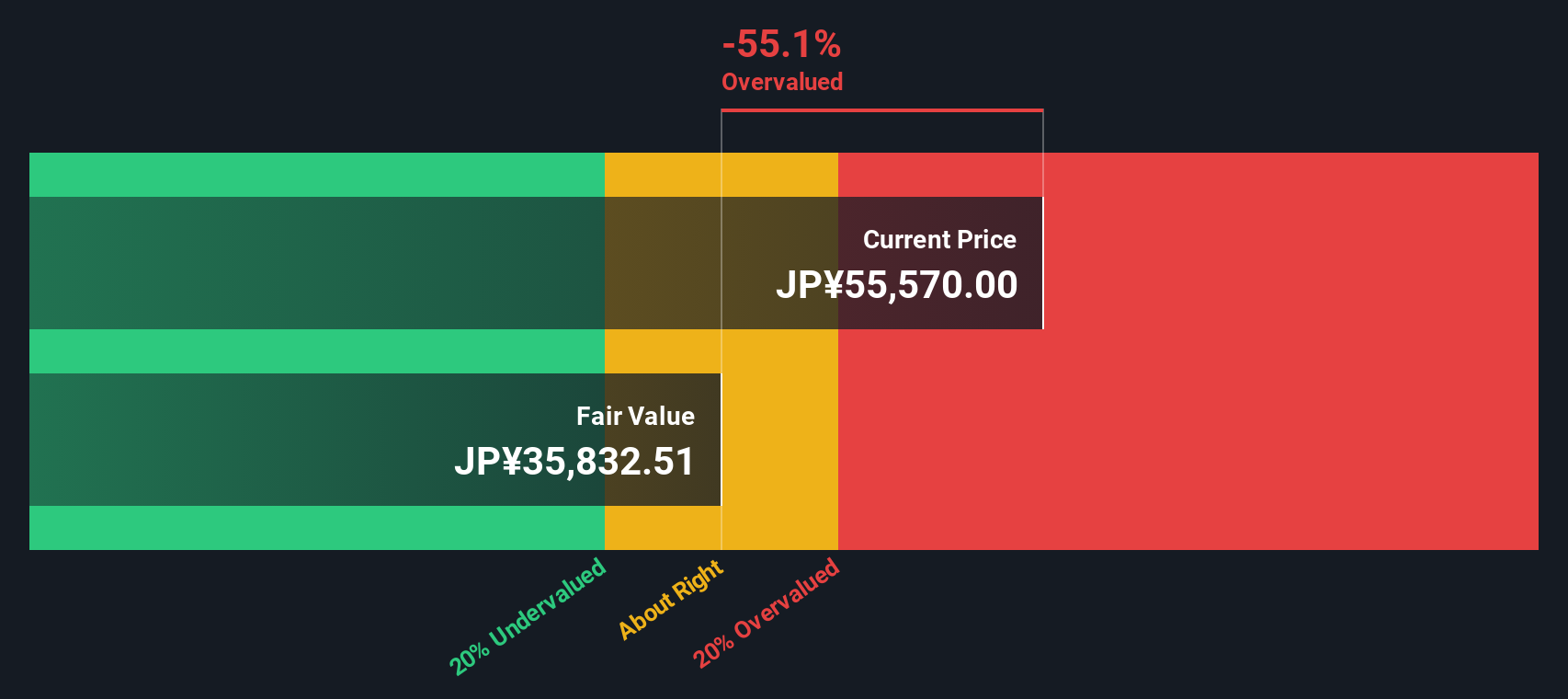

Result: Fair Value of ¥35,803.5 (OVERVALUED)

See our latest analysis for Keyence.However, shifts in growth momentum or renewed industry headwinds could quickly challenge the market’s confidence in Keyence’s premium valuation.

Find out about the key risks to this Keyence narrative.Another View: What Does the SWS DCF Model Say?

While the market is placing a big premium on Keyence's shares based on earnings, our DCF model paints a different picture and suggests the stock might be overvalued. Could this more cautious view be missing something vital, or is it a hint that optimism has run ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Keyence Narrative

Of course, if you have your own perspective or want to build a story around Keyence based on your research, you can easily do so in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Keyence.

Looking for more investment ideas?

Seize the moment and find your next opportunity. Simply Wall Street's screener tools help you spot fast movers and hidden value before others catch on.

- Unlock lucrative yield opportunities and track reliable income streams by checking out dividend stocks with yields > 3%.

- Target tomorrow’s leaders by seeing which companies are harnessing artificial intelligence innovation with AI penny stocks.

- Capitalize on strong companies trading below their intrinsic value by using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keyence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6861

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion