- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6787

Meiko Electronics (TSE:6787) Has Announced A Dividend Of ¥36.00

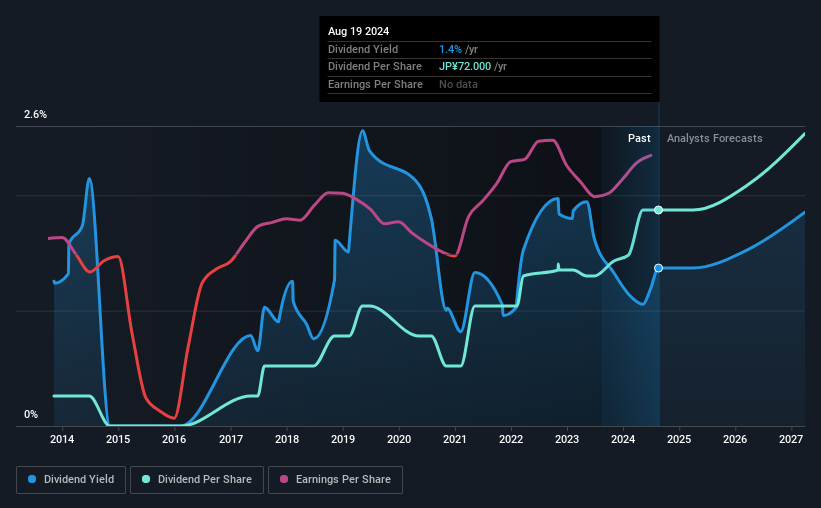

The board of Meiko Electronics Co., Ltd. (TSE:6787) has announced that it will pay a dividend of ¥36.00 per share on the 2nd of December. Based on this payment, the dividend yield for the company will be 1.4%, which is fairly typical for the industry.

View our latest analysis for Meiko Electronics

Meiko Electronics' Payment Has Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Before making this announcement, Meiko Electronics was paying a whopping 110% as a dividend, but this only made up 15% of its overall earnings. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

Looking forward, earnings per share is forecast to rise by 14.4% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 17%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the dividend has gone from ¥10.00 total annually to ¥72.00. This implies that the company grew its distributions at a yearly rate of about 22% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that Meiko Electronics has grown earnings per share at 17% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

Our Thoughts On Meiko Electronics' Dividend

In summary, while it's always good to see the dividend being raised, we don't think Meiko Electronics' payments are rock solid. While Meiko Electronics is earning enough to cover the payments, the cash flows are lacking. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Meiko Electronics that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6787

Meiko Electronics

Engages in the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics in Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026