- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6762

TDK (TSE:6762): Assessing Valuation After a Strong Multi‑Year Share Price Run

Reviewed by Simply Wall St

Recent performance and why TDK is on investors’ radar

TDK (TSE:6762) has quietly outpaced the broader Japanese tech space over the past year, and that steady climb is what makes the stock worth a closer look right now.

See our latest analysis for TDK.

Despite a softer patch lately, with a recent pullback tempering its 90 day share price return of 19.68 percent, TDK still has a 22.11 percent one year total shareholder return. This suggests the longer term momentum remains firmly positive.

If TDK’s steady climb has your attention, it might be a good moment to see what else is working in tech and electronics via high growth tech and AI stocks.

But with the shares still trading close to analyst targets after a strong multi year run, is TDK now a fairly valued quality compounder, or does the current price still leave room for upside if growth surprises?

Most Popular Narrative: 3.6% Undervalued

With TDK last closing at ¥2,433 against a narrative fair value of about ¥2,523, the story leans toward mild upside driven by improving fundamentals.

The company's focus on enhancing capabilities in quality, productivity, and technology, along with strategic investments in AI, can lead to improvements in net margins by increasing operational efficiency and driving technological advancements. TDK's strategic management of its business portfolio, including exiting non profitable segments and concentrating on high growth areas like AI, is likely to improve earnings by reallocating resources to more profitable ventures.

Want to see how steady revenue growth, rising margins, and a richer future earnings multiple all fit together? The full narrative unpacks the exact roadmap behind that fair value and the bold assumptions it makes about where TDK’s profitability could be a few years from now.

Result: Fair Value of ¥2,523.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing demand in automotive components and potential U.S. trade tariffs could pinch TDK’s revenue growth and challenge the upbeat margin and valuation narrative.

Find out about the key risks to this TDK narrative.

Another View: Multiples Flash a Caution Signal

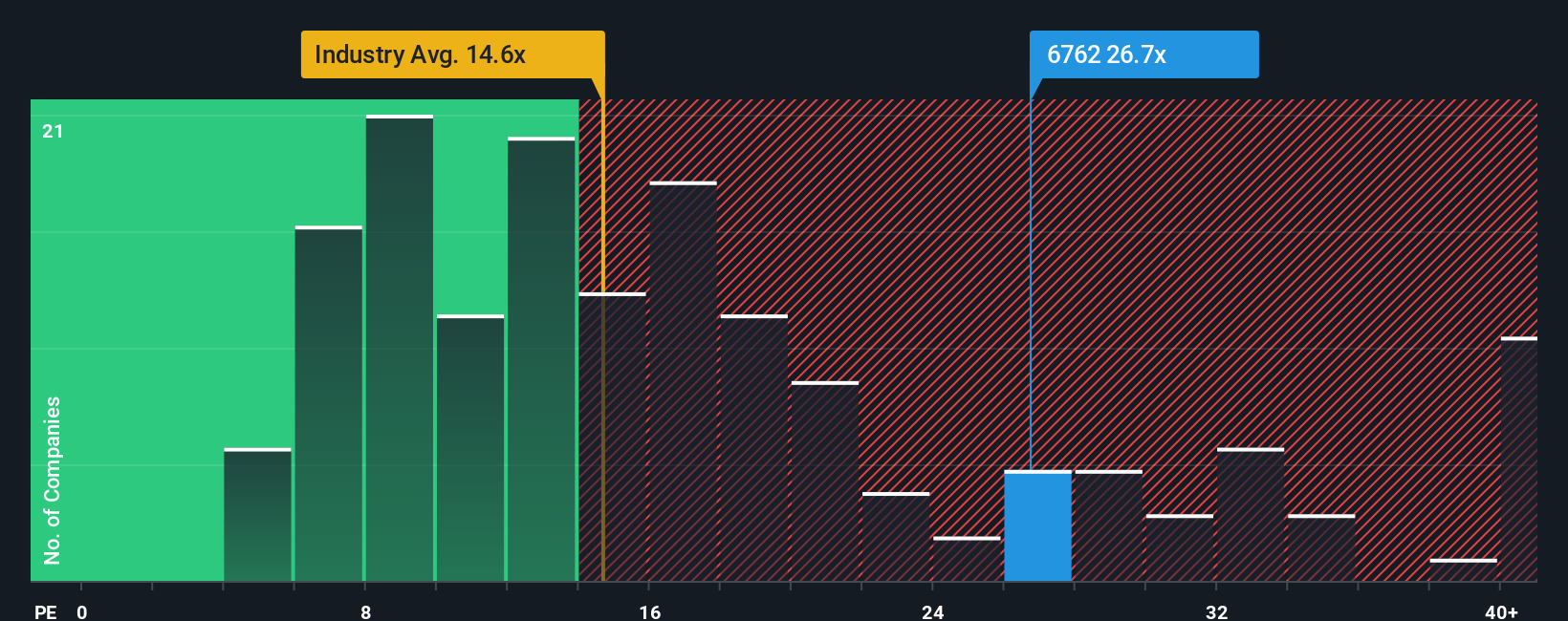

While the fair value narrative and analyst targets point to modest upside, our ratio work paints a tougher picture. TDK trades on a 26.7x earnings multiple versus a 24.5x fair ratio and just 14.6x for the wider Japanese electronics group, implying valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TDK Narrative

If this perspective does not quite match your own, or you would rather review the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your TDK research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge by scanning fresh opportunities across themes and strategies that could complement, or outperform, your TDK thesis.

- Capture potential market mispricings early by screening for these 906 undervalued stocks based on cash flows that combine strong fundamentals with attractive cash flow based valuations.

- Ride powerful structural trends by focusing on these 26 AI penny stocks positioned at the center of automation, machine learning, and next generation software demand.

- Boost your income potential by targeting these 15 dividend stocks with yields > 3% that can add reliable yield alongside the growth stories in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TDK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6762

TDK

Engages in manufacture and sale of electronic components in Japan, Europe, China, Asia, the Americas, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026