As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are increasingly seeking stable income sources amid fluctuating indices. In such an environment, dividend stocks offering attractive yields can serve as a reliable option for those looking to balance growth with income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Nippon Soda (TSE:4041)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Soda Co., Ltd. and its subsidiaries are involved in the development, production, processing, importation, marketing, sales, and export of chemicals and agrochemicals both in Japan and internationally with a market cap of ¥158.47 billion.

Operations: Nippon Soda Co., Ltd.'s revenue is primarily derived from its Chemicals Business at ¥50.26 billion, Trading Company Business at ¥51.54 billion, Agriculture Chemicals Business at ¥49.86 billion, Engineering at ¥21.44 million, and Eco Solution at ¥9.71 million.

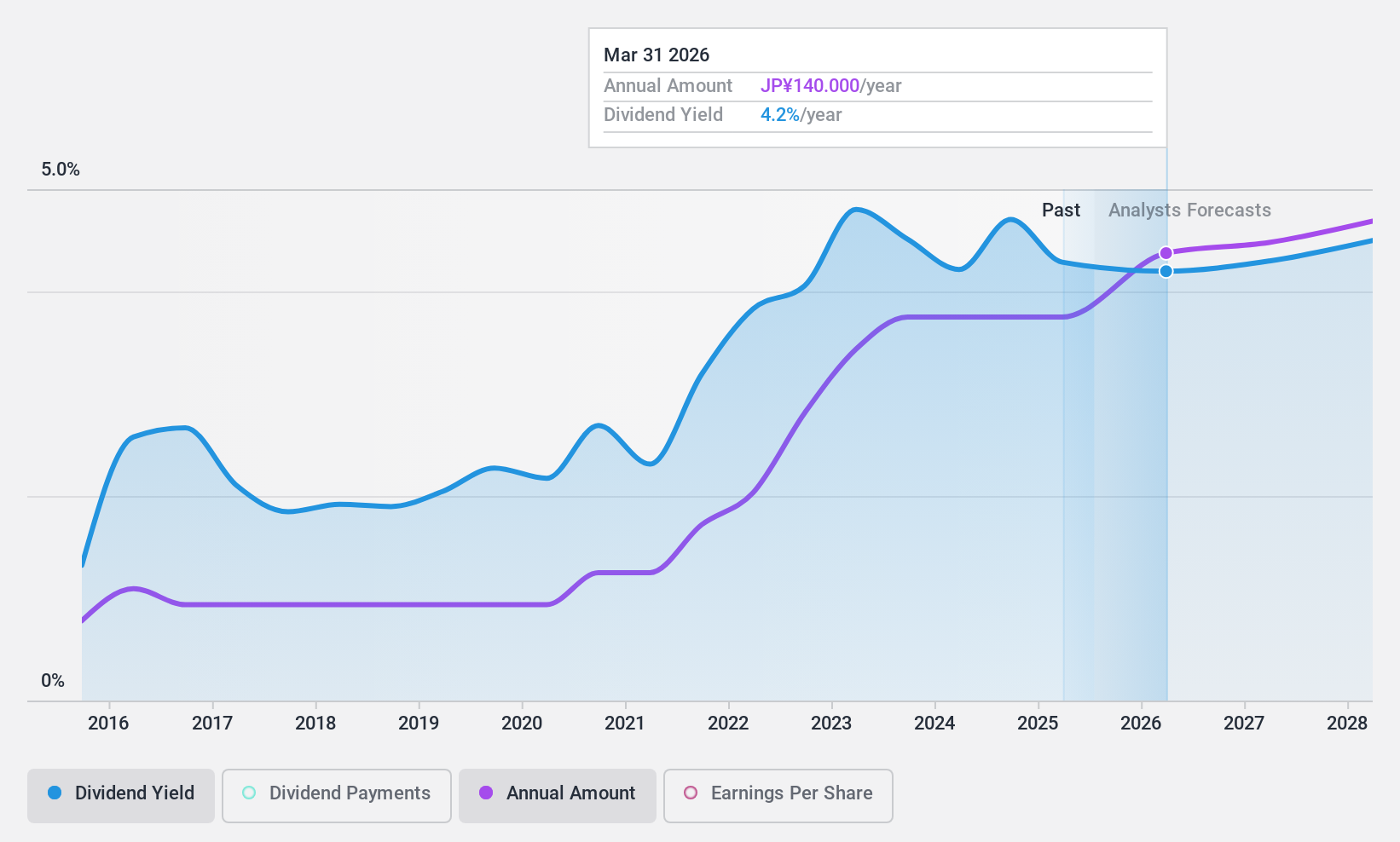

Dividend Yield: 4.2%

Nippon Soda's dividend payments, though offering a yield of 4.17%, are not well covered by cash flows, with a high cash payout ratio of 407.8%. Despite a relatively low payout ratio of 43% indicating coverage by earnings, the dividends have been volatile over the past decade. Recent strategic alliances to enter OLED displays and revised earnings guidance suggest potential growth avenues but don't directly address dividend sustainability concerns.

- Get an in-depth perspective on Nippon Soda's performance by reading our dividend report here.

- According our valuation report, there's an indication that Nippon Soda's share price might be on the expensive side.

Sankyo TateyamaInc (TSE:5932)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sankyo Tateyama, Inc. develops, manufactures, and sells building, housing, and exterior construction materials in Japan with a market cap of ¥189.30 billion.

Operations: Sankyo Tateyama, Inc.'s revenue is derived from its Material Business at ¥94.19 billion, International Business at ¥76.67 billion, Commercial Facilities Business at ¥43.64 billion, and Construction Materials segment at ¥185.18 billion.

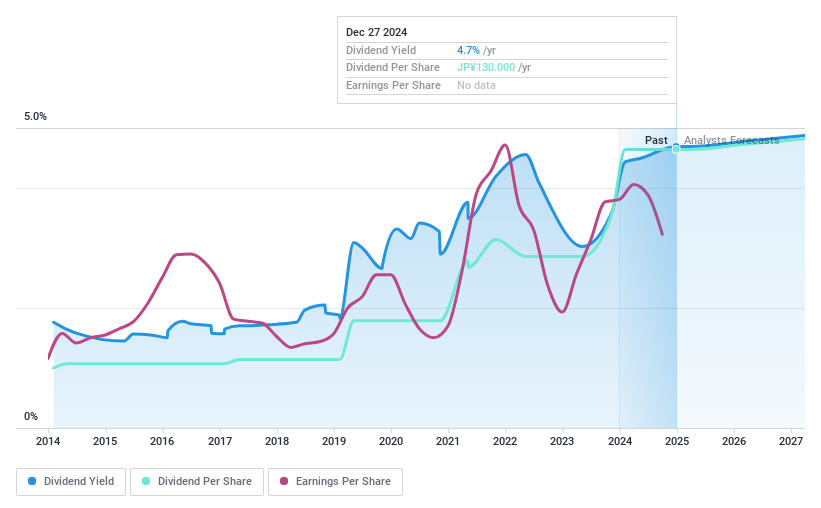

Dividend Yield: 4.1%

Sankyo Tateyama's dividend yield of 4.14% ranks in the top 25% of JP market payers but isn't covered by earnings, as the company is unprofitable. However, its cash payout ratio of 48.7% indicates coverage by cash flows. The dividends have increased over the past decade but remain volatile and unreliable, with debt not well covered by operating cash flow. Trading at a significant discount to its estimated fair value could suggest potential investment appeal despite these concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Sankyo TateyamaInc.

- Our comprehensive valuation report raises the possibility that Sankyo TateyamaInc is priced lower than what may be justified by its financials.

AiphoneLtd (TSE:6718)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Aiphone Co., Ltd. is a global manufacturer and seller of telecommunication equipment under the AIPHONE brand, catering to housing, healthcare, business, accessories, and smartphone applications, with a market cap of approximately ¥43.89 billion.

Operations: Aiphone Co., Ltd. generates its revenue from the production and sale of telecommunication equipment, focusing on sectors such as housing, healthcare, business solutions, accessories, and smartphone applications.

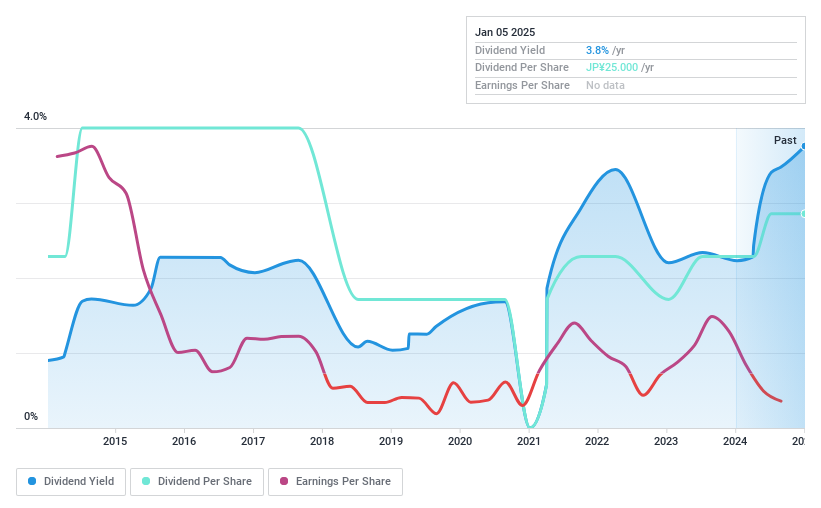

Dividend Yield: 4.8%

Aiphone Ltd. offers a compelling dividend yield of 4.85%, placing it in the top 25% of JP market payers, with stable and growing payments over the past decade. Its dividends are well-supported by both earnings, with a payout ratio of 62.2%, and cash flows, evidenced by a low cash payout ratio of 35.4%. Currently trading at 10.2% below its estimated fair value, Aiphone presents an attractive option for dividend-focused investors seeking reliability and growth potential.

- Click here and access our complete dividend analysis report to understand the dynamics of AiphoneLtd.

- The analysis detailed in our AiphoneLtd valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Gain an insight into the universe of 1973 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5932

Sankyo TateyamaInc

Engages in the development, manufacture, and sale of building, housing, and exterior construction materials in Japan.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives