- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6703

Should Oki’s Financial Corrections and IoT Focus Shift Require Action From Oki Electric (TSE:6703) Investors?

Reviewed by Sasha Jovanovic

- In December 2025, Oki Electric Industry issued partial corrections to its first-half fiscal 2025 financial results and revised elements of its medium-term business plan, introducing fresh uncertainty around previously disclosed performance metrics and targets.

- Alongside these revisions, OKI highlighted progress in disaster-resilient IoT and advanced machine-vision cable products, underscoring its push to reposition around social infrastructure and smart factory technologies.

- We’ll now examine how the partial corrections to OKI’s financial disclosures and medium-term targets affect the company’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Oki Electric Industry's Investment Narrative?

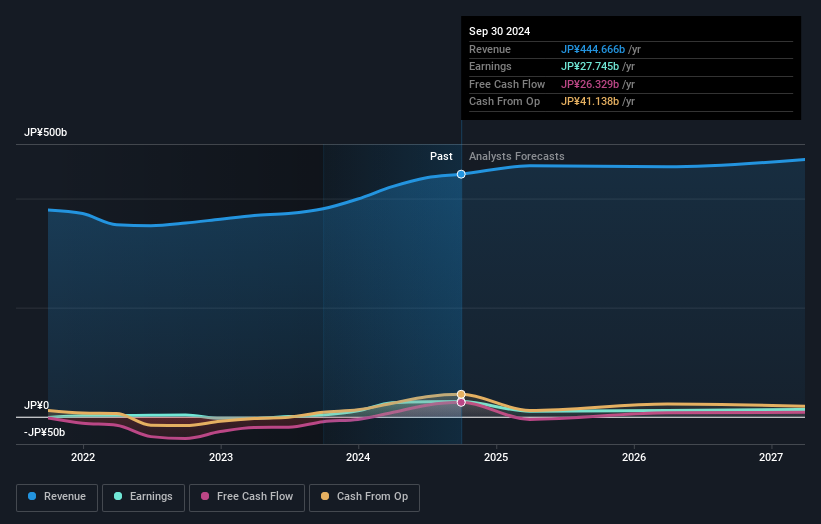

To own OKI, you have to believe the company can pivot from a low-margin, debt-heavy electronics player into a specialist in social infrastructure, photonics and smart factories without losing financial discipline. The recent partial corrections to first-half fiscal 2025 results and the medium-term plan introduce fresh questions around transparency and the reliability of its targets, which matters more in the short term than the relatively modest share price moves suggest. At the same time, the Indonesia railway trial and new machine-vision cables show that OKI’s Zero-Energy IoT and industrial cable technologies are gaining real-world traction and customer validation. Near-term catalysts still hinge on execution in these growth niches, but the biggest risk is that accounting revisions and high leverage unsettle confidence just as the transformation story is gaining attention.

However, one risk in particular may surprise investors who only look at recent returns. Oki Electric Industry's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Oki Electric Industry - why the stock might be worth as much as ¥264!

Build Your Own Oki Electric Industry Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oki Electric Industry research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oki Electric Industry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oki Electric Industry's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6703

Oki Electric Industry

Manufactures and sells products, technologies, software, and solutions for telecommunication and information systems in Japan and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion