- China

- /

- Healthcare Services

- /

- SZSE:301293

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with U.S. stocks ending the year on a strong note despite recent volatility, small-cap companies face unique challenges and opportunities amid economic indicators like the Chicago PMI's contraction and revised GDP forecasts. In this environment, identifying promising stocks requires looking beyond surface-level performance to uncover those with solid fundamentals and potential for growth in niches overlooked by broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Damon Technology GroupLtd (SHSE:688360)

Simply Wall St Value Rating: ★★★★★☆

Overview: Damon Technology Group Co., Ltd. engages in the research, development, manufacturing, sales, and servicing of automated logistics solutions both in China and internationally, with a market capitalization of CN¥3.44 billion.

Operations: Damon Technology Group generates revenue primarily from the high-end equipment manufacturing industry, amounting to CN¥1.57 billion.

Damon Tech, a smaller player in the machinery sector, has seen its earnings jump by 54.8% over the past year, outpacing industry peers. The company's price-to-earnings ratio stands at 26.1x, which is lower than the CN market average of 33.2x, suggesting potential value for investors. Despite an increase in debt to equity from 17.1% to 18.9% over five years, Damon Tech's interest payments are well covered by EBIT at a robust 187.8x coverage level and it remains free cash flow positive with CN¥24 million as of September end; however, recent one-off gains of CN¥38 million may have skewed financial results slightly for this period ending September 2024 while M&A activity could signal strategic growth or consolidation moves ahead given Zhu Guangkui's acquisition announcement involving a significant stake purchase valued around CNY140 million late December last year just before their latest earnings report highlighted net income rising sharply from CNY73 million previously up now reaching nearly CNY117 million reflecting strong operational performance overall amidst these developments within competitive landscape dynamics evolving rapidly today across broader machinery markets globally too!

Sanbo Hospital Management Group (SZSE:301293)

Simply Wall St Value Rating: ★★★★★★

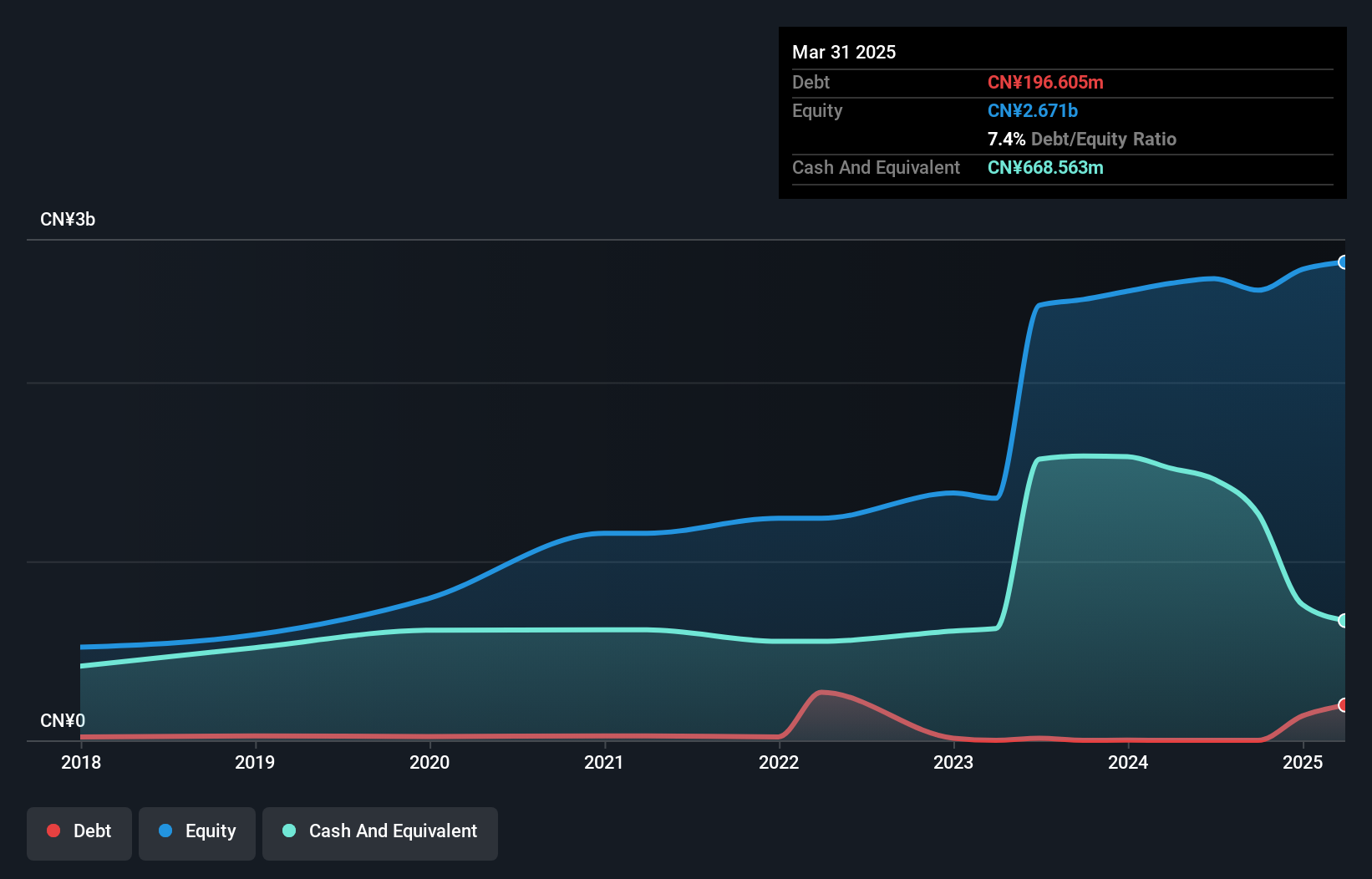

Overview: Sanbo Hospital Management Group Limited operates a network of hospitals that provide medical services, with a market capitalization of CN¥8.79 billion.

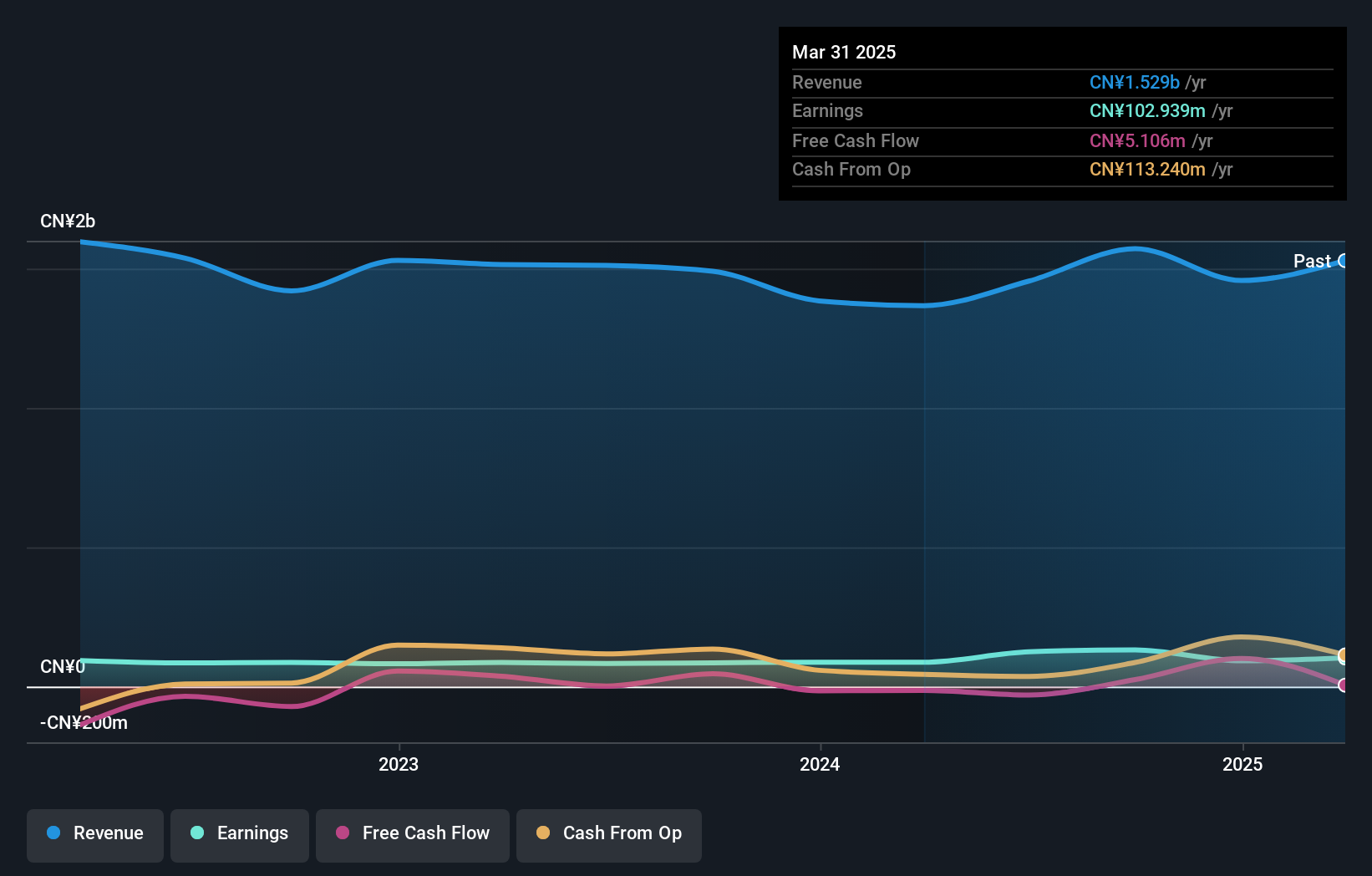

Operations: The primary revenue stream for Sanbo Hospital Management Group comes from its healthcare facilities and services, generating CN¥1.41 billion.

Sanbo Hospital Management Group has shown promising growth, with earnings increasing by 36.9% over the past year, surpassing the Healthcare industry's -5.7%. The company is debt-free now, a significant improvement from five years ago when its debt-to-equity ratio was 3%. Despite not being free cash flow positive recently, Sanbo's net income for the nine months ended September 2024 rose to CNY 104.55 million from CNY 73.15 million a year prior. Additionally, they completed a share buyback of approximately 2.99 million shares for CNY 104.19 million in late 2024, reflecting strategic capital management efforts.

Tamura (TSE:6768)

Simply Wall St Value Rating: ★★★★★☆

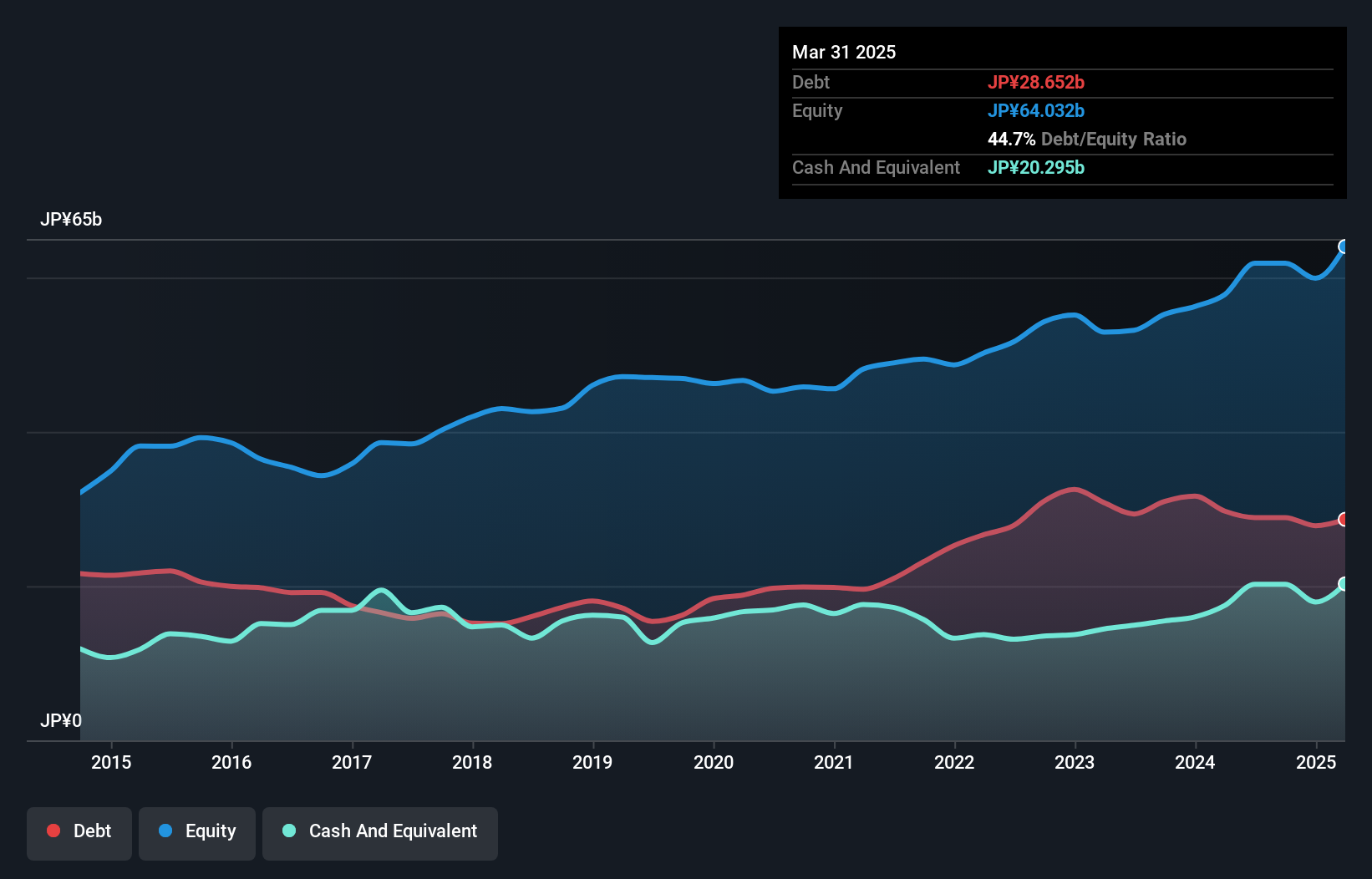

Overview: Tamura Corporation is engaged in the manufacturing and sale of electronic components, electronic chemicals, FA systems, and information equipment both in Japan and internationally, with a market cap of ¥44.97 billion.

Operations: Tamura's primary revenue streams include the Electronic Components Related Business generating ¥70.81 billion and the Electronic Chemistry Implementation Business contributing ¥32.89 billion. The Information-Processing Equipment Related Segment adds ¥3.62 billion to their revenue mix.

Tamura's performance paints an intriguing picture, with earnings growth of 269% over the past year, significantly outpacing the electronic industry's -1%. This small-cap entity shows a satisfactory net debt to equity ratio of 14%, indicating prudent financial management. Despite a rise in its debt to equity ratio from 34.6% to 46.7% over five years, interest payments remain well covered at 6.9 times by EBIT, showcasing robust operational efficiency. Recent events include a delayed earnings announcement due to an ongoing investigation into inventory accounting issues in China, which could impact future transparency and investor confidence.

- Unlock comprehensive insights into our analysis of Tamura stock in this health report.

Assess Tamura's past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 4654 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301293

Excellent balance sheet with very low risk.

Market Insights

Community Narratives