- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6814

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global trade tensions escalate, the Asian markets have been navigating a challenging landscape with mixed performances across major indices. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.03% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.96% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.63% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.59% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.06% | ★★★★★★ |

| Torigoe (TSE:2009) | 5.28% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.51% | ★★★★★★ |

Click here to see the full list of 1217 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

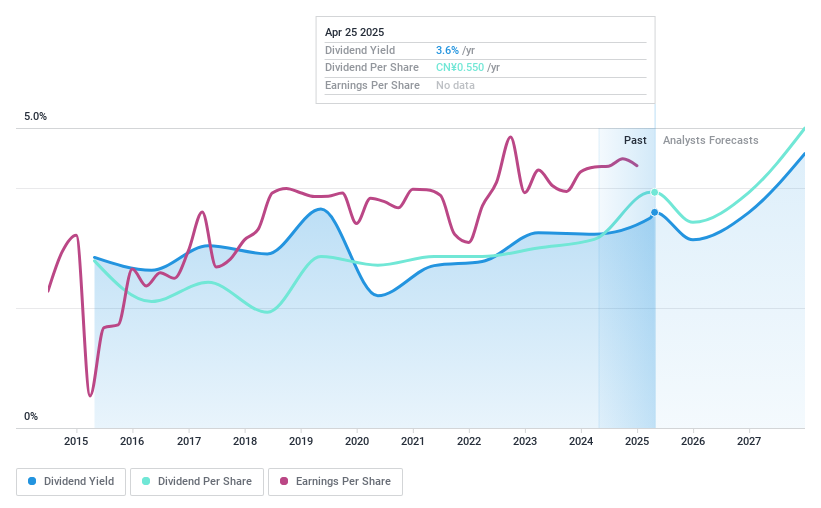

Heilongjiang Agriculture (SHSE:600598)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heilongjiang Agriculture Company Limited is involved in the contracting and management of cultivated land in China, with a market cap of CN¥30.33 billion.

Operations: Heilongjiang Agriculture Company Limited's revenue segments include the contracting and management of cultivated land in China.

Dividend Yield: 3.2%

Heilongjiang Agriculture reported increased revenue and net income for 2024, with net income reaching CNY 1.09 billion. Despite a dividend yield of 3.22%, placing it in the top quartile of CN market payers, its high cash payout ratio (93.2%) raises concerns about sustainability. The dividend is covered by earnings but not free cash flows, and past payments have been volatile and unreliable, with significant annual drops over the last decade.

- Take a closer look at Heilongjiang Agriculture's potential here in our dividend report.

- Our valuation report here indicates Heilongjiang Agriculture may be undervalued.

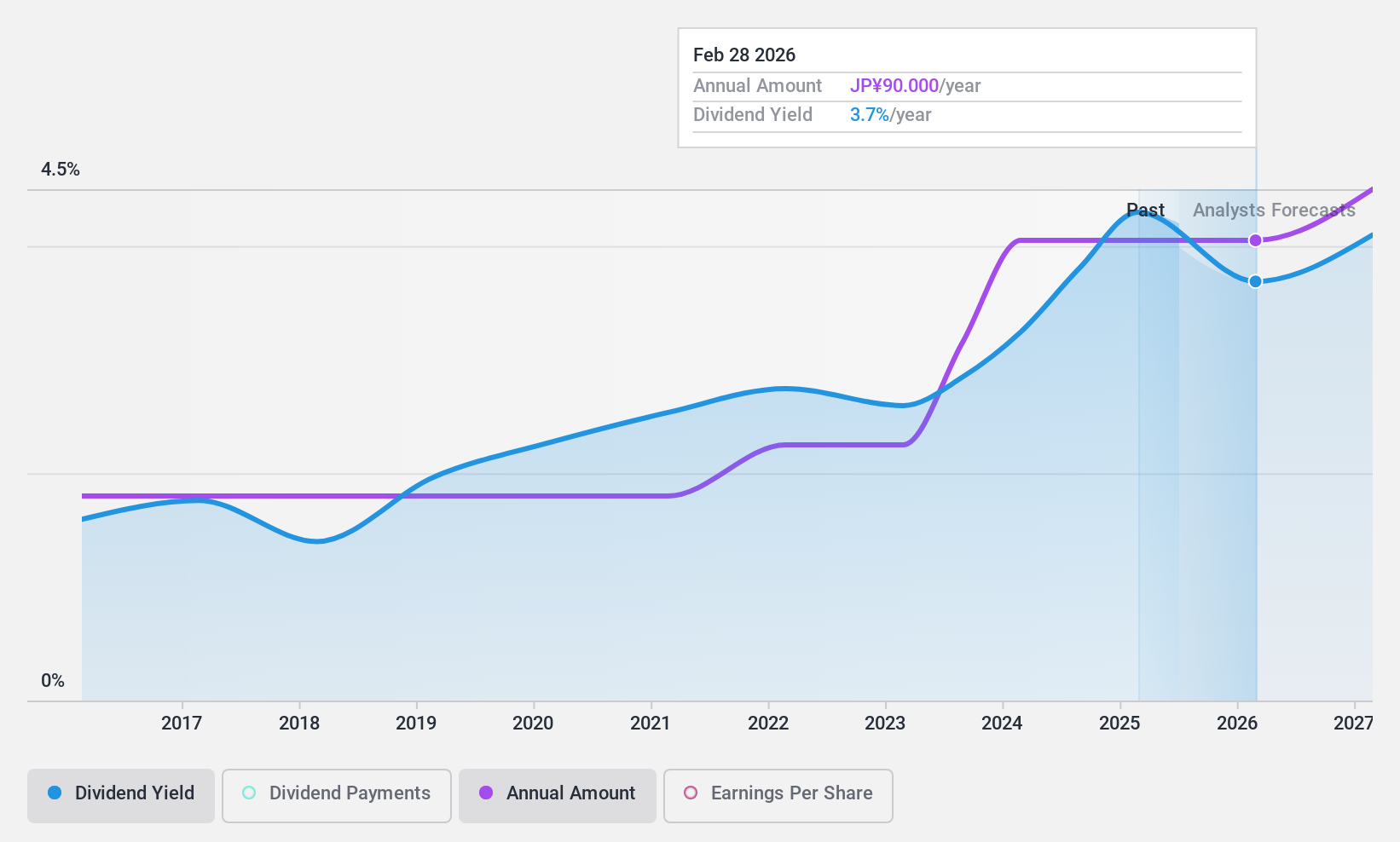

Warabeya Nichiyo Holdings (TSE:2918)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Warabeya Nichiyo Holdings Co., Ltd. operates in the manufacture and sale of food products for convenience stores both in Japan and internationally, with a market capitalization of ¥41.77 billion.

Operations: Warabeya Nichiyo Holdings Co., Ltd. generates revenue through the production and distribution of food products specifically designed for convenience stores in both domestic and international markets.

Dividend Yield: 3.8%

Warabeya Nichiyo Holdings offers a stable dividend history over the past decade, with payments consistently growing. However, the 3.76% yield is below top-tier levels in Japan and not well-supported by free cash flows or profits, despite a reasonable payout ratio of 58.7%. Recent challenges include delays in its U.S. expansion plans due to construction setbacks, potentially impacting future financial stability and dividend sustainability. The stock trades at good value relative to peers and industry standards.

- Click to explore a detailed breakdown of our findings in Warabeya Nichiyo Holdings' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Warabeya Nichiyo Holdings shares in the market.

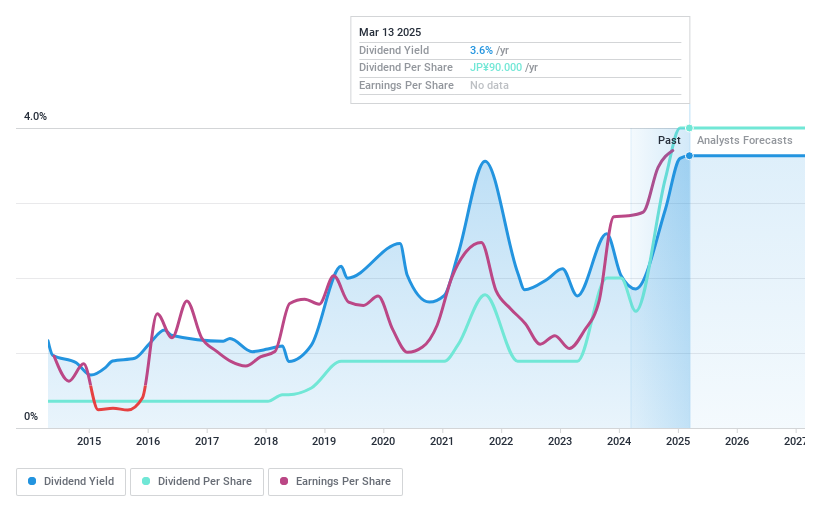

Furuno Electric (TSE:6814)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and internationally with a market cap of ¥75.39 billion.

Operations: Furuno Electric Co., Ltd.'s revenue segments include the Marine Business at ¥108.88 billion, the Industrial Business at ¥14.26 billion, and the Wireless LAN Handy Terminal Business at ¥3.98 billion.

Dividend Yield: 4.6%

Furuno Electric's dividend yield of 4.61% ranks in the top 25% in Japan, but its dividend history is volatile with recent fluctuations. The payout ratio is sustainable at 30.3%, covered by both earnings and cash flows, despite an unstable track record. Recent guidance indicates a significant increase to ¥75 per share for fiscal year-end dividends, highlighting potential improvements in shareholder returns amid management's focus on cost-conscious strategies and stock price considerations.

- Unlock comprehensive insights into our analysis of Furuno Electric stock in this dividend report.

- Our valuation report unveils the possibility Furuno Electric's shares may be trading at a discount.

Summing It All Up

- Dive into all 1217 of the Top Asian Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6814

Furuno Electric

Engages in the manufacture and sale of marine and industrial electronics equipment, wireless LAN system, and handy terminals in Japan, the Americas, Europe, rest of Asia, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives