- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6663

Taiyo TechnolexLtd (TSE:6663) Will Pay A Dividend Of ¥3.00

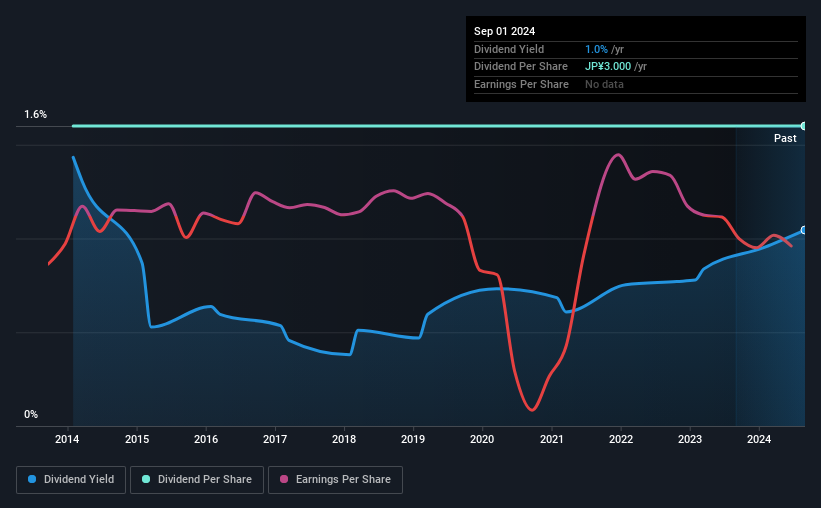

The board of Taiyo Technolex Co.,Ltd. (TSE:6663) has announced that it will pay a dividend of ¥3.00 per share on the 18th of March. This payment means the dividend yield will be 1.0%, which is below the average for the industry.

View our latest analysis for Taiyo TechnolexLtd

Taiyo TechnolexLtd Might Find It Hard To Continue The Dividend

Even a low dividend yield can be attractive if it is sustained for years on end. Taiyo TechnolexLtd is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

Assuming the trend of the last few years continues, EPS will grow by 29.8% over the next 12 months. It's nice to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

Taiyo TechnolexLtd Has A Solid Track Record

The company has an extended history of paying stable dividends. The most recent annual payment of ¥3.00 is about the same as the annual payment 10 years ago. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Company Could Face Some Challenges Growing The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Taiyo TechnolexLtd has impressed us by growing EPS at 30% per year over the past five years. The company hasn't been turning a profit, but it running in the right direction. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

Our Thoughts On Taiyo TechnolexLtd's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Taiyo TechnolexLtd that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo TechnolexLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6663

Taiyo TechnolexLtd

Engages in the manufacture and sale of flexible printed circuit in Japan, China, Thailand, rest of Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026