- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6703

Will Oki Electric Industry's (TSE:6703) 2026 Earnings Forecast Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

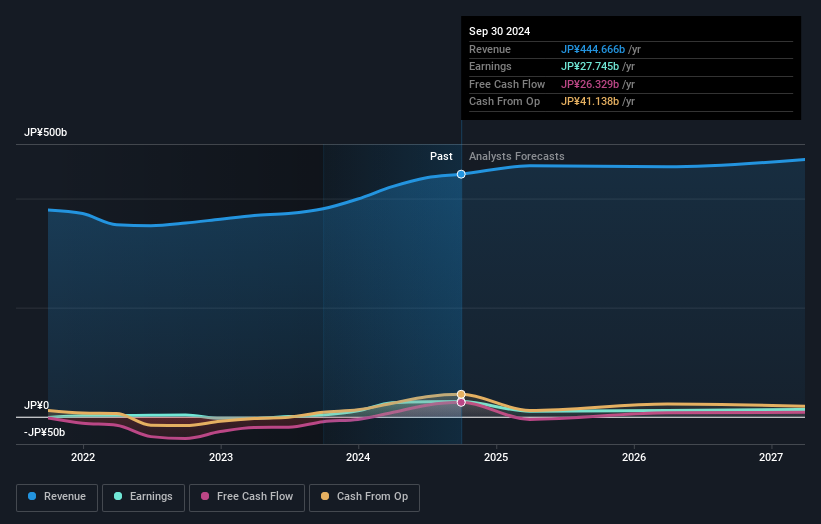

- Oki Electric Industry Co., Ltd. has announced its consolidated earnings guidance for the fiscal year ending March 31, 2026, forecasting net sales of ¥440 billion, operating income of ¥19 billion, and earnings per share of ¥184.47.

- This updated guidance offers shareholders detailed insight into the company’s financial expectations for the upcoming year, reflecting management’s outlook on operational performance.

- We’ll examine how these new projections, especially the anticipated operating income, inform Oki Electric Industry’s current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Oki Electric Industry's Investment Narrative?

To see Oki Electric Industry as a compelling investment, an investor really has to believe in the company’s ability to translate a long pipeline of partnerships and a growing payout into sustained earnings growth, despite single-digit revenue forecasts and recent swings in profitability. The latest earnings guidance resets expectations slightly lower on sales but shows confidence in expanding profits, which could boost sentiment around the sustainability of recent dividend hikes and recent strong share price returns. For the short term, this guidance tempers investor hopes for outsized top-line surprises but confirms a continued focus on improving margins and executing cross-border alliances, especially in India and Turkey, that could serve as new earnings drivers. Risks to watch include ongoing concerns about board experience and persistent share price volatility, which may increase scrutiny on management if results falter. All told, this news event doesn’t radically shift the near-term story but puts more weight on Oki’s ability to deliver on its profitability targets.

However, the board’s lack of experience raises questions that investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on Oki Electric Industry - why the stock might be worth less than half the current price!

Build Your Own Oki Electric Industry Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oki Electric Industry research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oki Electric Industry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oki Electric Industry's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6703

Oki Electric Industry

Manufactures and sells products, technologies, software, and solutions for telecommunication and information systems in Japan and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives