- Japan

- /

- Auto Components

- /

- TSE:5105

3 Asian Dividend Stocks With At Least 4% Yield

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and economic fluctuations, Asian markets have been closely monitoring developments, particularly in light of U.S.-China trade tensions and Japan's ongoing negotiations with the U.S. Amid these dynamics, dividend stocks remain a compelling option for investors seeking steady income streams, especially those offering yields of at least 4% which can provide a cushion against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.08% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.26% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.49% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.42% | ★★★★★★ |

Click here to see the full list of 1256 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

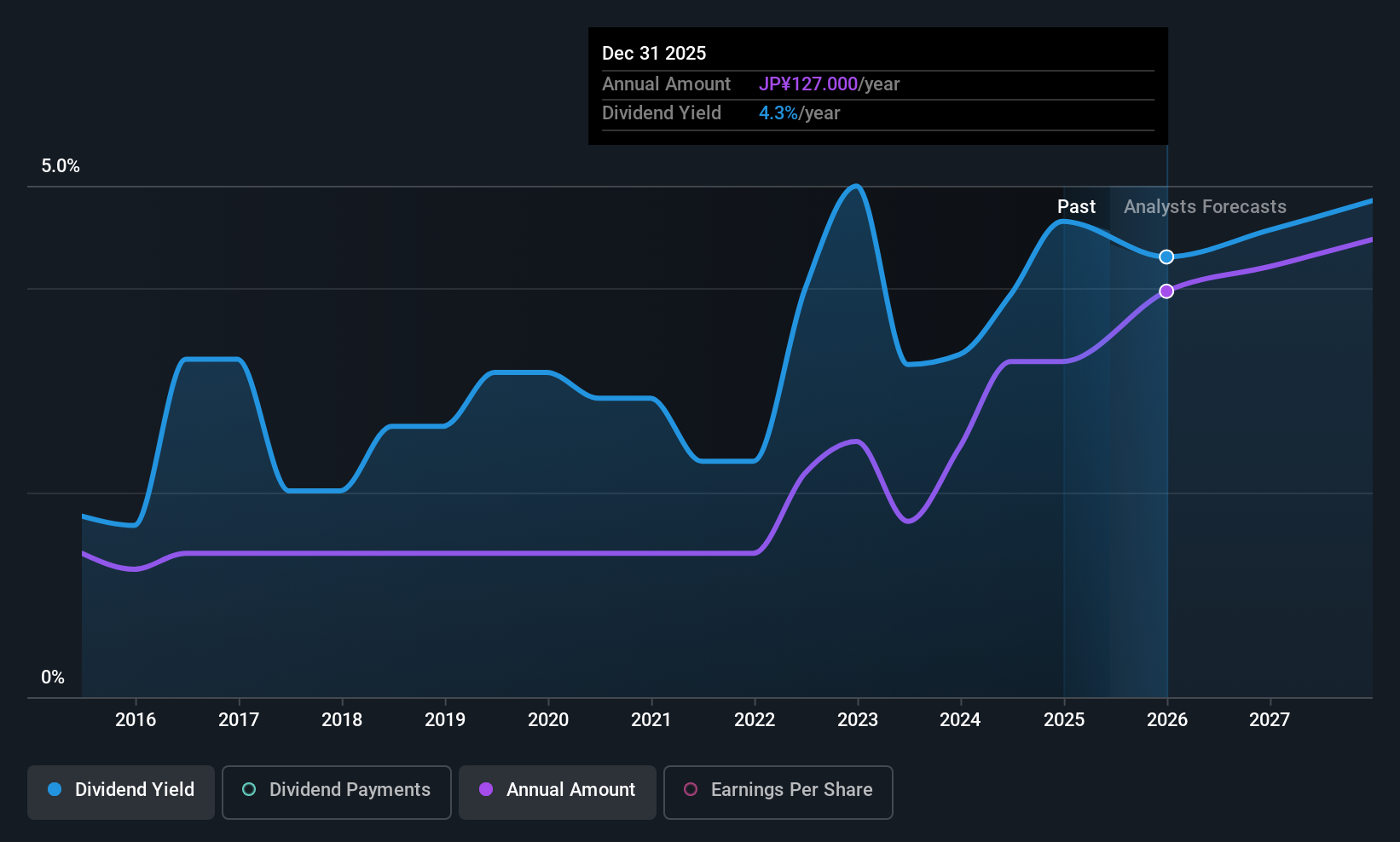

Toyo Tire (TSE:5105)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Tire Corporation manufactures and sells tires in Japan, North America, and internationally with a market cap of ¥473.01 billion.

Operations: Toyo Tire Corporation generates revenue from its tire manufacturing and sales operations across Japan, North America, and other international markets.

Dividend Yield: 4.1%

Toyo Tire's dividend payments are well covered by both earnings and cash flows, with a payout ratio of 28.3% and a cash payout ratio of 49.1%, respectively, indicating good coverage. Despite this, the dividend track record has been unstable over the past decade with volatility exceeding 20% annually at times. The stock trades at a significant discount to its estimated fair value and offers a competitive yield in Japan's market, although historical reliability remains a concern.

- Unlock comprehensive insights into our analysis of Toyo Tire stock in this dividend report.

- The valuation report we've compiled suggests that Toyo Tire's current price could be quite moderate.

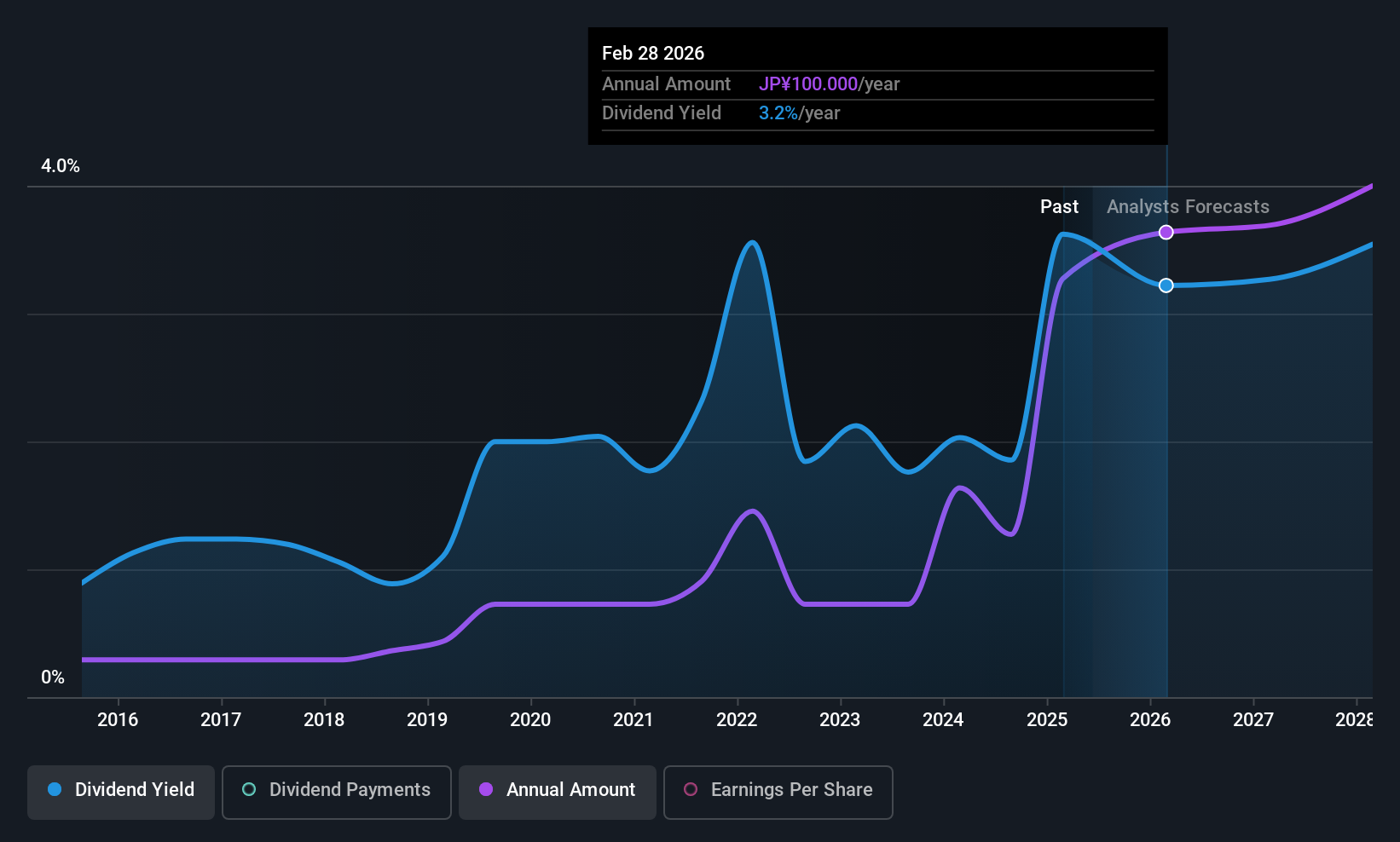

Furuno Electric (TSE:6814)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and other international markets with a market cap of ¥93.02 billion.

Operations: Furuno Electric Co., Ltd.'s revenue is primarily derived from its marine and industrial electronics equipment, wireless LAN systems, and handy terminals sold across various global markets including Japan, the Americas, Europe, and Asia.

Dividend Yield: 3.7%

Furuno Electric's dividends are well covered by earnings and cash flows, with a payout ratio of 27.4% and a cash payout ratio of 58.2%. However, the dividend track record has been volatile over the past decade. The company recently announced an increased dividend per share to ¥75 from previous guidance of ¥55, effective May 23, 2025. Despite trading at a significant discount to its estimated fair value, earnings are forecasted to decline by an average of 6.2% annually over the next three years.

- Click to explore a detailed breakdown of our findings in Furuno Electric's dividend report.

- According our valuation report, there's an indication that Furuno Electric's share price might be on the cheaper side.

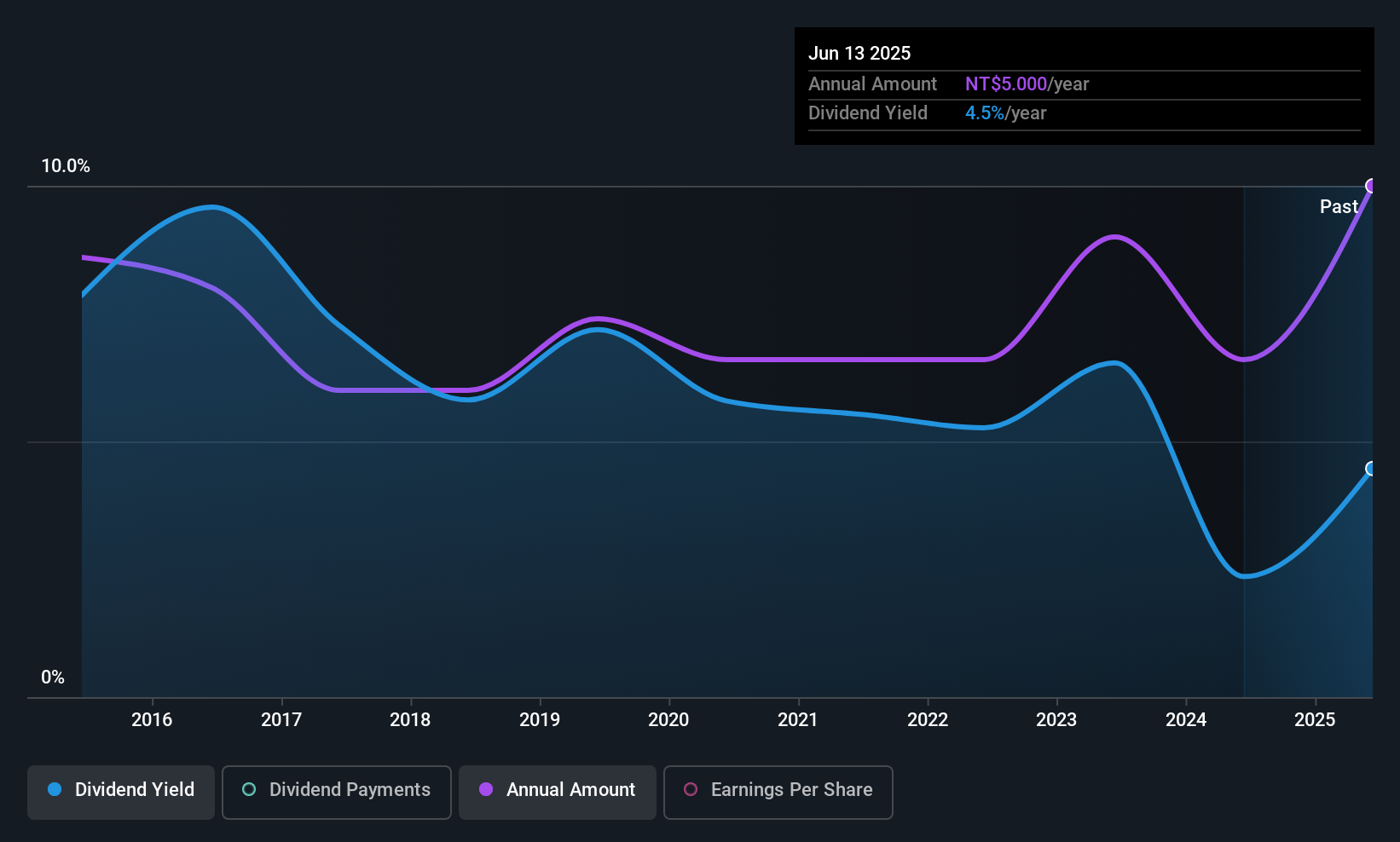

Test Research (TWSE:3030)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Test Research, Inc. designs, assembles, manufactures, sells, and maintains automated inspection and testing equipment globally with a market cap of NT$29.41 billion.

Operations: Test Research, Inc.'s revenue primarily comes from its operations in the design, assembly, manufacture, sale, and maintenance of automatic testing equipment, generating NT$6.79 billion.

Dividend Yield: 4%

Test Research's dividend yield of 4.02% is below the top 25% in Taiwan, and its dividend history has been unstable over the past decade. Despite this, dividends are currently covered by earnings with a payout ratio of 60.3%, and cash flows with a cash payout ratio of 79.5%. Recent earnings growth is notable, with Q1 net income rising to TWD 577.81 million from TWD 455.31 million year-over-year, supporting their recent dividend increase announcement for July distribution.

- Get an in-depth perspective on Test Research's performance by reading our dividend report here.

- Our valuation report unveils the possibility Test Research's shares may be trading at a premium.

Seize The Opportunity

- Click here to access our complete index of 1256 Top Asian Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toyo Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5105

Toyo Tire

Manufactures and sells tires in Japan, North America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion