- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6744

Undiscovered Gems To Explore In January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing core inflation in the U.S. and positive economic signals from China, small-cap stocks have shown resilience, with indices like the S&P MidCap 400 and Russell 2000 posting notable gains. In this environment, identifying potential undiscovered gems involves looking for companies that demonstrate strong fundamentals and adaptability to shifting economic conditions, which can offer promising opportunities for investors seeking diversification beyond large-cap equities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Guobang Pharma (SHSE:605507)

Simply Wall St Value Rating: ★★★★★★

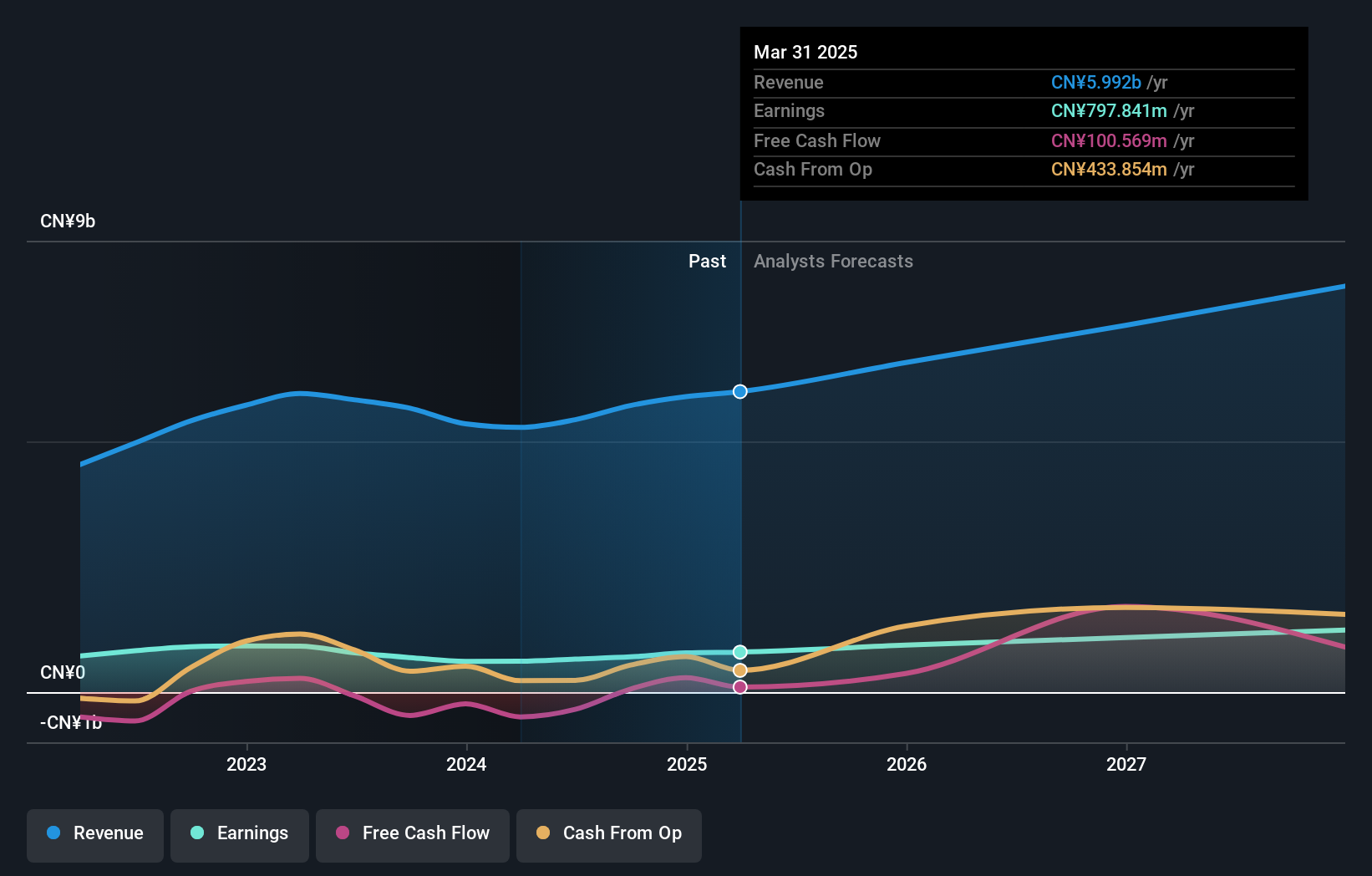

Overview: Guobang Pharma Ltd. focuses on the research, development, production, and sale of pharmaceutical and veterinary products with a market cap of CN¥10.91 billion.

Operations: Guobang Pharma generates revenue primarily from its pharmaceutical and veterinary product sales. The company reported a gross profit margin of 35.6% in the latest period, reflecting its cost management strategies.

Guobang Pharma, a smaller player in the pharmaceutical sector, is trading at 93.7% below its estimated fair value, suggesting significant upside potential. Over the past five years, its debt to equity ratio improved from 34.4% to 11.6%, indicating better financial health. Despite a modest earnings growth of 1.9% last year—outpacing the industry average of -2.5%—the company seems poised for future expansion with forecasts predicting annual growth of 22.59%. Although it repurchased no shares recently, Guobang has completed buybacks totaling CNY101 million under an earlier plan, showing commitment to shareholder value enhancement.

- Dive into the specifics of Guobang Pharma here with our thorough health report.

Gain insights into Guobang Pharma's historical performance by reviewing our past performance report.

Aichi Steel (TSE:5482)

Simply Wall St Value Rating: ★★★★★★

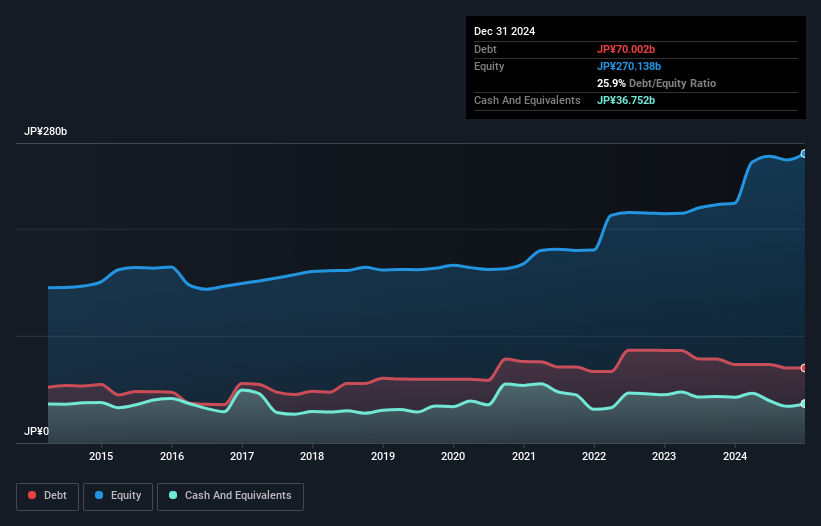

Overview: Aichi Steel Corporation is a Japanese company engaged in the manufacturing and sale of steel, forged products, and electro-magnetic products, with a market capitalization of ¥104.29 billion.

Operations: Aichi Steel generates revenue primarily through its Steel Company and Forge Company segments, contributing ¥145.19 billion and ¥122.92 billion respectively. The Stainless Company adds another ¥42.16 billion to the revenue stream, while the Smart Company contributes ¥19.42 billion.

Aichi Steel, a compact player in the metals sector, has shown resilience with earnings growth of 8% over the past year, outpacing its industry. Despite a ¥2.4 billion one-off loss affecting recent results, its debt to equity ratio improved from 36.5% to 26.5% over five years, and net debt to equity stands at a satisfactory 13.5%. The company is trading nearly 20% below estimated fair value and remains free cash flow positive. Recent guidance projects revenue of ¥300 billion for fiscal year ending March 2025, alongside increased dividends reflecting confidence in future performance despite past challenges.

- Unlock comprehensive insights into our analysis of Aichi Steel stock in this health report.

Assess Aichi Steel's past performance with our detailed historical performance reports.

Nohmi Bosai (TSE:6744)

Simply Wall St Value Rating: ★★★★★★

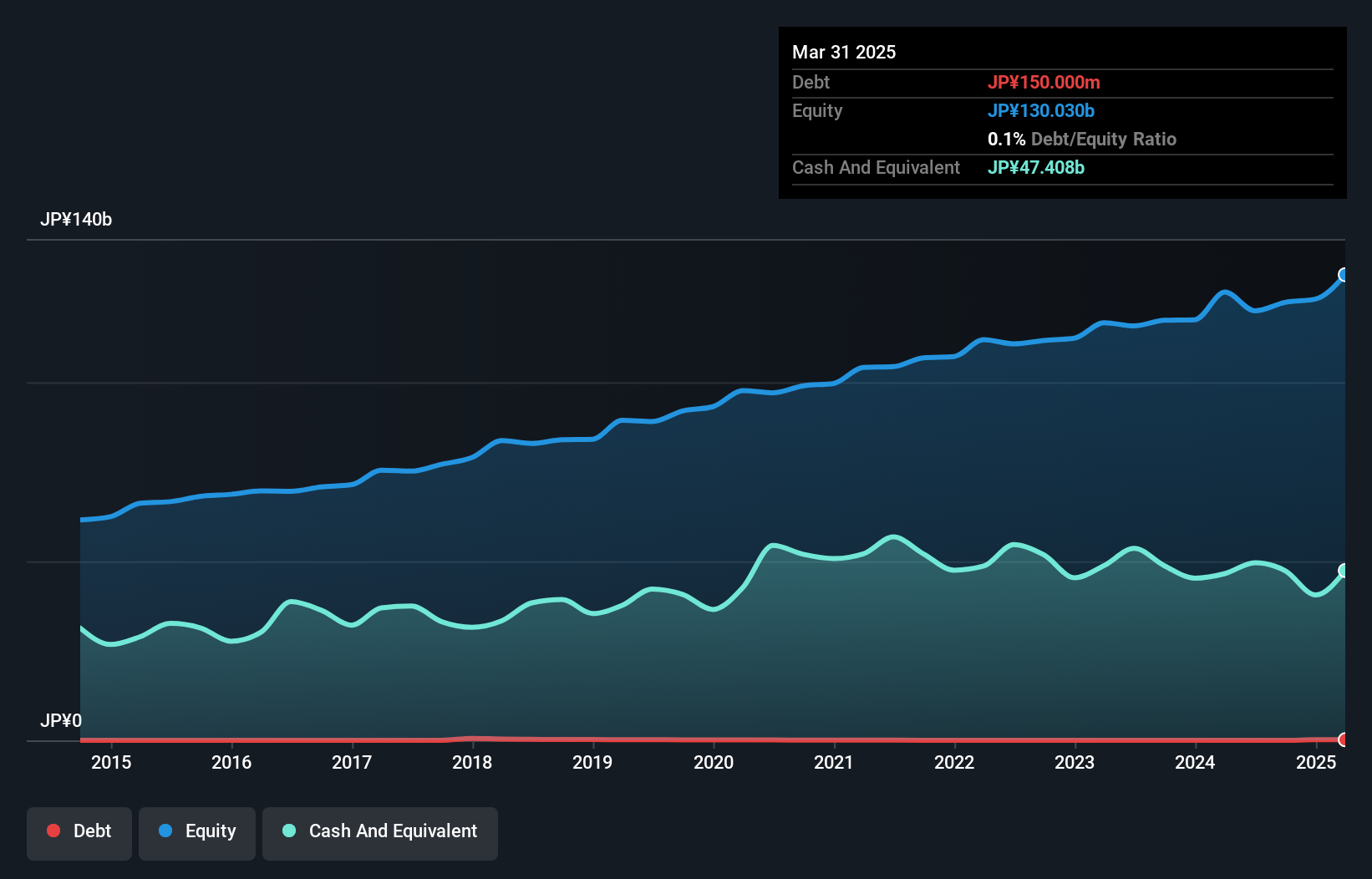

Overview: Nohmi Bosai Ltd. specializes in the development, marketing, installation, and maintenance of fire protection systems across Japan, China, the rest of Asia, and the United States with a market capitalization of ¥182.74 billion.

Operations: Nohmi Bosai generates revenue primarily from fire alarm systems, maintenance services, and fire extinguishing systems, with ¥45.72 billion from fire alarm systems and ¥33.20 billion from maintenance services. The company exhibits a notable net profit margin trend, reflecting its efficiency in managing costs relative to its revenues.

With a debt-free balance sheet and robust earnings growth of 27% over the past year, Nohmi Bosai stands out in its industry. The company is trading at 4.9% below its estimated fair value, suggesting potential undervaluation. Its high-quality earnings further underscore financial strength, with forecasts predicting a steady annual growth rate of 10%. Recent guidance anticipates net sales reaching ¥130 billion and operating income at ¥14 billion for the fiscal year ending March 2025. This outlook reflects confidence in sustained performance amidst industry challenges, positioning it as an intriguing prospect for investors seeking promising opportunities.

- Navigate through the intricacies of Nohmi Bosai with our comprehensive health report here.

Explore historical data to track Nohmi Bosai's performance over time in our Past section.

Turning Ideas Into Actions

- Explore the 4652 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nohmi Bosai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6744

Nohmi Bosai

Engages in the development, marketing, installation, and maintenance of various fire protection systems in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion